Funds continued on an upward trajectory as global stock markets continued their recovery from the Covid-19 in earnest. For the second month in a row this year all asset classes delivered positive returns in June.

Our monthly heatmap of asset class performance is a sea of green shades, indicating positive returns across all fund categories. However, Allocation and Money Market funds have stolen the top spots from Comodities and Equity fund, which were the top performing asset classes in May. Allocation and Money Market fund produced average returns of 4.1% and 3.8% respectively in June.

Allocation funds are multi-asset funds mostly composed of equities and bonds, and this mix makes them an attractive option at times of uncertainty. Money Market funds are also another popular safe bet when markets volatility seems not calming down. Unsurprisingly, they have been popular options among investors in recent months, a trend that is likely to continue as fears of a second wave of the coronavirus persist.

Meanwhile, the average Commodities and Equity fund returned 3.5% and 2.5% respectively, the former helped by a surge in the gold price - another sign of investors reaching for safe havens.

The lightest shade of green depicts the weakest performing asset class, Property and Fixed Income funds still produced positive returns in June however, at 0.9% and 0.7% respectively.

The chart below shows the returns of each asset class in June. The size of the box denotes the level of assets under management in the category.

Half Year Results

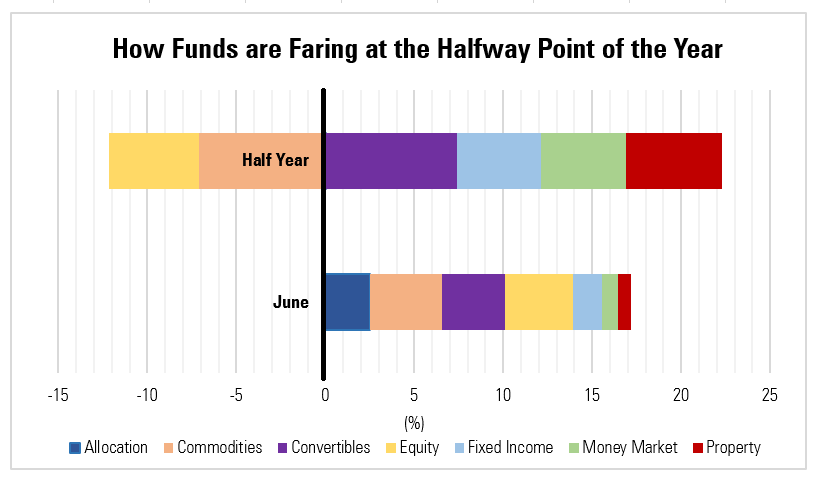

Despite the strong recovery that has defined the past two months, however, two asset classes are still yet to fully recover from the volatility of the first quarter of the year. At the halfway point of 2020, Equity and Commodities funds are still down an average of 5.1% and 7.1% respectively. The latter has been left bruised after oil prices briefly turned negative for the time in history while many global stock markets are playing catch up after March's brutal sell-off.

Six months into the year, Allocation funds are flat meanwhile. A return of 0% means they don't appear in the top bar graph below.

Surprisingly, given the gloomy outlook that surrounds the UK property market after shops, pubs and offices have stood empty for months, Property funds are among the top performing asset class halfway into the year, with an average return of 5.4%. Convertibles are the top performing group, up 7.1%.