![]()

Feel like you’ve missed the AI goldrush? Fear not: rather than focusing on the big AI players, Morningstar sees potential opportunities in the next rung of artificial adopters. These include those companies that can strengthen their products using AI, without the valuation risk.

In the ever-evolving landscape of technology, the rise of artificial intelligence, or AI, has been nothing short of revolutionary. With AI becoming more sophisticated in recent years, it has created both disruption and opportunity; and for investors eager to filter the winners and losers, it also brings risks.

“While we’d warn investors not to let hype dominate their investment decisions, we are seeing a tremendous shift in the make-up of equity markets, which are worthy of note for all investor types,” Morningstar Investment Management’s (MIM) experts write in their outlook for 2024.

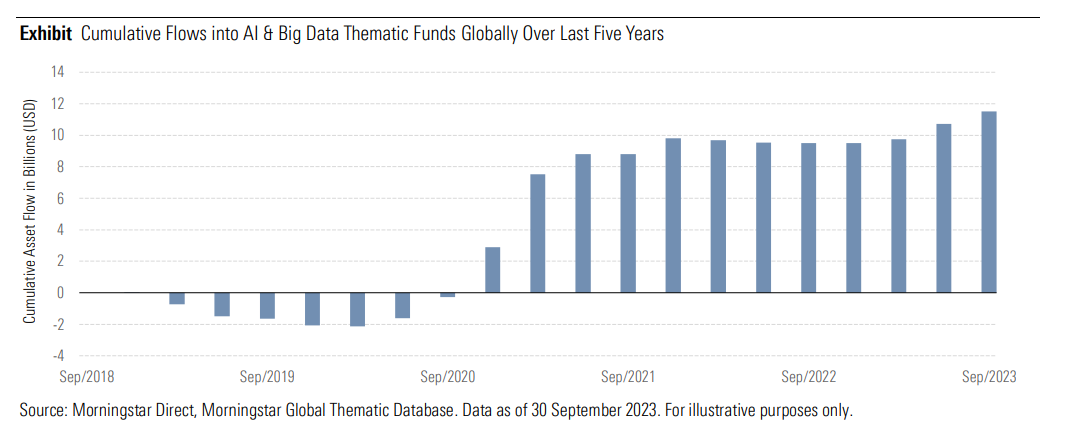

The interest from investors has already been dramatic, illustrated by massive inflows to AI and Big Data thematic funds globally and soaring share prices for big AI-players.

But according to MIM, it might be wise to steer away from the conventional major AI players (such as Nvidia) and look closer at the AI adopters set to strengthen their offerings through AI without the valuation risks.

“Artificial intelligence is an exciting theme and we expect a lot of market interest in 2024. One effective way to access the AI theme without paying huge valuation premiums is via second-derivative plays,” the report says.

But what exactly does "Second Derivative Plays" entail? It is not the chip makers or those that offer technology interfaces, but rather, those who can effectively embed AI into their workflow and drive new revenue growth opportunities. An investor making second-derivative plays might therefor be looking for opportunities that arise from the knock-on effects of AI.

Examples of Second Derivative AI Stocks

1) Most companies do not have the expertise or financial wherewithal to build and maintain their own AI platforms. That’s where IT consulting companies could come in with technical capabilities in artificial intelligence services.

2) Another example is data management providers that host enterprise data on which artificial intelligence models are run.

3) AI requires extremely high speeds to train its data models and we expect those with the highest networking speeds to allow it to reap the benefits of spending brought on by investments in generative AI.

4) Data centres will likely experience a long tailwind from the explosion of growth in AI. As AI is built, trained, and rolled out, it will require a great deal of computing power and data storage.

Don’t Chase Winning Shares - Look for Economic Moats Instead

If you’re one of many investors intrigued by AI, try to look beyond the obvious and explore the nuanced opportunities offered by Second Derivative Plays. But as always, beware of the risks and remember that it is a dangerous game to chase the winners in periods where product development and investor hype is in overdrive.

“Companies with economic moats could be more likely to benefit and may be less susceptible to disruption from AI than those without moats,” MIM’s experts explain, adding that moats based on a combination of customer switching costs, unique data sets and brands could be particularly valuable.

“Investors should be on the lookout for permanent changes in industry structures and customer preferences.”