August was a positive month for global equities, but which sectors and companies stood out? Our new monthly UK Market Barometer looks in detail at the key trends in the UK market last month, which stocks and styles performed well, and whether these moves leave companies over- or undervalued.

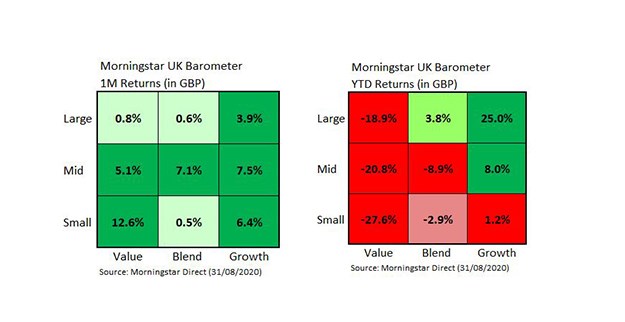

2020 has so far seen the triumph of large-cap growth over value as a style of investing, with tech stocks powering stock markets higher. According to Morningstar Direct data, even though Britain lacks technology giants like Amazon and Tesla, this trend has played out in the UK market: large-cap growth stocks are up 25%, substantially outperforming mid-cap and small-cap growth stocks.

But large-cap value stocks, although down nearly 19% so far this year, were overshadowed by the 27% drop in small-cap value, as seen in the right-hand chart below. (Morningstar currently defines small-caps as companies above $771 million in market cap, mid-caps as those above $3.2 billion and large-cap as $16.1 billion and above).

But the picture was very different last month. The left-hand chart above shows small-cap value stocks were back in favour, beating all other styles with a gain of 12.6%. The next biggest gains were seen in mid-cap growth stocks, which rose 7.5%.

While one month’s data should be treated with caution, September’s tech sell-off suggests that there may still be life in value investing after a year when growth won all the plaudits.

Among large-cap growth stocks, companies like London Stock Exchange (LSE) and credit score firm Experian (EXPN) are examples of stocks whose share price is higher now than at the start of the year. While most FTSE 100 shares were hit in the March sell-off, the strength of the recovery for Experian and LSE is notable, with both shares up 15% this year. Both companies are to some extent insulated from the coronavirus effect: the stock exchange saw higher trading volumes this year and with more people concerned about their finances, the use of Experian services has increased.

Banks and Miners Crushed

Large-cap value stocks include a cluster of natural resources and financial services companies that have seen sharp share price declines this year: Royal Dutch Shell (RDSB), is off nearly 50% so far this year as a bombshell dividend cut and drop in oil prices rattled investors. BP (BP.), which also cut its dividend, isn’t too far behind with a 39% drop in the share price in 2020.

The greatest large-cap losses are in UK-focused banks Lloyds (LLOY) and NatWest (NWG), with declines of over 50% this year. UK banks are out of favour for a cocktail of reasons: they aren’t allowed to pay dividends this year, the economy is weakening, and coronavirus will increase the rise in bad debts. Brexit isn’t helping much either, plus record low interest rates mean profit margins are under pressure for mortgages, loans and credit cards.

Still, among the large-cap value stocks are a cohort of resilient dividend payers such as Unilever (ULVR), which regularly features on of our top FTSE dividend list.

But which small-cap value stocks have led the August revival? Shares in bookmaker William Hill (WMH) and cinema chain Cineworld (CINE) are up around 65% in August as more UK shops and amenities re-open.

The tech bull run has stretched valuations in the US market, but what about the UK? Looking at the price/fair value ratio, a key Morningstar valuation metric, it’s not surprising to see large-cap growth stocks trading above their fair values (where 1 means the companies are fairly valued). Small-cap growth stocks are the only ones to be trading at their fair values, while small-cap value stocks offer the most scope for the upside, according to Morningstar analysts.