The Bank of England has stepped up its battle against high UK inflation with a 75 basis point hike in rates today. This move takes UK interest rates to 3%, following on from the 50 basis point increase in September. But there are tentative signs that the rate-hiking path in the UK may not be as aggressive as markets are pricing in.

Monetary policy committee members vote 7-2 in favour of an increase from 2.25% to 3%, with two members wanting a more modest rise, or 50 and 25 basis points respectively.

While a steep hike was expected today, inflation watchers were more keen to hear the Bank’s detailed outlooks, a report it delivers quarterly. Inflation is expected to hit just under 11% in the final quarter of 2022, from 10.1% in September, and this will be lower than expected because of the government’s Energy Price Guarantee (since curtailed by chancellor Jeremy Hunt). This peak inflation forecast is lower than in August, but the Bank is warning that there are "risks to the upside" - ie. the news could be worse than expected. Across the world, inflation is proving stubbornly hard to tackle with conventional monetary policy tools - effectively making money more expensive.

While inflation remains stubbornly high in the US, Eurozone and UK, the Bank is maintaining its forecast that this will ease next year: “In the MPC’s central projection, CPI inflation starts to fall back from early next year as previous increases in energy prices drop out of the annual comparison. Domestic inflationary pressures remain strong in coming quarters and then subside. CPI inflation is projected to fall sharply to some way below the 2% target in two years’ time, and further below the target in three years’ time.” (Author's emphasis.) This depends on the Bank continuing to hike rates up to above 5%.

While the Fed didn’t pivot, is there any sign of the Bank doing so? Today’s rise “will most likely mark the peak in pace of tightening, especially with the Bank highlighting financial markets are pricing too much too soon”, says Edward Hutchings, Head of Rates at Aviva Investors.

Neil Birrell, chief investment ifficer at Premier Miton Investors, said: “The Bank of England has produced the much anticipated 0.75% increase in the base rate, making this the fastest tightening cycle for decades. However, it does not look like they will push ahead as much as feared from here."

And Peter Doherty, head of fixed income at Sanlam Investments said that the Bank, despite hiking by the same amount as the Fed, may be diverging in the future.

"A dovish message overall with a clear signal that the peak on Base Rate will NOT be 5% as priced into markets – that could lead to a recession. This is a firm pushback on market rates and in a marked contrast to Powell and The Fed."

Current market projections imply interest rates of 3% in Q4 this year (the current quarter), rising to 5.2% this time next year but dropping back to 4.7% in the final three months of 2024. Rate expectations spiked during the September/October chaos but they have since dropped back as gilt yields have relented. So the market is telling us that UK interest rates will peak around 5%, from 3% now. But Bank Governor Andrew Bailey said that the path of interest rate rises may be "shallower" than the market is expecting - a chink of light for consumers and mortgage customers - but again much depends on how inflation pans out. Markets price interest rate expectations into the future but they don't always get it exactly right.

In terms of the UK economy, a recession is still on the cards and is forecast to last two years. Bailey said in the press conference today that the economic data has weakened since August but the labour market remains tight, with unemployment low, wages rising (but still below inflation) and many roles still unfilled.

Next Up: Jeremy Hunt

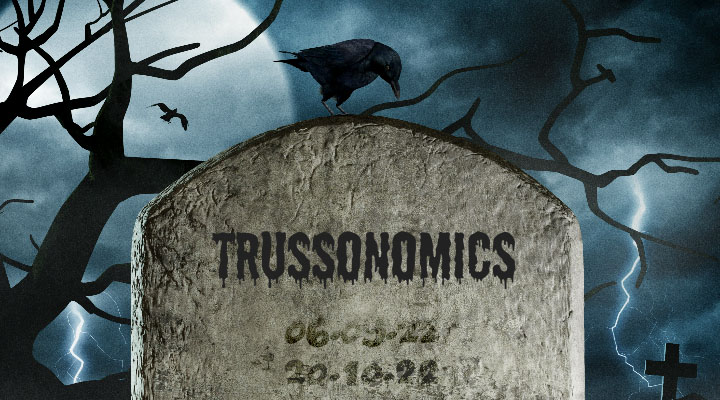

Before today's events, September’s MPC meeting was the Bank’s most recent and fell just a day before the ill-fated mini-Budget, which triggered political and market chaos. While the Bank did not bow to pressure to make an emergency rate increase in the intervening period, it did step in on a number of occasions to shore up confidence in the government bond market as a buyer of last resort.

The Bank referenced this political drama obliquely in today’s statement, with “UK-specific factor” doing some heavy lifting: “There have been large moves in UK asset prices since the August Report. These partly reflect global developments, although UK-specific factors have played a very significant role during this period.”

Governor Bailey noted today that Britain's gilt yields are still a premium because of "policy" decisions - he was careful not to pin the blame on political mistakes - and that there's still some way to go before the UK regains its international credibility.

"Markets remain febrile ... things have not settled down yet," said Sir David Ramsden, the Bank's deputy governor for financial stability.

Right on cue, sterling contined to slide today, falling from $1.15 on Wednesday to $1.12 today. Gilt yields rose again, particularly for 10 and 30-year government bonds.

These Bank forecasts do not take into account the government’s fiscal plans and OBR predictions due on November 17, an autumn statement delayed from October 31 while the new prime minister, Rishi Sunak and chancellor, Jeremy Hunt, get their ducks in a row. While the sense of national emergency in the Truss/Kwarteng era has subsided, the markets are eagerly awaiting the details of November’s fiscal statement, where tax rises and government spending cuts are expected.