Shares in Burberry slumped on Friday morning as it issued another profit warning amid an ongoing slowdown in the luxury sector.

Ahead of a third-quarter trading update on January 19, Burberry (BRBY) now says adjusted operating profit for the year ending March 30 will be between £410 million and £460 million.

"We experienced a further deceleration in our key December trading period and we now expect our full year results to be below our previous guidance," chief executive Jonathan Akeroyd said.

Significant Profit Downgrade

In November, the luxury fashion group had provided guidance that profits would be between £552 million to £668 million. The company made £634 million in the 2023 financial year. At that point in November 2023 the shares also fell significantly.

Morningstar luxury analyst Jelena Sokolova describes this as a "significant" profit downgrade by Burberry, whose fair value estimate has been cut from £24.60 to £21.

In previous periods, a slowdown in luxury spending in China was blamed. Now Europeans and American spending trends are flagging.

"Deceleration is mainly driven by the developed markets. It is something I’ve been cautioning about for the last one-two years, as pandemic times boom in spending by Americans and Europeans was not maintainable (driven by pandemic-time savings) and now is unwinding," she says.

"Chinese spending is failing to offset this – sales in the Mainland China were up 8% but the base of comparison is low as prior calendar year’s last quarter was impacted by lockdowns. Also demand in South Korea markedly weakened (down 10%)."

We have to wait to see what other listed luxury groups say before making judgments about the sector, Sokolova says.

"Since Burberry is the first to report (or profit warn) it’s hard to say to what extent the problems are industry-wide (as their release suggests) or Burberry specific."

By midmorning the company's shares were down nearly 8% to £12.57, and they're off around 44% since the same period of 2023.

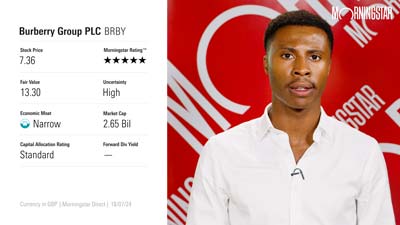

Morningstar Metrics for Burberry

Price: £12.67

Fair Value: £21

Morningstar Analyst Rating: ★★★★★

Uncertainty Rating: High

Economic Moat: Narrow