Sustainable investing was put to the test in 2022. Russia’s attack on Ukraine ignited an energy (and moral) crisis that shook the world, but while flows into sustainable funds held up better, elevated oil prices meant performance lagged.

Meanwhile, greenwashing concerns arose, prompting regulators to clamp down on misleading environmental, social, and governance investing claims. Criticism of sustainable investing grew, especially among politicians in the United States. And some asset managers stepped back from previous commitments.

Sustainability-focused investors should be discerning when selecting fund managers. Enter the Morningstar ESG Commitment Level, which aims to provide insights to simplify this process for investors. The ESG Commitment Level is a qualitative measure that aims to help investors better understand which asset managers are committed to delivering the sustainability outcomes that best meet investors’ preferences.

How committed is your fund manager to ESG investing? The answer may surprise you. Look closely when deciding what sustainable funds to own.

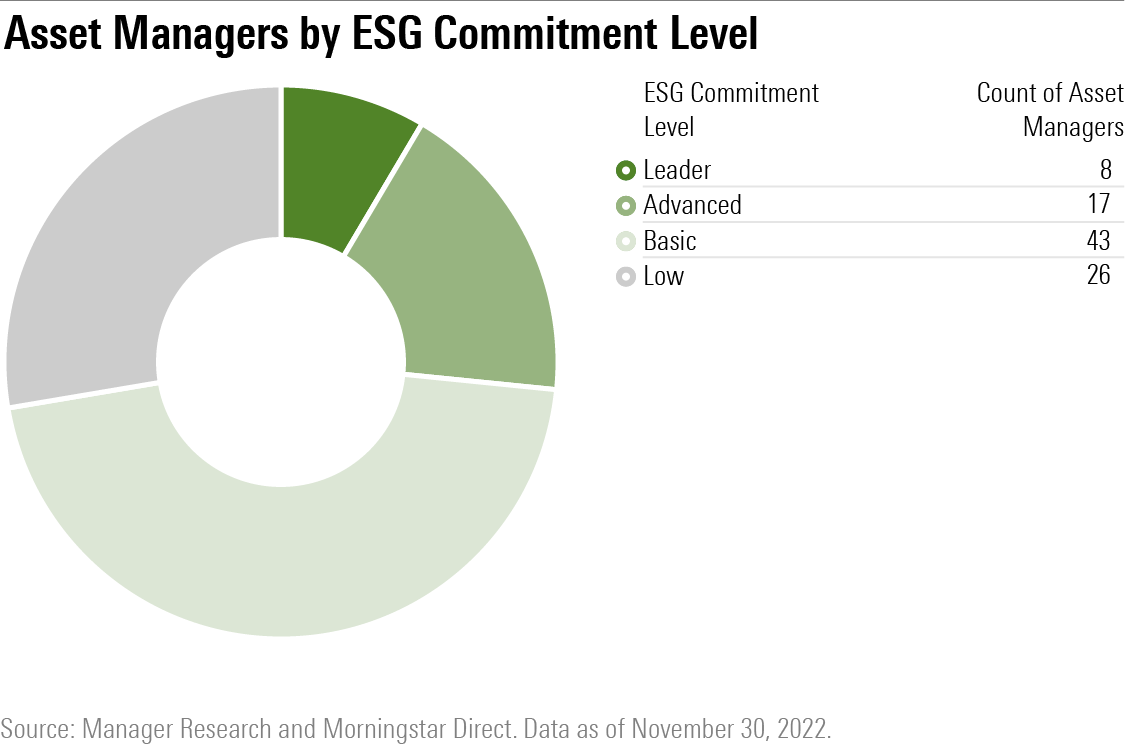

Just Eight of 94 Asset Managers Earn Top Marks

Of the 94 asset managers covered under the Morningstar ESG Commitment Level, we have awarded the highest honours to just eight. Robeco, Parnassus, Calvert, Impax, Australian Ethical, Boston Trust Walden, Affirmative Investment Management, and Stewart Investors all earn ESG Commitment Levels of Leader. The chart below shows the breakdown of ESG Commitment Levels. Meanwhile, 17 asset managers earn the next-highest rating of Advanced.

The largest and most diverse grouping of asset managers – 43 firms – receive ESG Commitment Levels of Basic. These range from industry behemoths such as BlackRock and State Street to boutiques including Colchester Global Investors and Acadian Asset Management. In general, these firms are progressing in their sustainability efforts but still blend in with the crowd. Some are still in the early stages, having kicked off ESG integration programs within the past five years, while others are much further along – close to, but not quite reaching, Advanced.

This breakdown reflects the varied landscape of ESG integration in asset management globally. A few firms continue to set the standard for sustainability-focused investing, and most are still playing catch-up.

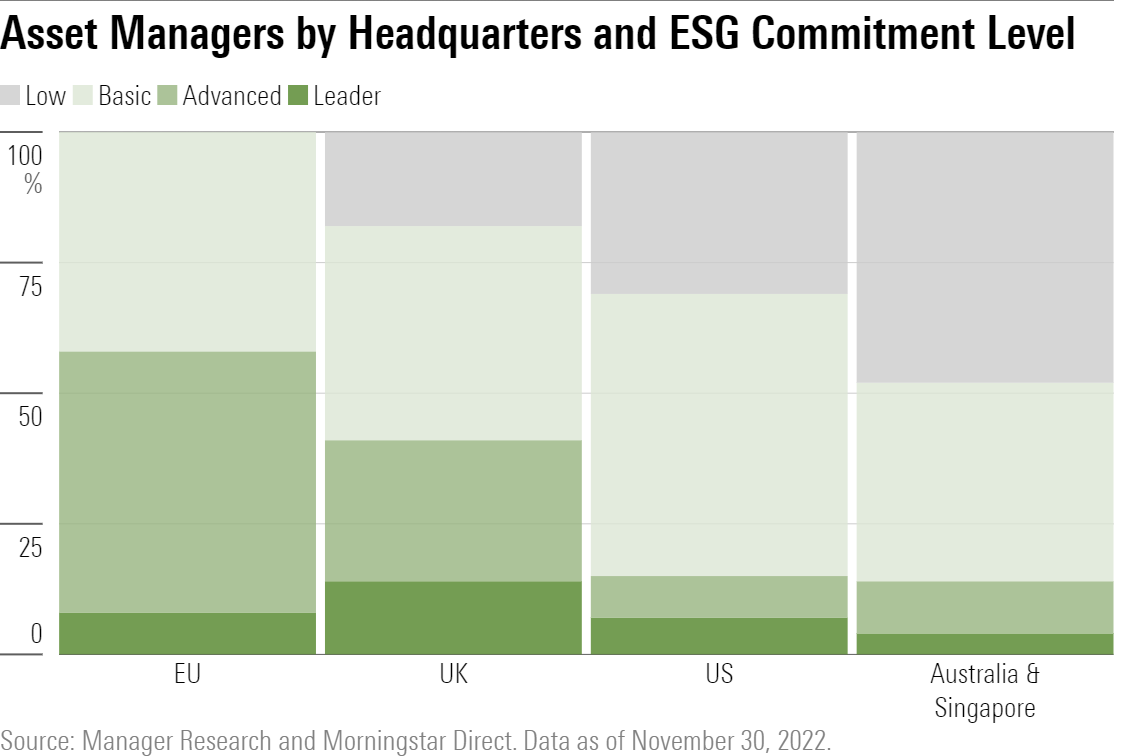

European is Further Along Than its Peers

More than half of European firms under coverage earn ESG Commitment Levels of Leader or Advanced. The United Kingdom has the highest proportion of Leader firms, including Impax, Affirmative Investment Management, and Stewart Investors.

Europe’s advantage in sustainable investing is driven at least in part by local investor preferences. Since the 1970s, for example, Norway’s sovereign wealth fund has developed sustainability criteria within its investment objectives, setting a standard for other large Nordic asset owners to follow.

In recent years, the EU Action Plan on Sustainable Finance, which aims to reorient capital flow toward sustainable activities, and the Sustainable Finance Disclosure Regulation (SFDR) have accelerated the adoption of ESG strategies by investors across Europe.

The US matches the UK in terms of the number of firms earning Leader, including Parnassus, Calvert, and Boston Trust Walden. However, by contrast, more than half of the US firms under coverage land at Basic, and 12 earn Low.

Although sustainable strategies have grown rapidly in the US, the pace of this acceleration continues to lag Europe, largely because of the political and regulatory environment. US regulation has fluctuated between a neutral stance and opposition by the previous administration of Donald Trump. More recently, the Securities and Exchange Commission has proposed rules that would increase reporting requirements for public companies, ESG-branded funds, and all funds that use ESG criteria in their process. These disclosure rules should create a clearer and more accessible environment for ESG-focused investors.

Small is Beautiful

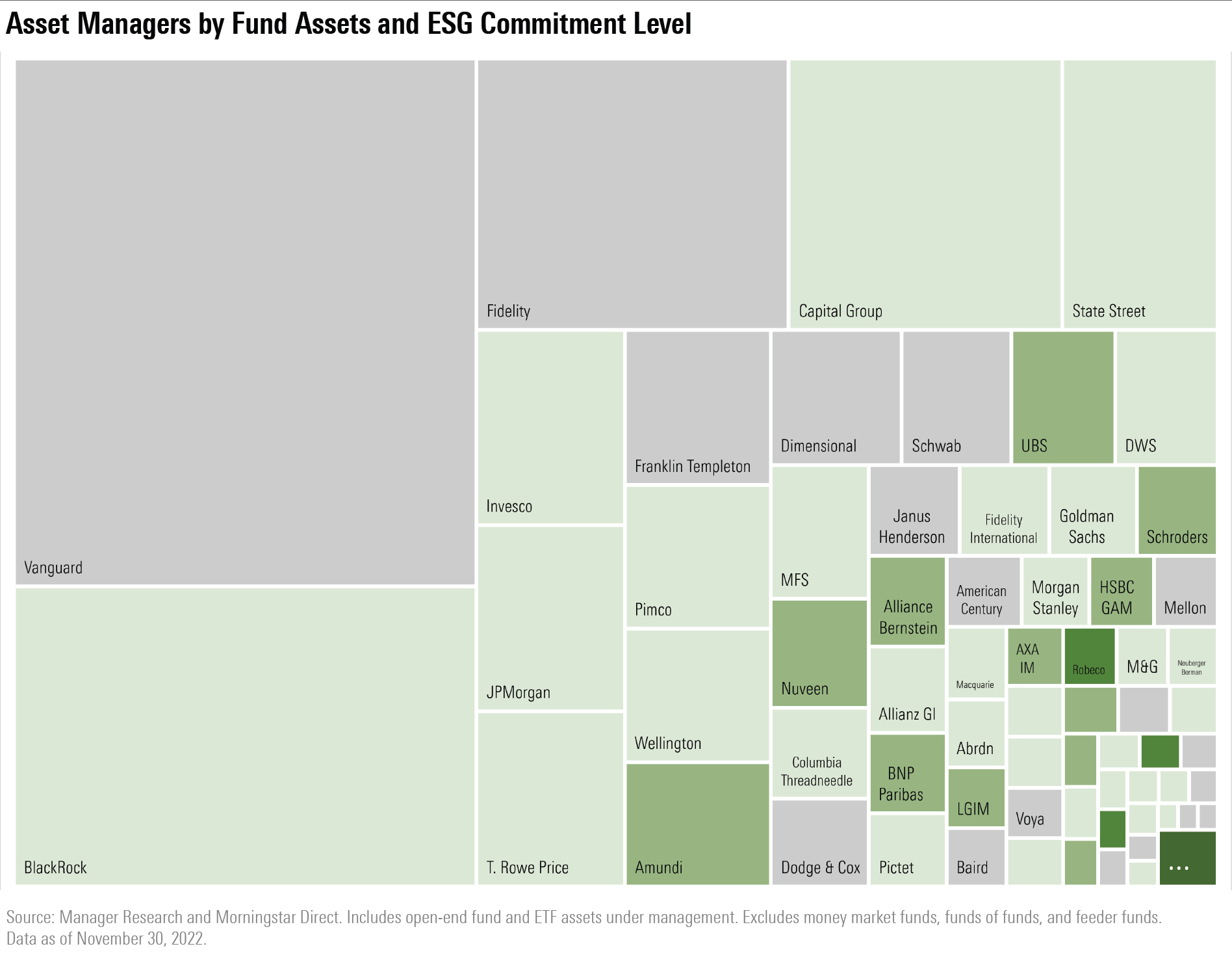

The most highly-rated asset managers tend to be small, dedicated shops with a high percentage of assets in ESG-focused funds. The Big Three, namely BlackRock, Vanguard, and State Street, are constrained in part because most of their assets track non-ESG indices. BlackRock and State Street earn Basic ESG Commitment Levels, while Vanguard earns Low.

Exhibit 3 shows a link between asset manager size and ESG Commitment Level. Among the most highly rated managers, Leader-rated Impax and Parnassus have fund assets of $10.5 billion and $38.0 billion, respectively, 100% of which is held in ESG-focused strategies (as of August 2022).

The largest shop to earn top marks is Robeco, with nearly $82 billion in fund assets as of August 2022. Robeco has been a trailblazer in sustainable investing for decades through RobecoSAM, which was founded in 1995 as Sustainable Asset Management. RobecoSAM became an affiliate of Robeco in 2007 and was fully integrated into Robeco in 2021.

Meanwhile, larger firms, which typically serve a broader spectrum of investors with various needs and ESG preferences, tend to have lower ratings. The largest 10 managers in our sample include seven firms rated Basic and three rated Low. These managers built their businesses through commendable strategies such as low-cost investing, technological innovation, and sharp stock-picking, but sustainable investing is a lower priority in the firms’ philosophies.

Large asset managers such as BlackRock, Vanguard, and Fidelity Investments face challenges when it comes to using all of the features in the ESG toolkit. For example, their outsize position in the markets precludes them from proposing or sponsoring shareholder resolutions, which are crucial tools for investors who aim to drive sustainable change through active ownership.