Magallanes Value Investors UCITS European Equity I GBPRegister to Unlock Ratings |

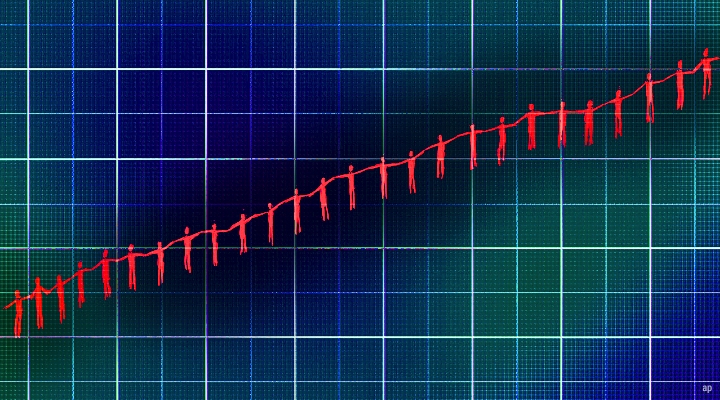

| Performance History | 31/03/2024 |

| Growth of 1,000 (GBP) | Advanced Graph |

| Fund | 2.2 | 16.1 | 12.1 | 19.1 | 4.9 | |

| +/-Cat | -5.7 | 2.2 | 23.8 | 8.6 | 0.2 | |

| +/-B’mrk | -0.4 | -1.5 | 16.6 | 5.9 | -1.4 | |

| Category: Europe Flex-Cap Equity | ||||||

| Category Benchmark: Morningstar DM Eur TME NR EUR | ||||||

| Key Stats | ||

| NAV 24/04/2024 | GBP 152.84 | |

| Day Change | -0.27% | |

| Morningstar Category™ | Europe Flex-Cap Equity | |

| IA (formerly IMA) Sector | - | |

| ISIN | LU1749426927 | |

| Fund Size (Mil) 24/04/2024 | EUR 964.51 | |

| Share Class Size (Mil) 24/04/2024 | GBP 53.09 | |

| Max Initial Charge | - | |

| Ongoing Charge 23/05/2023 | 1.19% | |

| Morningstar Research |

| Analyst Report | 26/06/2023 Francesco Paganelli, Senior Analyst Morningstar, Inc |

Magallanes European Equity’s edge resides in his focused team, talented lead manager, and repeatable investment process. The fund earns a Morningstar Analyst Rating of Bronze across all its share classes.The fund is run by the firm’s founder and... | |

| Click here to read this analyst report on the underlying fund. | |

| Morningstar Pillars | |

|---|---|

| People | 24 |

| Parent | 24 |

| Process | 24 |

| Performance | |

| Price | |

| Investment Objective: Magallanes Value Investors UCITS European Equity I GBP |

| The Sub-fund’s objective is to deliver high performance in both absolute and relative term over the long term horizon. To achieve this, the Sub-fund will mainly invest in a select portfolio of Transferable Securities (including equity related securities such as ADRs and GDRs) of companies which are domiciled in Europe. Up to 10% of the Sub-fund’s net assets can be invested in emerging countries. |

| Returns | |||||||||||||

|

| Management | ||

Manager Name Start Date | ||

Iván Martín Aránguez 31/12/2015 | ||

Inception Date 18/01/2018 | ||

| Advertisement |

| Category Benchmark | |

| Fund Benchmark | Morningstar Benchmark |

| MSCI Europe NR EUR | Morningstar DM Eur TME NR EUR |

| Target Market | ||||||||||||||||||||

| ||||||||||||||||||||

| Portfolio Profile for Magallanes Value Investors UCITS European Equity I GBP | 31/03/2024 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

| Top 5 Holdings | Sector | % |

Renault SA Renault SA |  Consumer Cyclical Consumer Cyclical | 5.00 |

Covestro AG Covestro AG |  Basic Materials Basic Materials | 4.41 |

Commerzbank AG Commerzbank AG |  Financial Services Financial Services | 4.25 |

UniCredit SpA UniCredit SpA |  Financial Services Financial Services | 4.23 |

Stellantis NV Stellantis NV |  Consumer Cyclical Consumer Cyclical | 4.14 |

Increase Increase  Decrease Decrease  New since last portfolio New since last portfolio | ||

| Magallanes Value Investors UCITS European Equity I GBP | ||

(1).jpg)