TM UBS (UK) - UK Equity F GBP AccumulationRegister to Unlock Ratings |

| Performance History | 31/03/2024 |

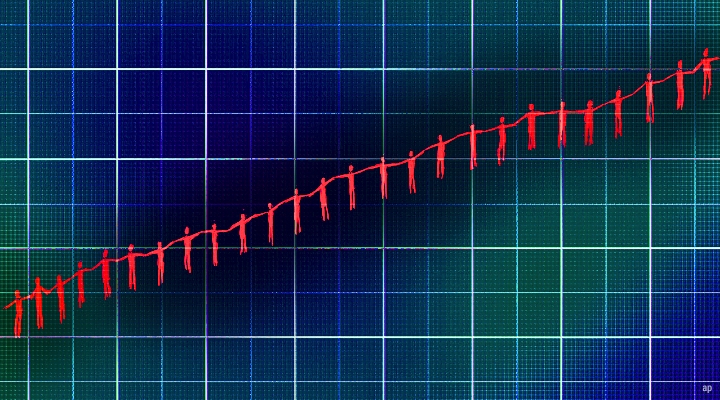

| Growth of 1,000 (GBP) | Advanced Graph |

| Fund | -10.9 | 16.6 | -2.0 | 6.7 | 4.0 | |

| +/-Cat | -1.8 | -1.4 | 0.0 | -1.5 | 0.7 | |

| +/-B’mrk | - | - | - | -0.9 | 0.6 | |

| Category: UK Large-Cap Equity | ||||||

| Category Benchmark: Morningstar UK All Cap TME ... | ||||||

| Key Stats | ||

| NAV 25/04/2024 | GBX 81.81 | |

| Day Change | -0.58% | |

| Morningstar Category™ | UK Large-Cap Equity | |

| IA (formerly IMA) Sector | - | |

| ISIN | GB00BCV7ST81 | |

| Fund Size (Mil) 30/11/2009 | GBP 9.84 | |

| Share Class Size (Mil) 25/04/2024 | GBP 3.25 | |

| Max Initial Charge | 5.25% | |

| Ongoing Charge 19/02/2024 | 1.15% | |

| Investment Objective: TM UBS (UK) - UK Equity F GBP Accumulation |

| To provide capital growth net of fees from a portfolio of investments over the longer term (5 year rolling period). The Fund will invest principally (85-100%) in UK equities (defined as companies incorporated, domiciled or with a significant proportion of their business in the UK), and the Fund may also invest in global equities (0- 15%), with a view to maximising potential returns. Equity investment will normally be made by direct investment, however the Fund may also invest indirectly (up to 15%) via collective investment vehicles (including those managed or operated by the ACD or its associate). |

| Returns | |||||||||||||

|

| Management | ||

Manager Name Start Date | ||

Gareth Thomas 16/05/2012 | ||

Inception Date 05/09/2013 | ||

| Advertisement |

| Category Benchmark | |

| Fund Benchmark | Morningstar Benchmark |

| IA UK All Companies | Morningstar UK All Cap TME NR GBP |

| Target Market | ||||||||||||||||||||

| ||||||||||||||||||||

| Portfolio Profile for TM UBS (UK) - UK Equity F GBP Accumulation | 29/02/2024 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

| Top 5 Holdings | Sector | % |

RELX PLC RELX PLC |  Industrials Industrials | 9.59 |

Shell PLC Shell PLC |  Energy Energy | 6.99 |

AstraZeneca PLC AstraZeneca PLC |  Healthcare Healthcare | 6.42 |

Compass Group PLC Compass Group PLC |  Consumer Cyclical Consumer Cyclical | 4.85 |

SSE PLC SSE PLC |  Utilities Utilities | 4.63 |

Increase Increase  Decrease Decrease  New since last portfolio New since last portfolio | ||

| TM UBS (UK) - UK Equity F GBP Accumulation | ||