Tax Has Got More Taxing

Understanding what individuals and companies would be paying in tax became harder this year. Four chancellors, three "budgets" (if you can call them that), two Tory leadership campaigns, and one Kwarteng in a magic money tree resulted in policy shifts, scrapped pledges and screeching U-turns on U-turns. Dividend taxes, National Insurance payments, corporation tax, additional rate tax and even basic income tax were all going up and then down, or down and then up, or staying where they were after promises to lower them. While it was hard to keep track of the details, the big picture was clear: we will all be paying more tax, not just in 2023 but for many years to come. In recent years the UK has become accustomed to a degree of political turbulence, but 2022 has topped this. If political trust was a limited company, it would be fair to say its shares would have tanked this year.

War is Hell

In February, the world held its breath to see if the tanks, weaponry and troops amassed on Ukraine’s eastern borders would be deployed in earnest. To some, Vladimir Putin’s saber-rattling was a display of machismo designed to spook NATO and the West. It was that, but it was also a logistical operation designed to supply a war machine ready to advance. Coverage since has suggested certain Russian units were not even aware the coming invasion was just that. The resulting devastation has exposed systemic Russian military corruption, ill-discipline and strategic error, but the price has been paid in human terms by everyone in Ukraine. In April, Hermitage Capital Management's Bill Browder predicted Vladimir Putin would be forced to double down into an even bloodier quagmire in the face of military failure, and at the moment it looks like he was right. In the longer-term, it's difficult to say anything with any certainty.

Elon Musk Is Twitter, Regardless of Any Poll

Elon Musk started 2022 as the CEO of Tesla and the world’s richest man. By the end of it he’d lost the wealthiest human tag, but gained a social media platform, buying Twitter for $44 billion. Currently he is still chief executive of the site, though that may not last. Musk has said he will abide by the outcome of a poll that instructed him to depart as CEO, but that doesn't mean seasoned Musk watchers aren't taking his words with a large pinch of salt. After all, most of his announcements this year have been subject to a will he/won't he debate, so here are some highlights: his intention to buy Twitter; subsequent declarations he wasn’t buying Twitter; the decision to sell 10% of his Tesla shares (again following an online poll); whether he’d allow controversial Tweeters such as Donald Trump and Kanye West back; or whether his SpaceX company would continue to fund satellite-based internet for war-torn Ukraine. He has now said he will step down as CEO of Twitter when he finds someone "foolish enough" to replace him. Will he though? The longer he seems to stay on, the longer Tesla's own pain seems to persist. If he does or doesn't, it's all peak Twitter.

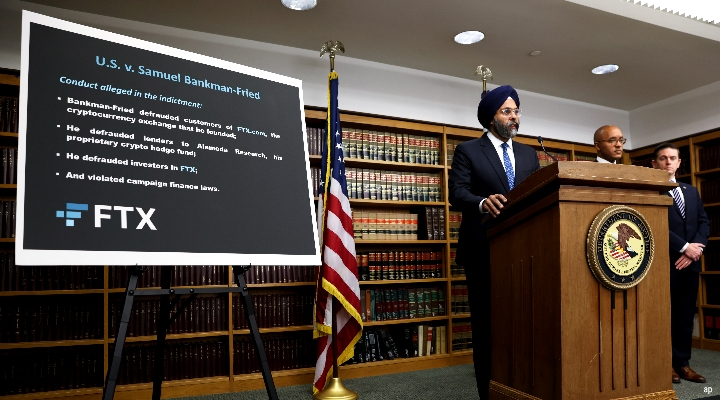

The Tide is Out on Crypto, Even if SBF's Jury Isn't

It has not been a good year for cryptocurrencies. Prices of many major cryptocurrencies plummeted in 2022, causing mass withdrawals and exposing some alarming practices at (at least) one major cryptocurrency exchange. Rivalling Elon Musk for headlines in recent months has been Sam Bankman-Fried, the founder of FTX, who’s now facing criminal fraud charges in the US relating the collapse of his firm. With his shorts, flip-flops and unruly hair, the Bahamas-based 30-year-old former billionaire cuts an unconventional figure, even among crypto-types. The fact he is staring at a 115-year jail term if convicted hasn’t stopped him doing the media rounds, along with some cryptic late-night rants on social media. We learned he doesn’t feel personally responsible for the lack of internal oversight and alleged misappropriation of funds between the various companies he ran. He has, though, apologised to customers who lost millions, and pledged to start a new company to help pay them back. None of that will happen if he's in jail, though.

We’re Heading Back to the 1970s

Remember that BBC detective programme where John Simm’s character, Sam Tyler, woke up to find himself trapped in a 1970s police drama? This year — economically at least — has felt a lot like that, with a global energy crisis, inflation roaring back, interest rates ratcheting upwards, looming recession and now a winter of strikes. Back in July, one of the speakers at Morningstar Investment Conference UK likened the UK's economic travails to the 1980s, warning that a comparison with the previous decade might be unwarranted. But that now seems too optimistic. The key word characterising current proceedings seems to be chaos, and there was plenty of that in the 1970s. We’ve had a number of prime ministers in quick succession, albeit from the same party. Just when we thought the sense of 70s deja vu could not get stronger, Abba announced their first gigs in decades, albeit in hologram mode. How did Sam Tyler eventually escape — or at least end up in the 80s-themed sequel? Let’s hope it is back on iPlayer so we can all find out.

FAANGs Have Lost Their Bite

It hasn’t been a good year for technology stocks, particularly the multi-billion mega-stocks that have come to dominate our online lives. Amazon, Google, Netflix, Twitter and Facebook, have seen revenues hit and share prices fall, leading to job losses in some cases. A bite has also been taken out of the once mighty Apple, which has fared marginally better than its rivals. But Apple’s share price also slipped, as Covid-19 problems in China affected manufacturing and supply. It also suffered lukewarm reviews for the latest iPhone, including one particularly scathing one from the daughter of its late founder, Steve Jobs — worshipped as a minor deity by many Apple fans. Is this the end of Big Tech? It seems unlikely, but it is clear they may not necessarily deliver the super-charged gains investors have been used to, particularly given the tightening regulations now appearing on both sides of the Atlantic.

Spokes Broke in ESG — But Failed to Derail it

The momentum behind ESG investing looks pretty unstoppable, but 2022 offered a more challenging background, with trouble in the US, and soaring valuations of oil and gas stocks on the back of rising fuel prices — a situation exacerbated by the war in Ukraine. ESG funds and investment strategies are typically underweight in this sector, causing performance to dip relative to non-ESG strategies. Certain institutional investors also broke with the ESG consensus, with Vanguard, for example, quitting the Net Zero Asset Managers Initiative. In May Stuart Kirk, HSBC's one-time global head of responsible investing, also made headlines for what appeared to be a somewhat blasé attitude to climate change, telling delegates at an event "who cares if Miami is six metres under water in 100 years?" He may have been swiftly removed from his post, but this wasn’t the only time this year HSBC got into hot water over climate change, with the UK’s Advertising Standards Authority banning a series of ads for "greenwashing" its own environmental credentials.

It's Not Been a Good Year to Run Ferries

Remember this story from March? Peter Hebblethwaite, the CEO of P&O Ferries, won the ignominious accolade of being worst boss in the world after admitting to parliament in March that he broke UK employment laws when sacking 800 ferry staff without notice — before adding, with astonishing candour, that he would probably do it again in similar circumstances. Hebblethwaite was voted worst employer in Europe by the European Transport Workers’ Federation in May, but in October surpassed this by winning the global version of this award via the International Trade Union Congress meeting in Australia. Hebblethwaite was also forced to withdraw from a panel at an industry event in the US after a scathing letter from the chair of the US House committee on transportation and infrastructure. He remains under investigation by The Insolvency Service, but despite his rule-breaking admission, and at least one ferry failing safety inspections, he was still subsequently promoted by P&O Ferries.

Gerald Ratner is Still Teaching PR

Remember the debacle with Center Parcs and the Queen's funeral? The holiday firm, better known for its premium half-term breaks and woodland lodges, generated a slew of bad headlines after announcing it would close on the day of the Queen’s state funeral in September. This meant holidaymakers returning home before travelling back to Center Parcs the next day to resume their holidays. After protests and considerable online ridicule, it backed down, but added guests would have to remain in their lodges during the day — leading pundits to ask how a hospitality business had managed to turn a funeral into a house arrest. The company eventually offered refunds to affected customers, but the bill for the damage it has done to its reputation may be higher.

Gilts Aren’t as Boring as we Thought

Gilts have long been seen as the safe and steady asset of the investment world. But this all changed following Kwasi Kwarteng’s disastrous mini-budget which led to a massive gilt sell-off, causing prices to plummet and yields to rise. As well as pushing up government borrowing costs this also left a number of major pension schemes close to collapse. The Bank of England was forced to step in, as it appeared that politicians, regulators, and many in the pensions industry were unaware of just how vulnerable these schemes could be in the event of unexpected market movements. In the inevitable post-crisis investigations "lessons" will no doubt be learned, and more robust regulations required on these liability-driven investments. Whether regulators go further and take a look at what other parts of the financial industry could be vulnerable in unexpected conditions remains to be seen.