We never tire of repeating it: fees are a key factor in a fund’s success. Another equally important variable, though, is fund size. Size and fees are tightly connected.

A recently published Morningstar study on Europe-domiciled active funds – entitled When Small Isn’t Beautiful – reveals a clear link between a fund’s asset base and its risk-adjusted net performance. The underperformance is mostly attributable to the higher fees of tiny funds and the relationship is particularly strong for equity funds. It also holds true to a lesser extent in fixed-income and multi-asset funds.

"Funds’ assets under management vary widely", says Matias Möttölä, EMEA director of Manager Research at Morningstar and author of the analysis.

"While many European open-ended funds have only a few million euros to invest, the largest funds in Morningstar’s database run dozens of billions of euros. With most funds charging fixed fees, such size gaps translate to enormous differences in revenue streams. Large funds can financially maintain a larger bench of portfolio managers, analysts, and supporting staff with the fee income they generate. In addition, larger funds provide the scope for fund companies to charge lower fees, which can benefit investors."

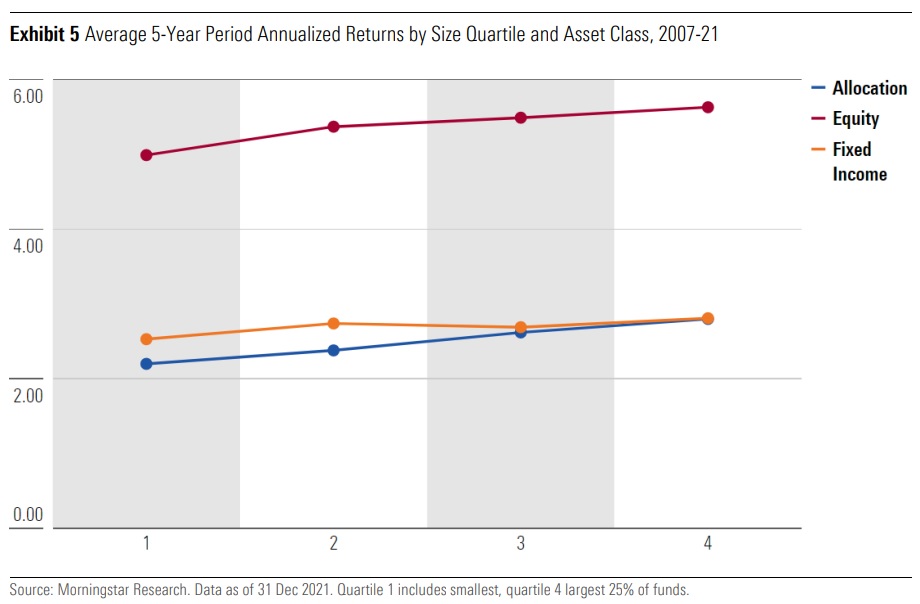

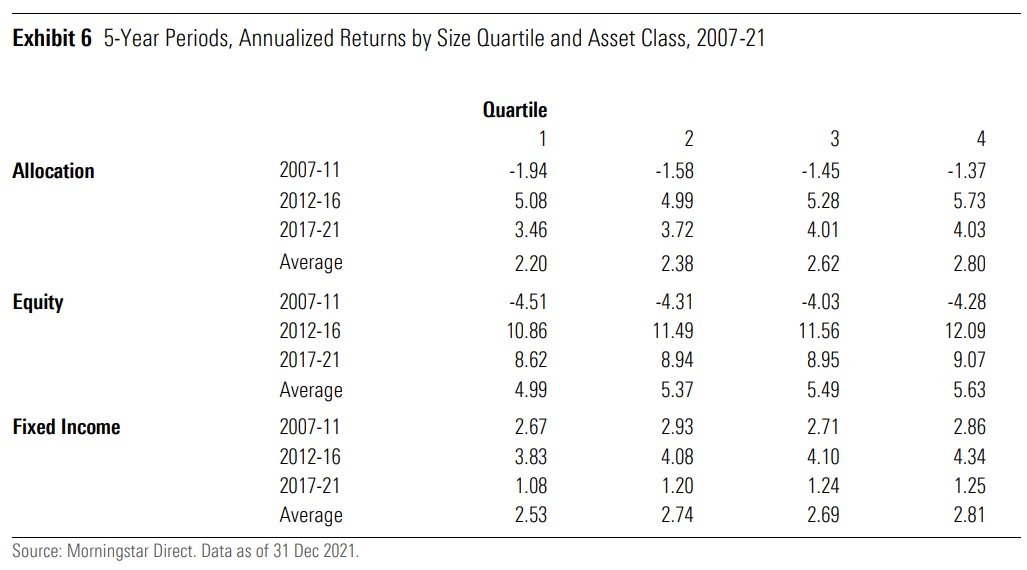

In all three asset classes (equity, fixed income, and multi-asset) and in all five-year periods included in this study, the largest funds beat the smallest. For fixed-income funds, the picture is slightly more mixed than for the others, but still strongly directional, with a positive slope overall between asset base and returns.

Spain and Sweden at Opposite Extremes

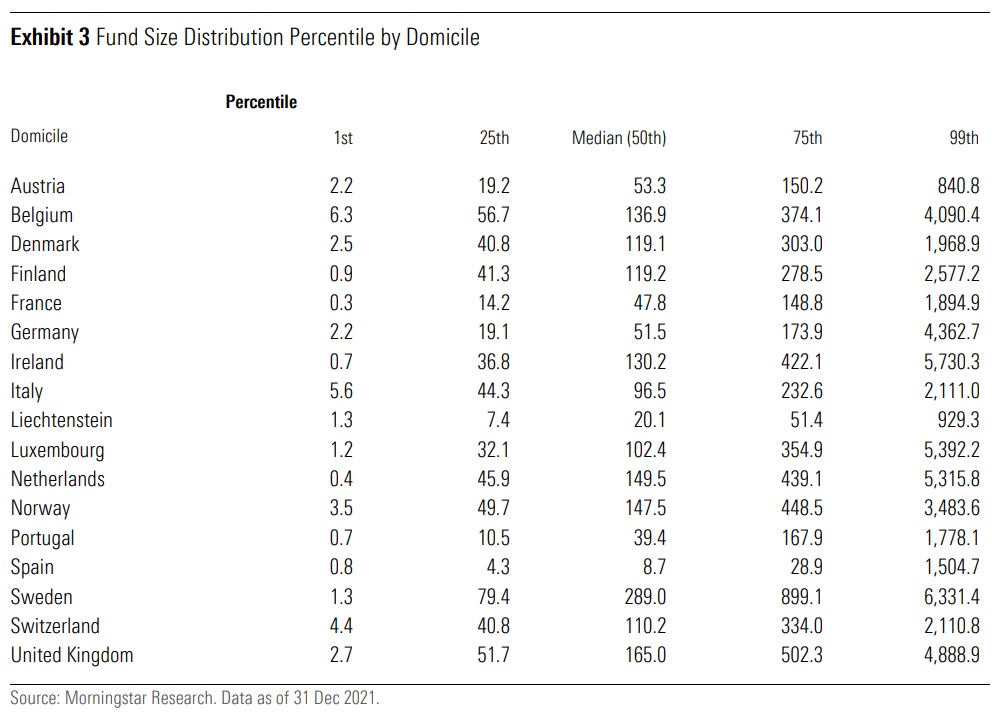

As well as by asset classes, the research discovers vast differences in fund size between countries of domicile: while the median fund had a mere EUR 8.7 million of assets in Spain, the typical Swedish active fund had EUR 289 million assets at the end of 2021.

"Spain is a relative outlier as the market has a large number of tiny multi-asset funds that serve as investment vehicles for a small number of investors," explains Möttölä.

At the same time, Sweden is one of the most developed fund markets in Europe and home of the region’s largest fund, AP7 Såfa, the default option within Sweden’s employment-based retirement system. The UK, also home to a strong fund investing culture, comes second. But the big picture across Europe remains that vast numbers of funds are hardly economically viable on their own.

A Matter of Survival

In Europe, small size and the ensuing lack of economies of scale is still the bigger issue.

Across the three asset classes considered, the median fund size was only EUR 76 million and the average was EUR 350 million at the end of December 2021. As many as one in four funds had less than EUR 20 million of assets.

"A typical management fee of 1% would create an annual gross revenue of EUR 200,000 for such a fund," the author highlights.

"This is clearly not sufficient to cover the cost of hiring a strong cast of portfolio managers, analysts, client representatives, back-office personnel, and the like, and paying for data and other third-party services on top.

"Granted, this is a simplistic view as individual funds typically feed into a broader business and their resources are not linked one-to-one to the cash flow they generate for the asset manager. However, it is typical for asset managers to add resources to strategies as they grow, and vice versa."

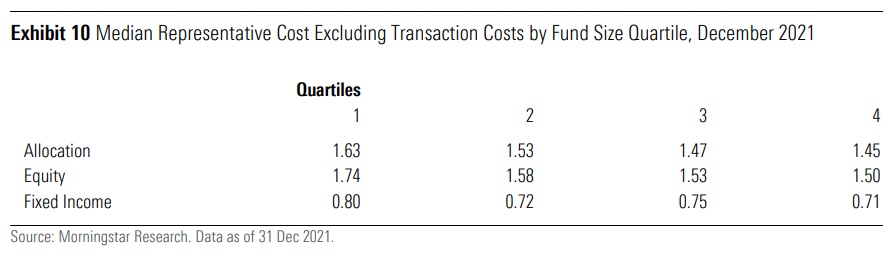

The key role of fees also becomes clear from Morningstar’s representative cost data for the end of last year. The median of the smallest quartile of equity funds was 24 basis points more expensive than funds in the largest quartile of the category, which is a meaningful bump in fees. The differences are directionally similar but smaller in magnitude for multi-asset and fixed-income funds. (Funds in this analysis have all outlived the prior five-year period, so new funds are excluded.)

Such research shows small funds are clearly at a disadvantage against larger funds, mostly because of their higher fees.

"The findings reinforce the importance of fundamental analysis," says Möttölä.

"Investors should focus their due diligence primarily on fees, but also on other key metrics such as ensuring that the funds they invest in are well-resourced. Larger funds have better bargaining power within their asset management organizations, and they are less in danger of being closed or merged.

"And, importantly, it seems asset management companies are also charging less for larger funds, which can achieve economies of scale."

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)