Beckham's Not Bending on Qatar

The World Cup starts this Sunday in Qatar, but the pre-match coverage is less about the fitness of today’s players but those of its former stars — with speculation about fractured reputations and damaged integrity replacing those of broken metatarsals. It has been reported that David Beckham has been paid £150 million to be an “ambassador” for the event. His role includes filming aspirational video messages, which usurprisingly gloss over issues of LGBTQ+ rights and Qatar’s treatment of migrant workers. He has been widely criticised for helping Qatar "sports wash" its international reputation. But will the fee be enough to cover the potential damage to brand Beckham?

Mon Dieu! Paris is Now Europe’s Largest Stock Market

A combination of Brexit, a plummeting pound, and recession has seen Paris overtake London as Europe’s biggest stock market. The value of companies listed on the French bourse now stands at $2.823 trillion, edging it past the value of those listed on the London stock exchange ($2.821 trillion). Just prior to the Brexit vote, the value of London-listed shares was some $1.5 trillion more than those listed in France. London has not been helped by the pound falling faster against the dollar than the euro, and the slump in many UK-focused shares this year. In comparison, large French companies like LVMH (MC) and Kering (KER) have benefited from expectations that the easing of Covid rules in China will help them sell more of their luxury goods.

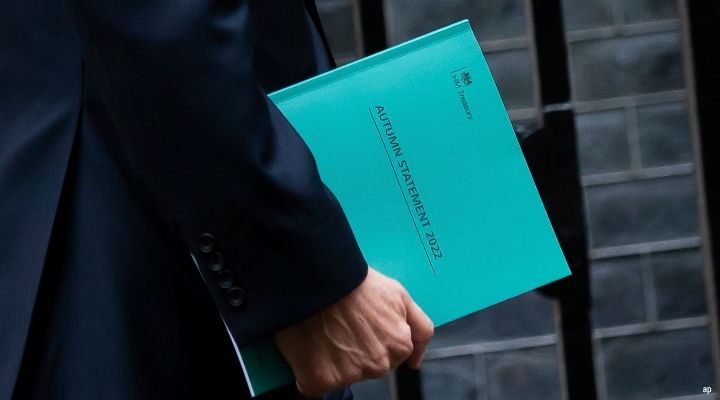

No-One Wants to Make Difficult Decisions

If a week is a long time in politics, eight weeks is an aeon in economic terms. This is the time between the disastrous "Trussonomics" mini-budget and this week’s Austerity 2.0 Autumn Statement — delivered of course by the same political party. Some of the galactic u-turns are clear to see: plans to ditch the 45p top rate of tax have not only been ditched, but this rate will now start from a lower earnings threshold (£125,000 rather than £150,000). Chancellor Jeremy Hunt will also increase the windfall tax on energy suppliers and extend it to electricity generators, but he will restrict help given to homeowners to pay these bills. Those listening to the speech could be forgiven for thinking that in some ways it wasn’t so different after all. Government borrowing remains eye-waveringly high, and despite talk of "difficult decisions" it is clear most of them have been kicked down the road — again! — with the biggest spending cuts coming after the next election. I guess the government might be thinking that by then it will be someone else’s problem.

The Roo is Done Down Under

The Deliveroo (ROO) name might sound like Aussie slang, and its logo includes a stylised kangaroo, but after a global company-wide review, the food delivery company has decided to quit the Australian market. The UK-based firm concluded it would take too much investment to make its operations profitable in the region due to heavy competition from the likes of Uber Eats, Menulog and DoorDash. This latest setback follows a similar withdrawal from the Netherlands last month, and a disastrous float on the stock market in March last year, which prompted some analysts to nickname it “Flopperoo”.

Amazon Revives Neighbours

In other Australia-released news, daytime favourite Neighbours will be given a new lease of life on Amazon’s free streaming service. The long-running soap broadcast a start-studded last episode three months ago — but will now be resurrected on Freevee next year. As well as new episodes, Amazon will also host the show’s 37-year back catalogue, giving fans the chance to catch up again with former Ramsey Street residents, Kylie Minogue, Jason Donovan and Margot Robbie.

Hardcore Twitter Backfires

While Jeff Bezos might be courting positive publicity by bringing back Neighbours and giving global legend Dolly Parton $100m to donate to the charities of her choice, rival tech billionaire Elon Musk just seems to be further enraging everyone. The new Twitter owner sent an ultimatum to remaining staff, saying they “need to be extremely hardcore” and either sign up for “long hours at high intensity” or quit. Employees had until Thursday to commit to these new terms, and so many are understood to have left as a result that Musk has closed the headquarters until next week. It is understood that Musk is planning to halve Twitter 7,500 workforce but one anonymous former employee told the BBC that there might now be less than 2,000 people left. #RIPTwitter.

SBF Goes Full WTF

Twitter is still alive for the time being though and topping a weird week off was a long, rambling and increasingly impenetrable DM thread by the former CEO of crypto-exchange FTX, now defunct. Sam Bankman-Fried, or SBF as he is usually known, appeared to criticise regulators ("f*ck regulators" were his precise words), suggest that the crypto sector, and the entire financial sector were broken, while adding that his former public image was a lie, along with the balance sheet of FTX. However, he also claimed he was "making it up as I go" and his "memory might be faulty in parts". He has later said he thought these DMs would remain private between him and journalist Kelsey Piper. There has also been wild speculation this is him getting in his "insanity" defence ahead of any regulatory or legal action around the platform's collapse. FTX later said on Twitter that Bankman-Fried doesn't speak for the company anymore.

Suits You, Sir!

It appears that Mike Ashley is swapping tracksuits for double-breasted suits. Frasers Group, of which Ashley is the majority owner, is in advanced talks to take over Gieves & Hawkes, one of the oldest tailors on Savile Row. Frasers Group, which now owns Sports Direct has bought a number of troubled retailers in recent years including Missguided, Hugo Boss, Lillywhites and Evans Cycles.

Bank Must Pay Fair Rate to Savers

Nikhil Rathi, the head of the Financial Conduct Authority, has urged banks to make sure savers get the full benefit of interest rate rises. At an industry dinner he questioned whether savings accounts paying next to no interest offered “fair value” for loyal customers. He added that how banks behave during this cost-of-living crisis “will determine the industry’s reputation for decades ahead”. His comments came ahead of new consumer duty rules, which, among other things, require banks, insurers, and other financial firms to ensure that existing customers are getting the same deals offered to entice new customers through the door.

Surging Demand for Primark Click-and-Collect

Primark’s first steps into internet shopping have not been a resounding success, with the website crashing on the first morning. After years of resisting an online option, Primark was finally trialling a click-and-collect service of children’s clothing in 25 shops across the northwest, Yorkshire and north Wales. It said higher than expected demand caused the problems. Primark lost an estimated £1 billion during the pandemic when stores were forced to close, and it was unable to take advantage of online shopping demand.