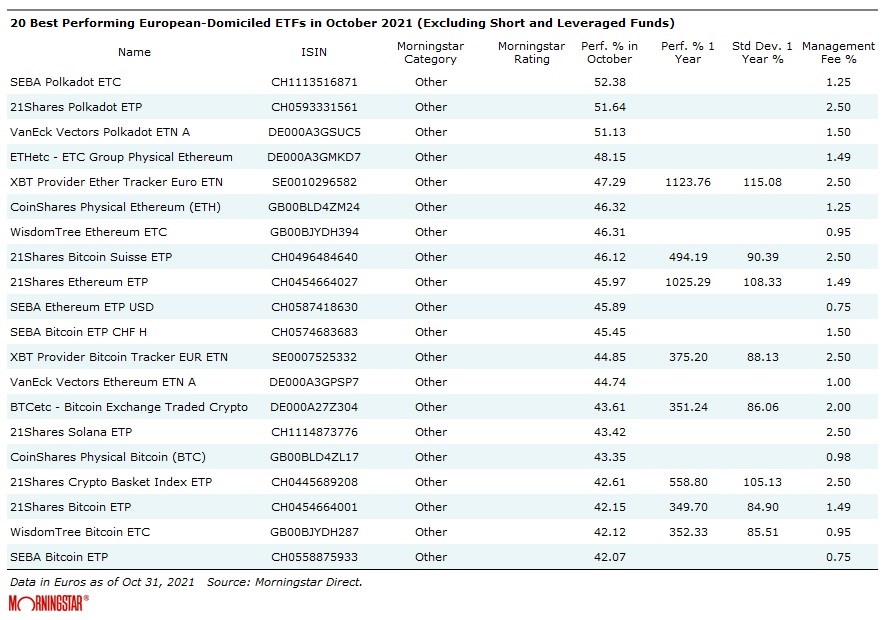

Our monthly round-up of the best and worst performing European exchange-traded products reveals a clean sweep for cryptocurrencies in the top 20, while natural gas and Brazilian ETFs were bottom of the pile.

The Top 20 list of ETPs was led in October by SEBA Polkadot ETC (SDOT), launched back in July on the SIX Swiss Exchange by issuer SEBA Bank. Actually, the whole podium was dedicated to the DOT, the native cryptocurrency of Polkadot, a blockchain interoperability protocol founded in 2016. The token’s price started its upward journey with $5.88 in November 2020 and never looked back since then (as of 2021 November 5 it is worth $51.76).

Ethereum and Bitcoin follow. The former, in the wake of the implementation of Altair (a technological upgrade to Ethereum's Beacon Chain that made the network faster, safer and more secure), ETH hit a new all-time high at the end of October, surpassing $ 4,400 (the high was updated to $ 4,642 on November 4).

Another event that took centre stage last month was the launch of the first Bitcoin ETF in the United States. The SEC's decision certainly helped push the price of the most popular cryptocurrency higher in the days following the introduction of the ProShares’ tracker, although the launch is unlikely to have an impact beyond the very short term. Rather than investing in Bitcoin itself, this product invests in Bitcoin futures contracts. This may sound like a technicality, but it’s not.

Beyond the Top 20, we have to go down to 34th place to find an ETP which does not invest in cryptos: First Trust Nasdaq® Clean Edge® Green Energy UCITS ETF (QCLU), followed in 35th position by Invesco Solar Energy UCITS ETF (ISUNLN), leads the group of strategies exposed to alternative energies and in particular photovoltaics, which gained between 15% and 24% in the month. Such issue of clean energy is also at the heart of the debate thanks to an important event such as the UN Climate Change Conference (COP26) which is taking place in these days in Glasgow.

The Laggards

At the same time, though, October proved to be a tough ride especially for natural gas and Brazilian stocks investors.

BNP Paribas’ HENRY HUB ERDGAS ETC (BNQ9), a collateralised exchange-traded commodity incorporated in Germany that tracks the total return of the rolling Henry Hub Natural Gas Futures lost 10.4% in October. The ETC ranked as top performer among European-domiciled ETPs in September, but was among the biggest losers last month.

As winter approaches, the price of natural gas is typically driven by the weather forecast for the cold season. After hitting seven-year highs, the value of gas fell by more than 9 percentage points in October, in anticipation of a milder-than-expected late autumn. At the same time, in the U.S. the storage situation is much calmer, as the United States is expected to have more than enough gas stockpiled for the winter, according to the US Energy Information Administration (EIA).

The negative momentum continues for Brazilian equity, which has fallen 22% in the last three months and slipped among the worst domestic equity markets of the year (-19% in the first ten months of 2021). Latin America’s largest economy is paying on one hand the price for the slowdown in China, as one of its major trading and export partner, and an unstable political situation, on the other. Four senior Treasury officials resigned on October 21, following the government's intention to raise the constitutional spending limit to increase welfare spending, in a pre-election move by President Jair Bolsonaro. This move has troubled international investors, on top of Brazil's ongoing Covid crisis.

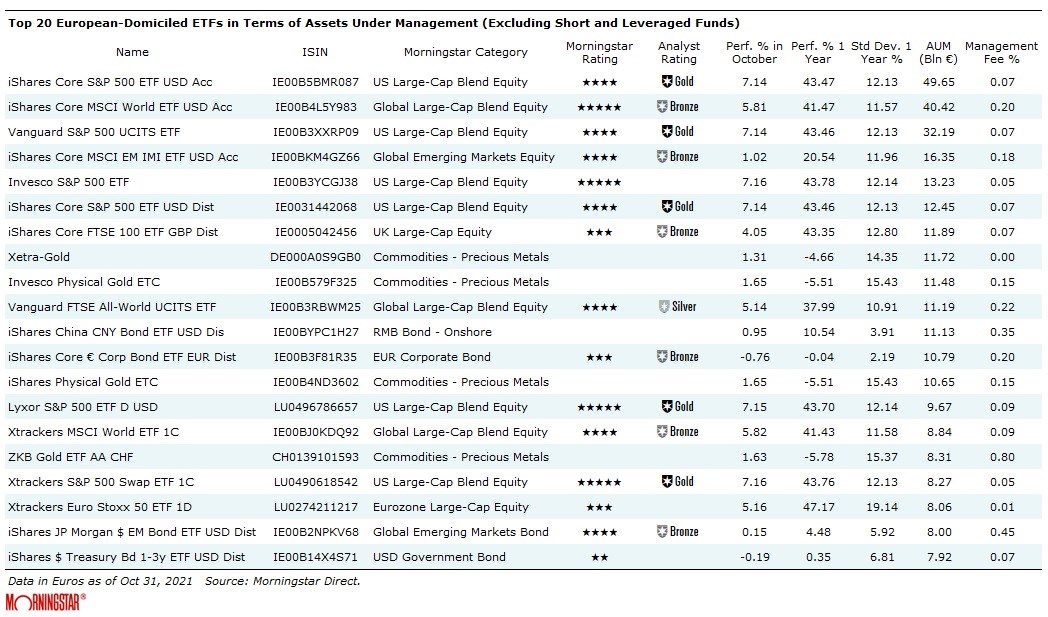

The Biggest

Monthly top and flop performers often coincide with very volatile and therefore risky products, which should play a satellite role in your portfolio. Below you have an overview of the biggest European-domiciled ETPs in terms of assets, which could be more appropriate to consider among core holdings. Monthly performances go from 7.2% of the Xtrackers S&P 500 Swap UCITS ETF 1C (XSPU) down to the iShares Core € Corp Bond UCITS ETF EUR (IEAC), which lost 0.8% in the month.

ANote on Methodology

According to Morningstar data, there are about 63 percentage points between the best and worst performing European exchange-traded products (ETPs) in October, with returns for the month ranging from 52.4% to -10.9%.

We have looked at the key trends in the tenth month of the year, excluding inverse and leveraged funds. These instruments, being purely passive products, reflect the evolution of the markets without the bias (good or bad) of an active manager.

.jpg)