As part of Morningstar's special report week on thematic investing, we look at the prospects for clean energy stocks, which have struggled since 2020 - as well as the wider renewable energy industry.

The energy crisis triggered by the war in Ukraine, combined with the fight against climate change and the widespread desire to decarbonise the economy, has given an extraordinary boost to investments in renewable energy, particularly in Europe.

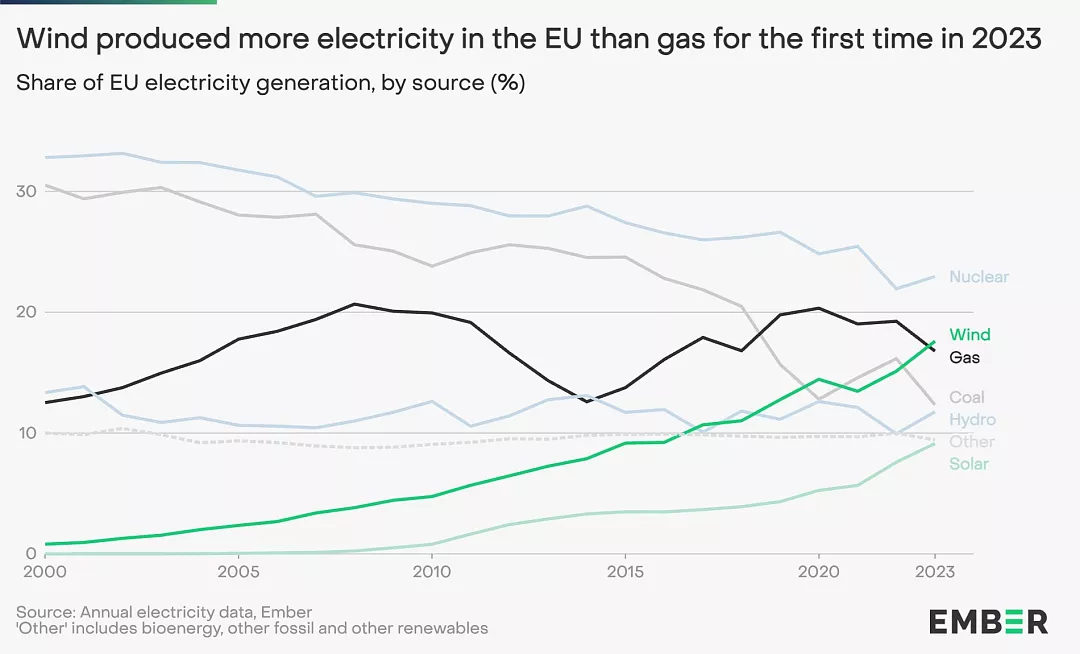

And much has been achieved in the last two years on the supply side. Figures from the Ember thinktank show that in 2023, for the first time, the share of European electricity generated by wind power surpassed that from fossil gas. Last year, wind and solar produced a record 27% of the EU bloc's electricity, an all-time high. Coal and gas suffered a similar decline, with the former dropping to an all-time low of just 12% of EU electricity production.

"The European energy sector is in the midst of a monumental change," says Sarah Brown, Europe programme director at Ember. "Fossil fuels are playing a role that has never been so marginal, while a system is emerging with wind and solar as the backbone."

Yet the Morningstar category of sector equity alternative energy funds (which also includes ETFs) posted an average return of -11% in 2022, -10.5% in 2023 and -4.3% for the year-to-date (figures in euros, as of April 15, 2024).

Within this group, there are also a few funds, all of them actively managed, that have managed to perform much better, such as the Pictet-Clean Energy Transition or the RobecoSAM Smart Energy Equities, especially in 2023.

Energy Projects Struggle With High Interest Rates

During the past year, four factors exerted a particularly negative impact: interest rate hikes, which increased the cost of capital, high inflation, which increased development costs, bottlenecks in the network and, finally, difficulties in supply chains.

"The most important factor driving this long underperformance is to be found in excess capacity, as supply is more than sufficient for current demand," says Fabrizio Arusa, senior relationship manager and ETF specialist at Invesco. "This weighs on margins, although it does represent an advantage: competitive pricing relative to fossil fuels is a large part of what makes this strategy viable for the climate."

"Factors such as rising interest rates particularly affect renewable energy companies due to the long-term nature of their cash flows and leveraged assets. In addition, offshore wind plans, especially in the US, have faced increased risks that have led to the cancellation of some projects,” explains Manuel Losa, senior portfolio manager of the Pictet-Clean Energy Transition fund.

Clean energy projects are subject to high upfront costs and have a high sensitivity to interest rates.

"To give some numbers, [power] plants typically have a lifecycle of around 30 years and are contracted for the first 10-15 years. However, they are often financed with debts with an average maturity of seven years. Existing assets developed and financed during a period of lower interest rates have become more difficult to finance in the current environment, which has been challenging for power producers with existing operating projects," says Aanand Venkatramanan, head of ETF EMEA at LGIM.

“It is important to remember, however, that the clean energy transition is not limited to renewables alone: sectors such as semiconductors, green buildings, power grids and electric vehicles also play a significant role,” says Pictet's Losa. And indeed, the Swiss fund manager's 2023 strategy was able to outperform the MSCI ACWI index largely due to its substantial exposure to these sectors.

Investing and the Greenium Effect

Passive management, on the other hand, struggled more, with iShares Global Clean Energy UCITS ETF USD (INRG) the most high profile casualty of the change in the weather. After being the absolute top performer in 2020, the fund has lost around 43% of its value since January 2021.

"Although the S&P Global Clean Energy Index has had a difficult time, the clean energy segment encompasses a wide range of stocks, so a distinction needs to be made between pure players, which focus exclusively on clean technology, and the rest of the universe, which includes renewables, utilities and the green industry," explains Natalia Luna, senior thematic investment analyst at Columbia Threadneedle Investments.

"In this sense, the sharp decline can be attributed to the correction among pure thematic players, which had benefited from high valuations thanks to the greenium effect, i.e. the willingness of investors to pay a premium for sustainability, in a climate of enthusiasm for ESG issues that had fostered substantial inflows," Luna continues.

"In reality, many companies experienced negative profitability and, in the face of a more difficult macroeconomic environment that led to a reversal of ESG inflows, underwent a natural correction."

Another important dynamic is the fact that the last two years have seen a significant drop in consumer prices for renewable energy, despite the fact that there has been a significant increase in production costs over the same period, creating strong pressure on company margins.

Clean Energy Drivers: Lower Rates, Cheap Stocks

Valuations of clean energy stocks experienced a real boom in the era immediately following the first wave of coronavirus. “These valuations reflected excessive optimism about project fundamentals as well as the macroeconomic environment,” according to LGIM's Venkatramanan.

Since then, however, the value of those stocks has fallen significantly.

"We believe that the market valued the renewables sector excessively negatively in 2023, adopting a generalised approach that failed to capture the structural support factors of the sector, nor distinguish between the different players," explains Natalia Luna. "Despite this, our investment approach to the energy transition has not changed and we continue to forecast positive and sustained growth, although not without obstacles related to the timing of the authorisation process, difficulties along the supply chain and an increase in bottlenecks in the grids."

For Invesco's Arusa, the current valuations of the investment universe are “extremely attractive” to date. Moreover, in an election year for the US market, a Democrat victory is “likely to prove a boon for clean energy stocks”.

“The spike in interest rates provides much-needed valuation support to the renewable energy sector, which has been negatively impacted by its rapid rise,” says Roman Boner, senior portfolio manager of the RobecoSAM Smart Energy Equities strategy.

“We believe that the current rise in capital costs is only a temporary setback for the renewable energy sector, as growth prospects in this decade remain strong and financing is still widely available. This creates attractive entry points for the medium to long term. This is a long-term structural issue that will follow a non-linear path that will produce winners and losers.”

Overall, Boner and the Robeco management team also remain confident about the outlook for earnings in 2024, even in the face of a more challenging macro scenario “as high energy prices and the urgent need for energy independence act as catalysts for greater investment in smart energy technologies.”

AI and Clean Energy

Not only geopolitical issues, but also the future of technology is pushing us towards cleaner and cheaper sources of electricity. “In fact, it is estimated that the demand for electricity from AI (artificial intelligence) will reach in a few years the level of the current demand of the whole of Europe,” says Manuel Losa.

According to Losa, the energy transition of our economy passes through three fundamental changes: “The first is related to cleaner electricity generation, with renewable sources that are not only cleaner but also cheaper. The second is widespread electrification, starting with sectors such as transport and heating of buildings. The last relates to increasing energy efficiency; the need to reduce energy use and increase optimisation is becoming increasingly important.”

“The increasing efficiency of renewables and falling prices for electric vehicles will indeed continue to drive this trend," says Pictet’s manager. "We firmly believe that the transition to a clean energy future is inevitable, despite short-term movements in commodity prices and possible policy interventions.”