The old adage “sell in May and go away” has proved a reasonably reliable indicator of stock market moves in previous years. Investors are urged to back off from equities in the summer because of underperformance – and a lack of buying interest during holiday season – and “come back on St Leger’s Day” in September.

But we are not living in normal times: the equity markets endured a savage sell-off in March, the worst in decades, and a slight recovery in April despite the lack of clarity on the future economic impacts of the lockdown.

So does the mantra still stand this year? Research by online investment service BestInvest reveals it may not be the most reliable indicator, even in a year of low volatility. Particularly when you factor in dividends, the summer months are still fruitful ones for investors.

We have recently written about the dangers of trying to time the market and the risks of spending time out of the market, for example by taking a pension holiday. BestInvest managing director, Jason Hollands, notes that with UK equities down nearly 30% so far this year, pressing the sell button may not be wisest move: “Selling up now when markets have already fallen so sharply since the start of the year could simply result in crystallising losses."

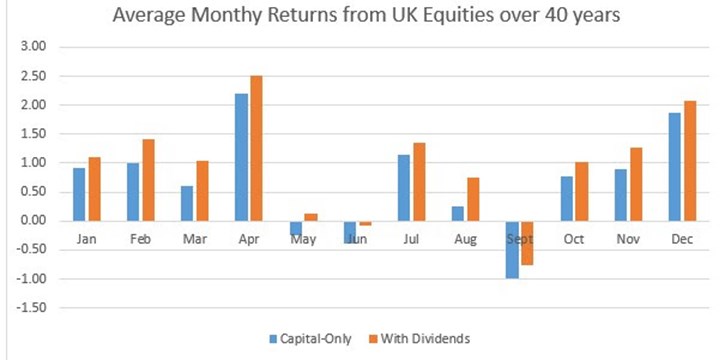

The BestInvest data, which goes back forty years, found that on average May and June posted negative returns but September, the month when investors are traditionally implored to return, is actually worse for UK equities. And if you factor in dividends, returns are on average in positive territory in May, albeit by a very modest 0.1%. Meanwhile, July returns were stronger than January, February, March, September, October and November.

Summer's a 50/50 for Investors

Averages can be misleading, however, and the firm also looked at the frequency of positive and negative returns over the time period. It found returns were negative more than half the time in May (52% of the time) and June (58% of the time).

The adage does cover the whole of May to August, however, so when July and August are factored in the picture changes; the market has risen by 10% over that period more often than it has fallen by 10%.

Investing platform Willis Owen has run its own analysis of the FTSE 100 over 34 years and found that the index was down 17 times over the summer months – exactly half of the time – so investors would have the same chance of predicting the outcome by flipping a coin. When you factor in dividends, the “sell in May and go away” strategy was effective on only 12 occasions, it adds.

“Sell in May has triumphed on occasion as investors focus on the important things in life, such as holidays, in the summer months,” says Adrian Lowcock, head of personal investing at Willis Owen.

“However, as an investment strategy, it is far from failsafe. This year, with volatility much higher than normal, it is difficult to forecast returns on investments, with many companies unwilling, or unable, to predict their profitability for the rest of the year.”

Investors often gain comfort from looking at past events to see patterns in what happened - which is known as hindsight bias - and then trying to predict the future. Over the long-term, though, this research shows that predicting returns based on seasonality is a very flawed approach. In the current climate trying to see into the future is an impossible task, even for professional money managers, so the odds of the average investor getting it wrong are even higher.