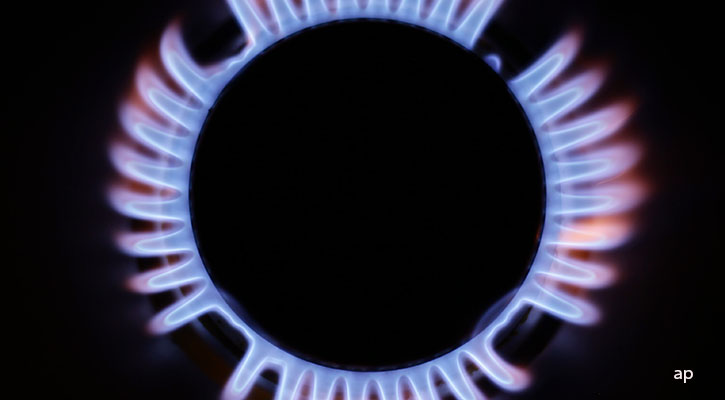

Energy bills for the average UK household will be frozen at no more than £2,500 per year, and businesses will be spared crippling increases, as Prime Minister Liz Truss took action to shield Britons from the global gas crisis.

The prime minister's two-year plan paid for by tens of billions of pounds of borrowing will save the typical household around £1,000 from October and protect bill payers from further expected rises over the coming months.

For businesses and other non-domestic users such as schools and hospitals, which have not been covered by the existing price cap, a six-month scheme will offer equivalent support.

After that there will be ongoing support for the most vulnerable industries, with a review in three months' time to decide where the help should be targeted.

The plan will see the government limit the price suppliers can charge customers for units of gas, replacing the existing price cap set by regulator Ofgem. Talk of energy price caps will now switch to the "Energy Price Guarantee" - which is now in upper case on the UK government website. Last month Ofgem's 80% increase in the price cap (due in October) caused alarm in many quarters.

Ministers will provide energy suppliers with the difference between the new, lower price and what they would charge were this not in place.

The prime minister told members of Parliament: "This is the moment to be bold. We are facing a global energy crisis and there are no cost-free options."

Downing Street has refused to put a cost on the programme, previously estimated to cost up to £150 billion. The prime minister's official spokesman would only say the price will be "tens of billions".

Some Reaction

Justina Miltienyte, head of policy at Uswitch.com, welcomed the news because it removes the uncertainty of quarterly price rises. But, households will still be facing a very difficult winter - even taken into account the £400 energy bill support - households could pay on average £237 more in the winter months than last year.

She also points out how the freeze will work - and how it will still incentivise people to be more energy conscious.

“It’s important to remember that bills are not frozen. This is a cap on the unit rate of the energy you use - it is not a cap on your final bill. The less energy you use, the less you will pay, so you may still be able to save money by managing your energy usage this winter."

The intervention doesn't fix the energy market either.

“This help, while much-needed, is unaffordable to sustain. The longer we have to rely on Government support to keep prices down, the higher the final bill will be for taxpayers for years, if not decades, to come."

Hargreaves Landsdown analyst Susannah Streeter sees a knock-on effect ion the bond markets: "Given the volatile nature of the energy markets, freezing bills will require an elastic budget and there is a risk that overseas investors who the UK relies on for borrowing, will baulk at financing a ballooning debt."

Alice Haine, personal finance analyst at Bestinvest, reiterates the point that the price per uint will be capped rather than your bill. “This means that those using more energy than average will pay higher bills and those using less will pay less, so not everyone is looking at the same bills.”

And the move will have a psychological impact on consumers:

“Truss’s plan of action goes a long way towards taking fear out of the equation – fear that life will simply become unaffordable in the face of soaring energy prices and fear that jobs will be put at risk because businesses won’t be able to afford to keep the lights on.

“It also removes the uncertainty over what lies ahead for the economy – with expectations that inflation will now peak next month at a more modest figure rather than the dizzying highs in excess of 22% expected early next year.”

Windfall Tax 2 Nixed

Truss said she would not "give in" to Labour's calls for a new windfall tax on the soaring profits of energy and gas giants to pay for a reduction in bills. Shares in utilities like Centrica and SSE have risen this week as fears over a windfall tax receded (although Centrica is included in the first windfall tax, effective May 2022, because of its oil and gas operations). BP and Shell shares also rose as investors surmised that "things could be worse" and that the bad news for the sector is already price in.

"Her determination not to impose a further windfall tax on the oil and gas sector and her vision for the UK to become a net energy exporter is adding to the strength of companies in the sector which have already been boosted by super-high gas prices and elevated crude costs," says Streeter.

Instead the energy bill freeze will be paid for by borrowing, with Truss promising chancellor Kwasi Kwarteng will give specifics during his emergency fiscal announcement later this month. See more on our analysis of Trussonomics.

Labour leader Keir Starmer said Truss's refusal to fund the plans with a windfall tax is "driven by dogma" and will mean "it's working people who will pay for that".

Officials hope that the measure could curb the cost of servicing the national debt by reducing inflation by up to 5 percentage points from the predicted peak, with external forecasts estimating inflation could hit up to 15% next year.

Under the current domestic energy cap, households face average bills of £1,971 per year, but this was set to rise to £3,549 in October – and forecasts have suggested it could hit as high as £7,700 by April 2023.

The £2,500 "energy price guarantee" will apply in England, Scotland and Wales from October 1, with the same level of support made available to Northern Ireland, which has a separate energy market.

The guarantee is based on the existing cap, plus the already promised £400 energy bills discount for all households, meaning costs will be similar to those faced today.

Green levies worth around £150 a year on average will be temporarily removed from household bills, lasting for two years.

Fracking Ban Lifted

As expected, Truss also ended England's ban on fracking – the process of extracting shale gas by fracturing rocks with high-pressure water.

This could see domestic shale gas production begin in as little as six months, but will face heavy criticism from opponents who have long warned that fracking can cause earthquakes, water contamination, noise and traffic pollution.

She told MPs that fracking would only go ahead in areas where there was local support for it.