ESG investing has become a popular strategy in recent years as investors seek to align portfolios with their values and focus on companies with a positive impact on society and the environment. While these investors place a big emphasis on climate change, the issue of controversial weapons is often overlooked.

Indeed, controversial weapons are often given less attention in ESG investing, despite their significant impact on human rights, but the war in Ukraine has rekindled attention in this area.

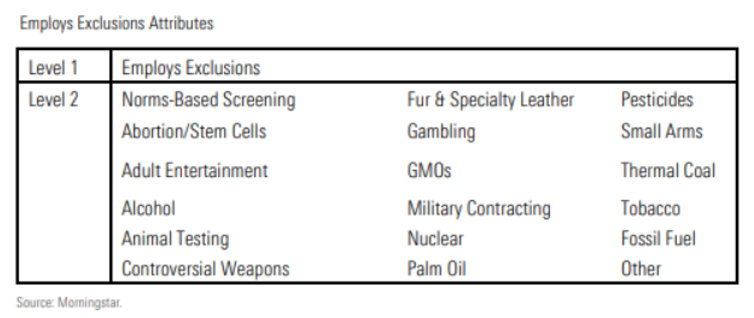

In 2019, Morningstar, using information provided in regulatory filings, introduced a set of indicators that identify strategies that use exclusions of specific industries, companies or business practices. Below you will find the list of exclusion attributes identified by Morningstar Sustainalytics and one of these exclusions is "Controversial Weapons".

The Controversial Weapons Avoidance Indicator identifies strategies that avoid investments in companies that derive a significant percentage of their revenues from controversial military weapons such as weapons of mass destruction, nuclear weapons, landmines and cluster munitions. These strategies do not necessarily preclude companies profiting from conventional military weapons.

Which companies are targeted? Many are based in emerging countries, but there are some in Europe and the United States such as…

BAE Systems is a global defence, aerospace and security company, offering a broad range of products and services for air, land, naval and cyber defence. The company manufactures weapon systems and munitions, naval and air support, ground combat vehicles and other services tailored to the military, as well as solutions for the Royal Saudi Air Force, Australian Defence Force, the Indian military and the Oman Armed Forces. It also produces fighter aircraft, such as the Typhoon and F-35 Lightning II.

Airbus is a supplier and manufacturer of commercial and military aircraft and defence equipment. The company operates in three main segments: Airbus, Airbus Defence and Space and Airbus Helicopters. The company's Defence and Space segment produces military aircraft such as the Eurofighter fighter jet, A400M transport aircraft, A330 MRTT tanker, and C295 tactical transport aircraft. Airbus Helicopters also serves the military industry, offering a variety of helicopters such as the Tiger multi-role fighter aircraft, the H225M military transport helicopter and the H125M single-engine helicopter. Additionally, the company provides secure satellite communications solutions for the military.

General Dynamics operates in the aerospace and defence industries. It develops and manufactures numerous defence systems, including nuclear submarines, battle tanks, combat vehicles, rockets, Gatling guns, command and control systems, communications systems, interception solutions, and munitions. Of the company's four business segments, three are in the defence industry: Combat Systems, Marine Systems, and Technologies. General Dynamics reports that sales to the US Department of Defence and the US Foreign Military Sales programme combined accounted for 57.15% ($21.9 billion) of total revenues ($38.4 billion) in the 2021 financial year.

Leonardo is a manufacturer of high-tech solutions, mainly for the aerospace, defence and security sectors. The company is active in several areas, including helicopters, aircraft, military electronic equipment, air and ground defence systems. Relevant products include, among others, the AW159 and AW249 combat helicopters, the Eurofighter Typhoon and the F-35 JSF. The company reports that military sales accounted for 83% (€11.7 billion) of total revenues (€14.1 billion) for the financial year 2021.

How Many Funds Exclude?

One might think that most funds expressly avoid investing in companies related to controversial weapons, but the reality shows a different picture. Overall, within the main equity categories, the percentage of funds that explicitly exclude these types of companies from their portfolios is around 50%.

In the table below, we've calculated the percentage of funds that exclude companies specifically involved in manufacturing controversial weapons across different Morningstar categories.

But how do we know if the fund actually excludes controversial weapons? It's not easy. We definitely need to do some additional research. A little hint can help. Most of the funds classified as article 9 of the SFDR regulation do this, but not all. (Article 9 funds are those that have sustainability as a specific objective and we’ve written about them here.) For example, in the Eurozone Large Cap Equity category, 75% of Article 9 funds apply this exclusion criterion.