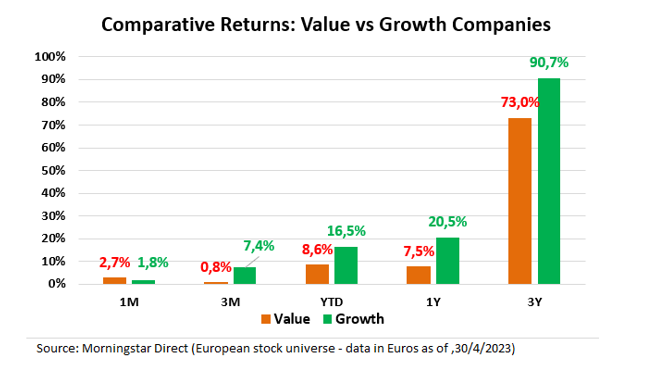

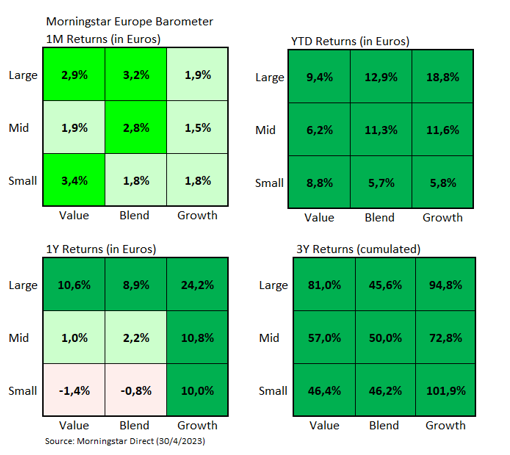

April ended with all segments of our European Style Box in positive territory, but with value outperforming growth (2.7% in Euros versus 1.8% respectively). In the medium- and long-term, however, European growth companies have clearly outperformed their value counterparts: for example, if we look at the performance over the last 12 months, the growth style achieved a gain of 20.5% in euros versus 7.5% for the value style.

Within the value style, some energy companies such as Shell PLC or TotalEnergies SE stood out, with gains of over 6% in both cases (in euros). On the other hand, within this investment style, it was the two large basic materials companies, Anglo American PLC and Rio Tinto PLC, that pushed returns down the most, with falls of 8.7% and 7.8%, respectively.

On the growth side, the three largest companies by capitalisation, LVMH Moet Hennessy Louis Vuitton SE, Novo Nordisk and L'Oreal SA outperformed the market in April (the Morningstar Europe index was up 2.4% in euros), with gains of 4.0%, 3.5% and 6.7% respectively. But the poor performance of ASML Holding NV, which lost 8%, explains the worse relative performance of the Large Growth area versus the market in a whole.

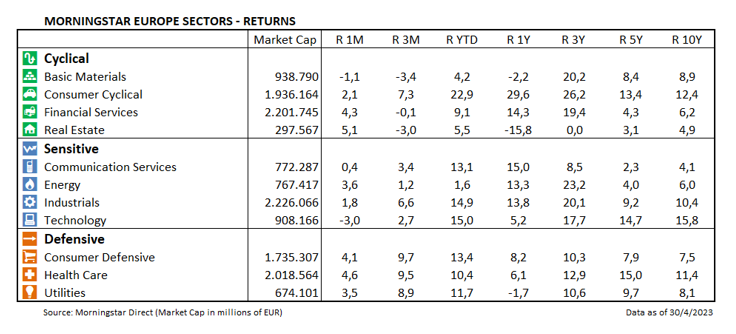

At the sector level, there were only two sectors that ended April in negative territory: technology, with a loss of 3.0% in euros (heavily impacted by the fall of ASML Holding NV) and basic materials (-1.1%).

The biggest gains were for real estate (+5.1%, although the sector accumulated a loss of 16% over the past 12 months) and healthcare (+4.6%). Within the latter sector, the strong rises of the two Swiss giants, Roche Holding AG (+8.5%) and Novartis AG (+9.0%), were particularly noteworthy.

The European banking sector also performed well last month, up 4.3%, despite declines in UBS Group AG (-2.8%) and Banco Santander SA (-5.3%).

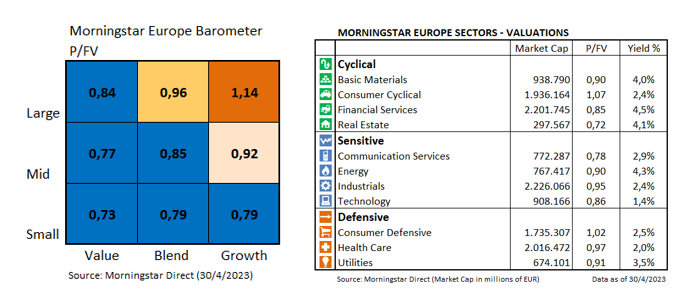

In terms of valuations, there is still a large gap between Large Value (trading with a Price/Fair Value of 0.84) and Large Growth (1.14).

The financial sector is one of the cheapest sectors (Price/Fair Value of 0.85) and has the highest dividend yield (4.5%) in Europe. It is also striking how cheap the European technology sector is, with a Price/Fair Value of only 0.86.

.jpg)