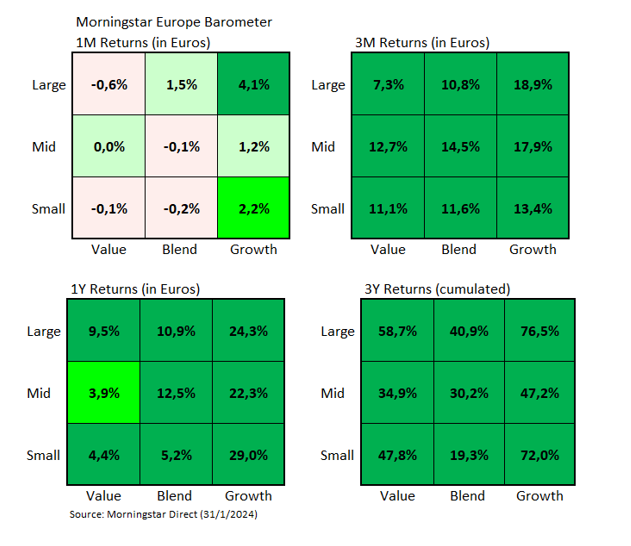

European stock markets have had a slow start to the year, with the Morningstar Europe Net Return Index up 1.4% in euros in January. But this result hides sharp differences between sectors, factors and styles.

Starting with factors, the Large Growth segment rose by 4.1% while Large Value declined by 0.6%. There were also differences between large and small companies, with the former gaining a combined 2.1% in January compared to 1.0% for the latter.

Among large cap growth companies, the biggest contributors to January's gains were ASML Holding NV (ASML; +17.1% in euros), Novo Nordisk A/S (NOVO B;+11.0%) and SAP SE (SAP;+15.3%).

On the Large Value side, Deutsche Telekom AG (DTE; +4.6%), Volkswagen AG (VOW; +7.2%) or AXA SA (CS; +5.7%) rose strongly but could not offset losses in some of the companies that weigh more heavily by market capitalization, such as Shell PLC (SHEL; -3.3%), TotalEnergies SE (TTE; -1.2%) or Rio Tinto PLC (RIO; -4.3%).

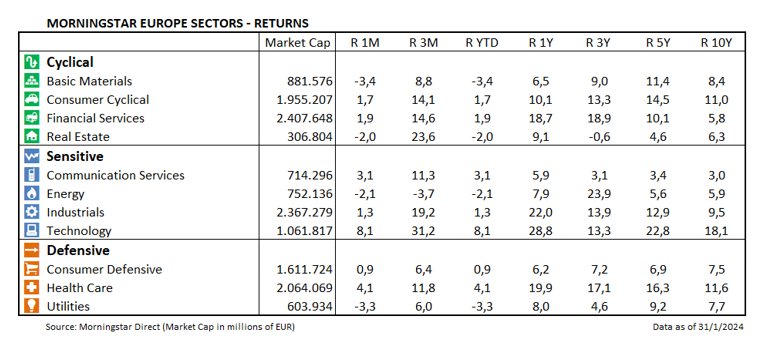

At the sector level, there were large differences in performance in the first month of the year. The biggest gainer was the technology sector, rising 8.1%. We have already mentioned the strong performance of ASML Holding NV and SAP SE which contributed the most to the sector's performance, though Dassault Systemes SE (DSY), Capgemini SE (CAP) and ASM International NV (ASM) all rose by more than 9% in euro terms.

Another sector that did well in January was healthcare, thanks to Novo Nordisk, which is by far the European company with the largest market capitalization in the sector. Other contributors to the sector's strength were GSK PLC (GSK), up 9.8% in euros, Novartis (NOVN), up 5.1% and Sanofi (SAN), up 4%.

Among the sectors that suffered losses in January were utilities, led lower by RWE AG (RWE) and EDP Renovaveis (EDPR), which dropped by 16.6% and 18.8% respectively. Basic materials were also weak, with a decline of 3.4%. Glencore PLC (GLEN) fell by 9.5% in euros and BASF (BAS) by 8.9%.

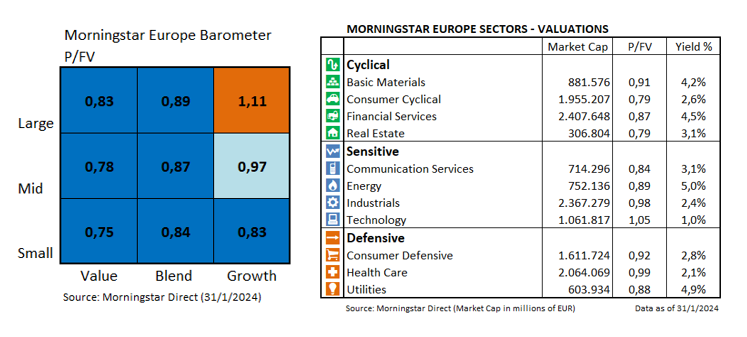

Regarding valuations, the trend remains the same: value is more attractive than growth and large companies are more expensive than smaller companies.