.jpg)

Owning European banks has been quite a bad idea for a while.

In the years of underperformance since the Global Financial Crisis, banks have come to be considered either "value traps" – stocks with depressed valuation multiples because of insufficient earnings potential – or a high-beta play for shorting when investors became risk averse due to macro uncertainties.

Declining interest rates and regulatory pressure have also held back banks' return on equity and severily limited their ability to return capital to stockholders.

"Negative or zero interest rates depressed net interest margin over the past decade as European banks could not earn a spread on a significant part of their deposit base", write Morningstar analysts Johann Scholtz, Niklas Klammer and Ben Slupecki in their last Banking Landscape report.

This led to significant underperformance which lasted most of the last 20 years. Over that period of time, European banks have returned -0.02% per annum, compared with +6.6% for the wider European market, Morningstar data shows.

Yet with the recent rebound in interest rates caused by the restrictive monetary policy of the European Central Bank (ECB) since July 2022, the tide seems to be turning, with European banks finally reporting better financial results. Can this last?

It is not the first time that investors have bet on a return of value stocks, including banks. Cyclical sectors benefit from such a move, because they are considered more sensitive to the economic cycle.

A better economic environment means higher interest rates, which drives net interest margins, is one source of revenue for banks. It also tends to increase activity in financial markets, bringing more frequent transactions, including mergers and acquisitions and IPOs which support investment banking businesses.

The recent outperformance of European banks supports this thesis, even if the timing seems odd. After all, investors are now expecting a slowdown in economic activity that would make the ECB’s policy less restrictive.

Between July 2022 and September 2023, the ECB deposit faciliy rate jumped to 4% from 0%. Over the same period of time, 2-year Bund yield jumped to 2.7% from 0.4%. This has helped European banks charge more for lending money and drove their combined revenue from €260 billion (£225.2 billion) in 2021 to an estimated €357 billion in 2023.

Glimmer of Hope

"Banks' shares are on track to outperform the European market for the third consecutive year, a feat last achieved in the early 2000s", BNP Paribas Exane's analysts wrote in a report in November.

"This, despite the relentless bad news this year; Credit Suisse’s demise; the regional bank crisis; credit concerns and economic malaise. This speaks of the power of owning a sector trading near trough valuations, with generous capital returns and continued earnings upgrades".

European banks returned 25.3% so far this year, outperforming the broader market, which rose 13.6% over the same period.

Of the 45 banks in the Stoxx Europe 600 Banks index, just twelve outperformed the sector benchmark. The main stocks behind the sector gains were Unicredit [UCG], HSBC [HSBA], BBVA [BBVA], Santander [SAN], Intesa Sanpaolo [ISP], BNP Paribas [BNP] and Credit Agricole [ACA].

Despite the rebound, financial services – which include banks, but also insurers and other services such as asset managers – are still slightly underrepresented in the 2,580 European large cap funds available for sale in Europe, according to Morningstar data as of end of October. On average, they represent 16.2% of assets under management, compared with 17.7% in the benchmark index.

The hope of better earnings growth in a higher-rate environment partly explains the outperformance of the sector. That and the prospect of better capital return to shareholders may brighten European banks' outlook in 2024.

What's The Outlook for European Banks?

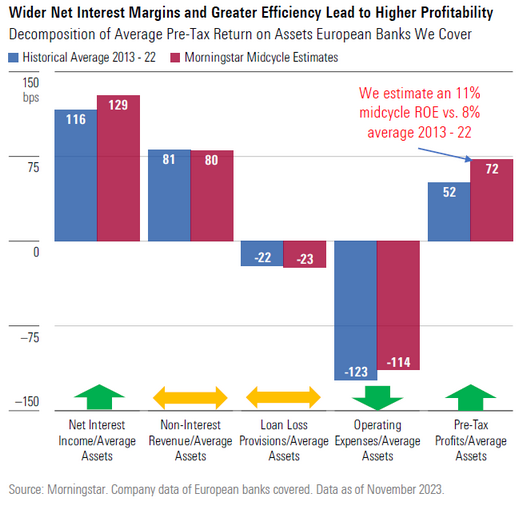

In their report, Morningstar analysts estimate "European banks can generate a midcycle return on equity of 11% compared to the 8% average it generated over the past decade.

"European banks are not a growth story," they continue.

"Profitability gains will drive shareholder value. A structural change in net interest margins following the return of normal monetary policy is the main driver of increased profitability."

"European banks have a high degree of operating leverage, which amplifies the step change in net interest margins".

According to consensus estimates cited by BNP Paribas Exane's analysts, the banking sector could earn €223 billion in net income this year, compared with €172 billion last year.

Even if valuation multiples are depressed, Morningstar's analysts believe European banks may continue to outperform in 2024, provided their earnings keep growing. "Profitability increases should be the main driver of shareholder value", they write.

The reason here is both operational efficiencies and the absence of additional regulatory pressure.

"Digitalisation has led to a material reduction in the number of branches and employees of European banks. The pronounced increase in regulatory and compliance costs is largely in the base, and the efficiency gains achieved will be more visible in the future."

The most surprising fact is that despite the recent rebound, the valuation gap with the European market is far from closed. Since 2000, when the sector was trading at a valuation multiple close to the rest of the market, European banks have suffered a massive derating that they never managed to erase.

This means investors can still find value in the European banking sector for the long run. According to Morningstar's analysts, among ten banks with a "Narrow" Economic Moat, two score a Morningstar 5-Star rating: ABN Amro [ABN] and Lloyds Banking Group [LLOY]. Four have a 4-star rating: Santander [SAN], ING Group [INGA], Svenska Handelsbanken [SHB] and KBC [KBC].

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)