With the clock ticking until the introduction of the new Consumer Duty on 31 July, the FCA has released its latest survey on Britons' financial lives.

It makes sobering and uncomfortable reading because it shows the dire impact of the cost-of-living crisis on the nation's finances and people's mental health. The survey also sheds a harsh light on the provision of financial services in the UK and reminds policymakers how much work needs to be done to get us financially ready for retirement.

Still, there are signs of improvement in some areas compared to five years ago.

In a 335-page document, the FCA looks at a range of issues, including vulnerable customers, scams, trust in financial companies, financial "resilience" in an era of soaring inflation, access to banking, and customer service. There’s a lot to digest and this article won’t tackle all the issues it raises in detail. Instead we’ll look at the key findings.

Financial Firms Get Bad Marks

Starting with financial services and a stark statistic: just 41% of those surveyed in May 2022 had confidence in UK financial services and just 36% thought most financial firms were honest and transparent in the way they treat customers.

These are disappointing numbers but perhaps unsurprising in the context of the many scandals we've seen since the financial crisis, as well as the broad spectrum of products and services available in the industry, including everyday banking, mortgages, financial advice, pensions, credit cards and insurance.

Given the complexity of our household finances, consumers are likely to have different experiences and not all of these will be satisfactory. The industry may be encouraged by an improvement in the scores since 2017, however. Back then, 39% had confidence in financial services and 31% thought financial firms were honest and transparent.

People Don't Like Products, But Buy Them Anyway

In an era of multiple suppliers and (relatively) easy switching, especially in retail banking, customer loyalty is an elusive factor. But one surprising outcome of the survey is more people have faith in their provider than those in general. What do we mean by that?

In one instance, 11% had strong trust in mortgage lenders, but 54% had trust in their own provider. That seems obvious but an important point. The message we can glean from this is very much "I like my bank (and if I didn't I would switch), but I don't like banks generally."

Does this vindicates the competitive nature of modern finance, which offers a huge range of products? Not quite. 23% of people in the survey had experienced problems accessing a financial product or service in the two years to 2022. While this includes people refused services – a normal part of day-to-day interaction with banks – some received alternative products whose price or terms were "completely unreasonable".

This phenomenon is most noticeable in credit cards or loans, where the "next best thing" comes with an APR consumers thought was too high. 33% of people who didn’t like the product accepted it anyway, which speaks volumes about how people about the quality and variety on offer to them.

What are the overall figures for financial products? Some 37% of respondents had an investment product, up from 32% in 2020, but this uplift can be explained by the increasing adoption of cryptocurrencies, something the regulator has publicly said it is not completely comfortable with. But this is eclipsed by the percentage of people with a savings account, which was 70% in 2022. The data also bares this out. Cash ISAs are much more popular than their stocks & shares counterparts.

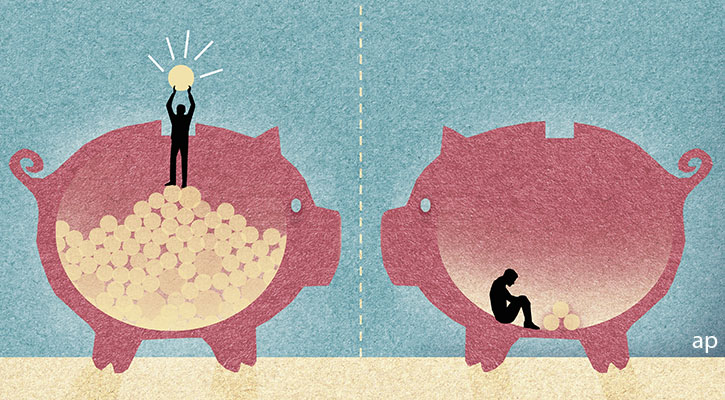

Are We Saving Enough for Retirement?

More than half of participants in the survey had a pension pot (described by the FCA as a "pension in accumulation"), but 35% of had defined contribution savings of less than £10,000. This will be worrying to the government and regulators. For comparison, the state pension currently pays £10,000 a year so such figures imply there is a significant shortfall in people's savings.

Two connected statistics will deepen this anxiety: 8% of respondents had received regulated financial advice in the year to May 2022, up from 6.2% five years ago. Sound good?

Well, more than half of those surveyed had stopped saving and investing altogether because of the cost-of-living crisis. While not all saving and investing is long term, when faced with a client worried about a retirement saving shortfall, most IFAs would probably recommend some form of equity exposure.

An interesting corollary to the low takeup of financial advice is the increasing number of people (nearly 30%) seeking financial "support" from publicly-available information.

The FCA includes official sites such as Citizens Advice as well as Which?/MoneySavingExpert in this definition, alongside the media and even friends or family. While the regulator is concerned about "influencers" using social media to flog bad products or scams, it passes no judgment on more legitimate sources of information.

What is the Consumer Duty?

The Consumer Duty launches on July 31 and the FCA is keen to frame its survey's findings as evidence of why it’s needed. Sat in front of MPs last week, Nikhil Rathi and Ashley Alder, the FCA’s chief executive and chairman respectively, were keen to stress how dramatic and wide-ranging the Duty will be.

According to Alder, the switchover next week "implies a lot of change" and will help support consumers. Financial firms have been readying for next week by making sure their processes comply with the FCA's aims, whether through staff training or process updates.

According to the FCA, the Duty "requires firms to act in good faith towards retail customers, avoid foreseeable harm, and enable and support retail customers to pursue their financial objectives". This is not just a question of financial companies "improving their customer service" by reducing call wait times, although that would of course be nice.

Companies will be expected to: provide helpful and responsive customer service; equip their customers to make good decisions through communications people can understand; and provide products and services that meet consumers’ needs and work as expected.

They will also have to explain and justify their pricing decision, answering questions like: does this product offer fair value and why?

A note on methodology: the FCA interviewed 19,145 people, the majority of which were spoken to in May 2022; so while this is a "2022" survey, the data comes from around the mid-point of last year. The survey is run roughly every two years so the last comparison point was 2020, the year of the pandemic and repeated lockdowns. The survey itself has nearly 1,300 questions. The regulator extrapolates the results to the wider population; hence its claim that “21.9 million people" had confidence in financial services

.jpg)