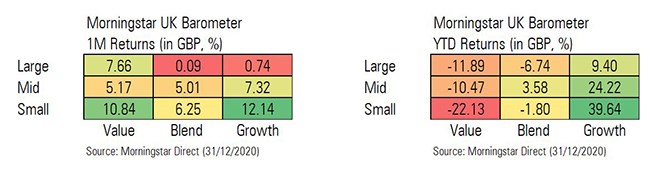

Growth stocks triumphed over value for much of 2020 but November saw a strong comeback for the out-of-favour investing style. Now we have data for the full year and the Morningstar Market Barometer reveals how value, growth and blend stocks performed in December and over 2020 as a whole.

The Morningstar UK Index, which covers 302 stocks from £425 million in size to £114 billion, was up over 13% in November alone, but eked out a gain of just 0.63% in December – which is normal after such a strong rally. For 2020 overall, the index was down 11.46%, lagging behind US and Asian indices – the S&P 500 was up 16% last year – and reflecting investors’ lack of enthusiasm for UK stocks in general.

A Look at Large Caps

Large-cap value stocks continued their strong run in December, according to Morningstar data, posting gains of 7.66%, but that was not enough to save the category from a near 12% decline for 2020 as a whole. Asia-focused insurer Prudential (PRU) was the biggest gainer in December, rising over 15%, while defence firm BAE Systems (BA.) was the only loser in this 19-strong cohort. As you would expect in such a volatile year, large-cap value stocks nursed some heavy losses for 2020 as a whole – cruise giant Carnival (CCL) leads this list with a loss of more than 60%, while miner Glencore (GLEN) was the best performer, despite still being marginally in the red.

Moving down the market cap scale, the difference between monthly and yearly performance is even more stark among small-cap value stocks, which posted gains of 10.84% in December versus a loss of 22% for the year. Small caps are notoriously volatile even in “normal” years and in 2020, miner Ferrexpo (FXPO) was the best of the bunch with a gain of 94%, while commercial property REIT Hammerson (HMSO) suffered an 82% loss for 2020 as UK lockdown restrictions decimated the sector.

In the mid-cap value space, where many household names such as Royal Mail (RMG), Whitbread (WTB) and Sainsbury’s (SBRY) reside, the 2020 loss of around10% was on par with large-cap peers.

In the few trading days since the Brexit deal was agreed, UK stocks have made strides however. Morningstar’s head of fund research, Jonathan Miller, has recently looked at how sustainable the value bounceback is likely to be.

Growth Triumphs

Despite a mediocre November and December for growth stocks, the investing style was the clear winner for 2020: large-cap growth names were up 9.4% in a year when the FTSE 100 and FTSE All-Share were fell more than 10%, while mid-cap growth stocks were up an impressive 24% and small-cap stocks by 40%.

The best-performing stock in the large-cap list was Ocado (OCDO), with a gain of over 78% (it was also the biggest gainer in the FTSE 100 in 2019) as locked-down food shoppers scrambled to win delivery slots. The retailer is rated as a two-star stock by Morningstar analysts after such a strong run, indicating that its shares are overvalued. Still, analyst Ioanis Pontikis is positive about the company’s prospects: “From its humble beginnings as one of the first niche online grocers to its current status as a technology powerhouse and online retail disrupter, Ocado Group offers unique exposure in one of retail's largest and most dynamic segments: global online food retailing.”

AstraZeneca (AZN) is the biggest company in the large-cap growth group by some margin, but even being on the right side of one of the biggest stories in decades does not guarantee strong investor returns. Shares in the pharma group, whose Covid-19 vaccine is nwo being rolled out in the UK, were off by around 1% in 2020. Over a five-year period Astra’s shares have put in a more impressive performance, however, climbing 71% to the current price of around £74. Despite this strong run, Morningstar analysts say the shares are worth £83.60, as the company has a number of (non-Covid) drugs in the pipeline that have blockbuster potential.

Even bigger gains were seen in the UK small-cap part of Morningstar UK index: the standout was renewables manufacturer Ceres Power Holdings (CWR), whose shares surged over 400% last year as it rode the boom in ESG stocks. Some of that gain was seen in December alone, when the shares rose 50%. Another company in the right place at the right time was video game developer Frontier Developments (FDEV), which rose 150% in 2020. Notable fallers in this list include Capital & Counties Properties (CAPC), which manages and develops commercial property and exhibition space in London.