It’s been such an eventful 12 months that it’s easy to lose track of all the unexpected events that have affected investors in the last year. From GameStop to negative oil prices, we round up some of the most unexpected and dramatic of these developments:

1. Oil Prices Go Negative

No one knew whether the oil price could go negative until it actually happened; the price of WTI crude for May delivery went to -$37 per barrel on April 20, a drop of 300%, pricing in a total collapse in global energy demand during the pandemic. It was a technical sell-off as traders scrambled to offload futures contracts, and the price rebounded quickly.

2. ... And Shell Cuts Its Dividend

Ten days later Royal Dutch Shell (RDSB), the biggest contributor to FTSE 100 dividends, announced its first dividend cut since 1945, a drop of 66%. Shell’s cut was one of the biggest blows suffered by UK income investors in 2020.

3. Interest Rates Cut to New Record Lows

March was a busy month for the Bank of England as it cut interest rates twice: from 0.75% to 0.25% on March 11 and then from 0.25% to 0.1% on March 19, where they remain a year later.

4. 10 Year Gilts Hit Record Lows Too

The price of bonds soared during the pandemic as investors fled equities to safe haven assets, but yields fell sharply – in August 2020, the benchmark 10-year UK Government bond fell to a record low of 0.07%.

5. The Worst UK Economic Slump Since 1709

The dire economic outlook was one reason why gilt yields were so low. In 2020, the economy contracted by nearly 10% - the worst since WW2, but the Bank of England models suggest this slump was actually the worst since 1709, when The Great Frost caused starvation across Europe.

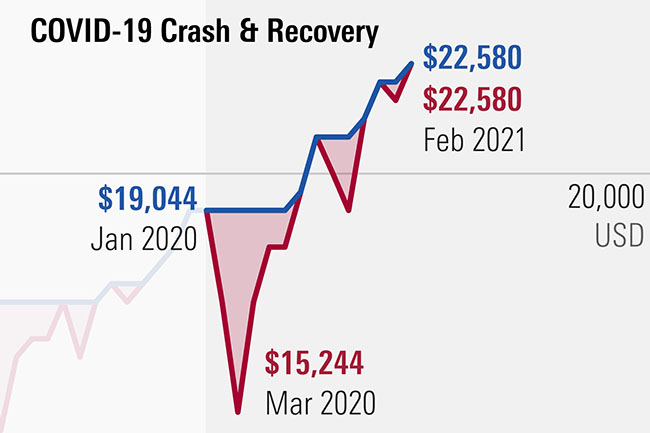

6. The Shortest Bear Market in History

Once global stock markets appreciated the magnitude of the coronavirus crisis, there was an almighty crash, similar to the financial crisis in 2008 and in 1987. But the speed and magnitude of the recovery caught many by surprise too – making the crash the shortest in history.

7. Tesla’s Electric Year

Tesla (TSLA) was the centre of attention in 2020, which is not surprising considering its shares gained 717%. The firm became the biggest car market in the world by value, joined the S&P 500 and revealed it had bought $1.5 billion of Bitcoin, pushing the cryptocurrency to new highs.

8. GameStop and the Rise of the Redditors

Tesla wasn’t the only stock beloved of day traders: humdrum US retailer GameStop (GME) became an unlikely target for bullish Reddit message board followers and shares rose 2,500% in two weeks. Was this a victory for retail investors over hedge funds? Morningstar’s John Rekenthaler explains what happened.

9. China is a Top Performing Stock Market in 2020

As the source of the coronavirus outbreak, China was the first to impose strict lockdown measures, meaning the economy could recover quickly. Experience of previous healthcare emergencies helped. This rapid rebound triggered a rally in Chinese stocks and the market was nearly 30% higher at the end of the year. China and US tech funds were the best-performing in 2020 as a result.

10. But Ant IPO Suffers Beijing’s Wrath

Financial firm and Alibaba spin-off Ant Group was primed to become the world’s largest IPO in October 2020 and poised to list in Shanghai and Hong Kong. An intervention by China’s rulers thwarted this blockbuster float, which was a reproach for founder Jack Ma (who vanished for three months) and a reminder of the risks of investing in emerging markets.

11. A Travel Stock is the Biggest IPO of 2020

In the end, travel booking service Airbnb (ABNB) grabbed the attention and ended speculation about its plans to go public with the largest US float of the year. Considering the impact of coronavirus on travel, Airbnb’s float suggested that even a global pandemic could not dim investors’ appetite for consumer-focused IPOs, especially those promoted as “tech disruptors”.

12. Vaccine Makers Unloved

To bring a working coronavirus vaccine to market so quickly was hailed as a scientific miracle – and one that would help restart the global economy after a catastrophic year. But investors in vaccine makers like Pfizer and AstraZeneca were less impressed. Shares in both firms actually fell in 2020.