In 2022 European-domiciled strategic-beta exchange-traded product (ETP) assets and flows exhibited significant volatility, but dividend funds offered an attractive alternative for those seeking regular income.

Strategic-beta funds have failed to generate the same level of enthusiasm in Europe as they have in the US. However, there is a group European investors like a lot: dividend strategies.

What is Strategic Beta?

Widely referred to as "smart beta", strategic beta refers broadly to a group of indices and the ETPs and other investment products that track them.

Most seek to enhance returns or minimise risk relative to more traditional benchmarks. Others seek to address oft-cited drawbacks of standard benchmarks, such as the negative effect of contango in long-only commodity futures indexes, and the overweighting of the most indebted issuers in market-value-weighted fixed income benchmarks.

These indices may also aim to capture a specific factor or set of factors such as Value, Momentum, Small Size, Low Volatility, or Quality.

Investors Embraced Dividend Funds

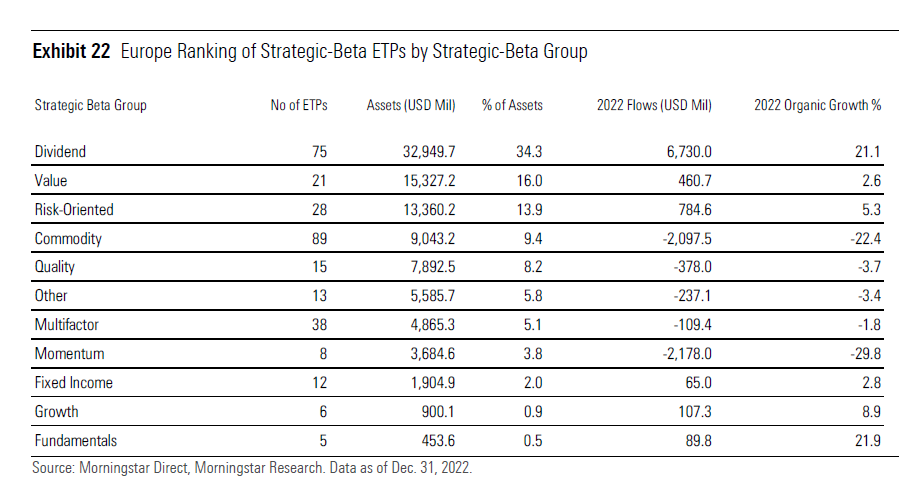

According to Morningstar's Global Guide to Strategic-Beta Exchange-Traded Products, in 2022, the highest flows of $6.7 billion (£5.4 billion) went into dividend strategies in Europe.

Dividend strategies performed better than the overall strategic beta markets, which gathered $3.2 billion of net inflows. In Europe, net assets in strategic-beta ETPs reached approximately $96 billion last year, and accounted for a modest share of approximately 6.8% of the total pool of ETP assets domiciled in Europe.

"Throughout 2022, European-domiciled strategic-beta ETP assets and flows exhibited significant volatility owing to challenging equity market performance and fluctuations in foreign-exchange rates," says Monika Calay, director of passive strategies research of Morningstar in EMEA.

"This volatility was reflected in the fluctuating net assets of strategic beta ETPs, which reached a peak of $114 billion in March but experienced a substantial outflow in September, hitting their lowest value of USD85.4 billion for the year".

Why Are Dividend Strategic Beta ETPs so Popular?

As 2022 marked a period of historic downturn in the global market and even bonds didn't feel that safe, many investors found themselves reconsidering their income strategies.

Against that backdrop, dividend funds offered an attractive alternative for those seeking regular income and some measure of stability.

Dividend strategic beta ETPs are at the top or near the top of investor preferences not only in Europe, but also in the rest of the world. In 2022, ETPs belonging to the Dividend Strategic Beta category gathered $85 billion of net new money globally, accounting for 52% of the global net flows into all strategic beta products.

In US, which is the largest strategic beta market in the world, Morningstar's dividend strategic beta group claimed top spot in the flows league table in 2022, reeling in $69.8 billion in new money. That translated into a 21% organic growth rate, the best clip since 2013, when its asset base was less than a third of that size.

The upward phase for dividend strategies is continuing this year. As Valerio Baselli, senior international editor at Morningstar explained in a recent article, in Europe "the first quarter was more than positive, with nearly 2 billion in inflows. It was the third best quarter ever (after the second and first quarters of 2022). In general, flows on these types of funds have rebounded strongly since January 2022, after a long period of modest inflows".

Momentum Strategies Dogged by Large Outflows

Apart from dividend strategies, other strategic beta ETP assets and flows exhibited significant volatility in 2022. Most of them experienced large outflows in September, when Morningstar Global Net Return Index fell by more than 9% over the month, one of its worst monthly declines in the past two decades.

Market sentiment in September was weighed down by concerns over high inflation and the Federal Reserve's decision to raise interest rates, which further added to market uncertainty. Moreover, the lingering impact of the coronavirus pandemic, including disruptions in global supply chains, market volatility and intensified selling pressure. In that environment, Momentum and Commodity ETPs experienced the largest outflows of -$2.1 billion.

Risk Strategies Were Back on Top in 2022

Among the few strategic beta funds with positive net flows in 2022 were Risk-oriented strategies. These offerings got inflows of $785 million and their assets grew to $13.4 billion.

The figure is not surprising in a climate of market turbulence. Risk-oriented ETPs in Europe mostly consist of minimum-variance or low-volatility strategies, which seek to offer investors a balance between gaining equity market exposure and minimising risk.

Since the beginning of 2023, however, outflows have prevailed, probably because investors have now learned that Risk-oriented ETPs tend to perform best when markets go down.

The Largest Strategic-Beta ETPs

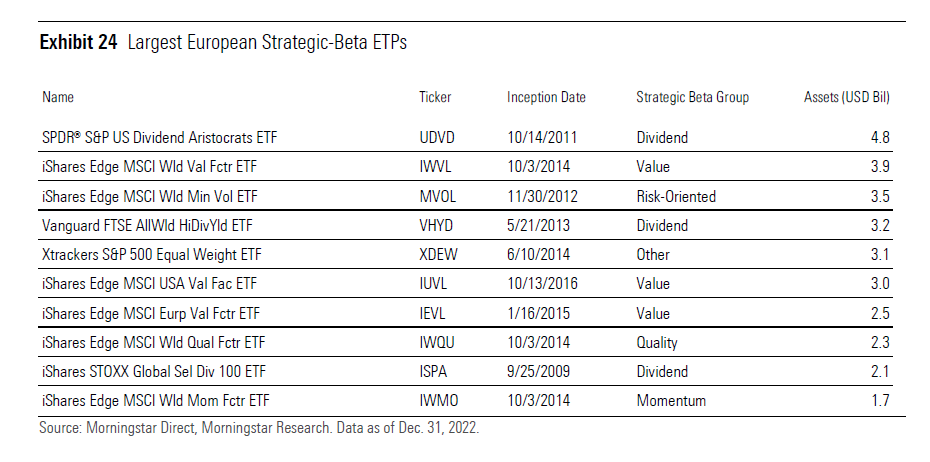

Investors' preference for high-dividend ETPs is reflected in the ranking of the largest strategic-beta ETPs in Europe.

At the top, there is the SPDR® S&P US Dividend Aristocrats ETF (USDV) with $4.8 billion in assets (as of December 31 2022) and a Morningstar Medalist rating of Silver.

Two other dividend-oriented products are in the top 10: Vanguard FTSE All World High Dividend Yield ETF (VHYD) with $3.2 billion assets and a Gold Medallist rating, and iShares STOXX Global Select Dividend 100 ETF (ISPA), which has $2.1 billion assets and a Neutral Medalist rating (all ratings are as of May 31 2023).

.jpg)