.jpg)

Ilija Batljan is a man of many titles.

He's a former refugee, a successful municipal councillor, a fired real estate director, a multi-billionaire, a suspected insider criminal, and now, as the founder and ex-chief executive of Samhallsbyggnadsbolaget I Norden (SBB), the symbol of an over-leveraged real estate industry in crisis.

The charismatic and optimistic founder of Swedish landlord SBB, Batljan has become the face of Sweden’s fragile real estate market and, arguably, its collapsing currency.

After thousands of retail investors took losses as SBB's stock cratered, the next big question is how much systemic damage the country of Sweden can actually take.

Rise and Fall

After a career in local politics, Batljan decided to set out as an entrepreneur. Boosting his portfolio value from zero to 70 billion Swedish kronor in less than four years, he managed to build one of Sweden's largest real estate empires at record speed.

Many pointed out red flags from the get-go; the charm offensive, the strange cross-ownership, the optimism bordering on hubris, the generous promises and the setbacks that were always blamed on someone else.

Batljan managed to turn dull properties like pre-schools, fire stations and nursing homes into one of Sweden's most-owned shares. The stock was loved by analysts, fund managers and retail investors, reaching a peak in November 2021 at 69.38 kronor per share. At the start of June 2022, it traded around 5 kronor, more than 92% off historic highs.

As former chairman of the municipal board in Nynäshamn, near Stockholm, Batljan had first-hand experience with Swedish municipalities' struggles balancing their budgets. It's highly likely his history in politics made him aware of the opportunity to buy properties from Swedish municipalities to then rent them back to the same actors.

At first glance it seems ingenious – the municipalities receive a lump of cash that creates some room in their budgets, and they get to stay in their property. At the same time SBB creates a portfolio of low-risk tenants. For the municipalities, however, it was clear early on such sales would result in a long-term loss.

All was well until inflation soared across the world and central banks embarked on the fastest rate hike cycle in decades. SBB is stuck with massive debt, leaving it highly exposed to interest rate changes. Just before Christmas, part of the company was sold to the Canadian investment and property company Brookfield.

The crash accelerated when credit rating agency S&P decided to lower SBB's rating to junk status (BB+) early in March, setting off the start of what may be a death spiral. Last week, the long-term credit rating was lowered again to BB-.

SBB's Crisis Leaves Sweden Exposed

Investors from China and Saudi Arabia have reportedly been interested in buying the leftovers of the company. This has sparked major debates about the risk of foreign powers controlling formerly public assets. The crisis in SBB prompted some municipalities to try to buy back properties.

Annika Wallenskog, chief economist at Sweden's Municipalities and Regions, has long followed SBB's municipal acquisitions.

"It will be a difficult task for the municipalities to buy back community properties. In many cases, the municipalities have not entered a buyback clause", she said to Sydsvenskan.

One high-profile object at risk of foreign takeover is the storied military installation of the Dalregementet, one of Sweden's most prestigious and oldest provincial regiments.

"Foreign interests should not have that insight into Swedish security issues", Cecilia Vestin, chief executive of the state pension giant Kåpan's real estate company, said to SVT Nyheter.

In Sweden there are few rules governing who can own Swedish security-related buildings, something Vestin wants to see changed due to the risks involved when this type of asset ends up in the hands of foreign adversaries.

Batljan to Blame?

Meanwhile, the Swedish krona has fallen to levels not seen since 2008. According to several economists the real estate market's crisis, encapsulated in the story of SBB, is to blame.

"The major short-term explanation is that people abroad are very worried about the Swedish real estate market for two reasons; firstly regarding our high household debt and what it does for domestic consumption; secondly, they are worried about the real estate companies, as illustrated by SBB," Lars Henriksson, senior strategist at Handelsbanken, told Swedish news agency TT.

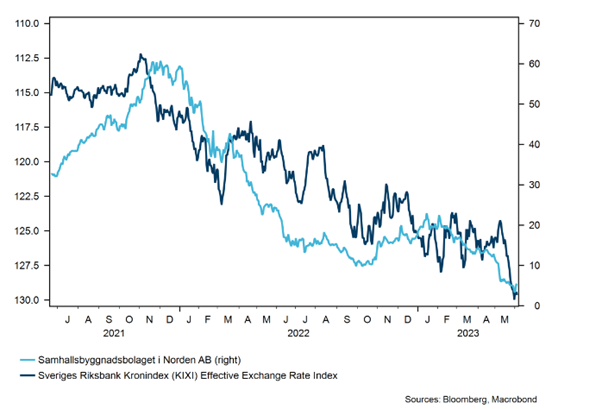

The collapsing share price of SBB goes hand in hand with the fall in the Swedish krona:

Yet to say that Swedish banks are imperilled would be "close to insane" Henriksson says.

"Some of the real estate companies' loans are bond loans that are out on the market now, and some have loans directly with the bank," he says.

"The fact there is a concern that the real estate companies would drag the banks along in the fall is close to insane. The Swedish banks are incredibly well capitalised and are currently making a lot of money".

Handelsbanken believes that the Swedish krona slowly will strengthen going forward and that the real estate companies' grip on the currency might loosen when clear indications of an end to the rate hike cycle appear.

Watch Out For Warning Signs

This is not the first time in history a company has rocketed to the moon just to come crashing back to Earth, and nor will it be the last.

It's when a company aggressively hits back against critics one should take a closer look. Germany's infamous Wirecard had a pattern of aggressive tactics to silence reporting about its business operations or accounting.

When short seller Viceroy Research first called out SBB, Batljan immediately pushed back, decrying a "conspiracy" and a "robbery of retail investors".

There are no claims that SBB has conducted any fraudulent business, but it certainly has, however, ignored the consequences of a highly-leveraged portfolio in a market with soaring interest rates. Batljan has consistently promised an increasing dividend pay-out every year for a hundred years, as well as stating that an investment in SBB shares is "safer than the bank". At one point he even told investors SBB could "easily" handle interest rates of 10%.

Another red flag is executives making promises that seem too good to be true.

.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VPCBITMQP5FKLIZ32POIXOV3MQ.jpg)