European smaller companies are back on top together with inflation-linked gilts in July, while China funds trailed the group, according to the latest Morningstar data.

European equities saw a strong first quarter in 2021 but dropped off the radar in the second. However, smaller companies are now making a comeback on the top 10 performance list together with index-linked gilts and property. Meanwhile, at the opposite end of the chart, regulatory changes in China meant funds with a Chinese focus accounted for all entries.

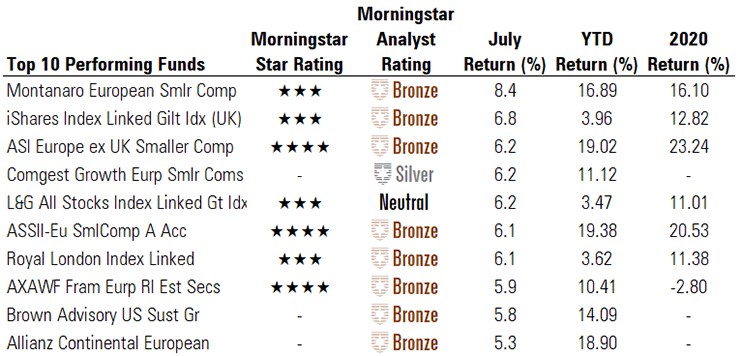

Top Performing Funds in July

Looking at the top funds first, Montanaro European Smaller Companies had the strongest performance in July among funds with a Morningstar Analyst Rating. The fund has a high exposure to technology, healthcare and industrials and returned 8.4% in the past month. So far this year the fund has achieved growth of 16.89%, similar to its 2020 full-year gains of 16.10%.

This is no surprise as the vaccine rollout across Europe has allowed economies to re-open – and England has already had its “Freedom Day”. European mid – and large-cap stocks also performed well, accounting for several of the funds between 10th and 25th place, due to notable factors such as the Bank of England removing restrictions on dividend payments.

Two other categories performed well in July: inflation-linked bond funds and property. Bronze-rated iShares Index Linked Gilt had the second-highest return in the past month with 6.8%, while L&G All Stocks Index Linked Gilt returned 6.2% and Royal London Index Linked returned 6.1% - ranking five and seven in the top 10 performers table.

AXA World Funds - Framlington Europe Real Estate Securities returned 5.9% due to its investments in European real estate, which has been a winning category in the past month. Its main assets are Vonovia and Segro, which have helped the fund reach a 11.38% return year to date. Several other property funds feature in the top 50, another positive effect of entering a post-pandemic environment with workers returning to offices and the property market still hot.

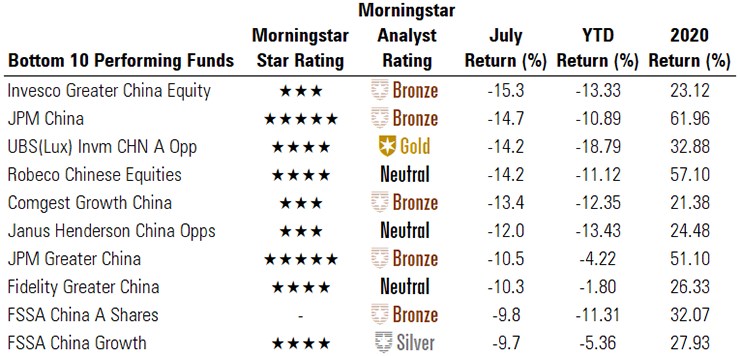

Worst Performing Funds of July

At the other end of the spectrum, China funds dominate the table, hampered as the government there has been coming down on the technology and education sectors, leaving markets spooked and funds with sometimes double-digit losses. In fact, all bottom funds this past month cover Chinese equities, and only a handful of the bottom 100 funds did not have either an Asia or Emerging Markets focus.

The worst performer was Invesco Greater China, down 15.3%. The fund has a high exposure to domestic consumption and companies like Meituan and Alibaba, while its largest holding is Tencent. It has lost 13.33% overall this year in contrast to its 23.12% growth in 2020. However, the disparity is worse for JP Morgan’s China fund, which lost 14.7% in June after 61.96% growth in 2020.

UBS saw its Gold-rated China Opportunities finish third from bottom in our cohort this month. The fund is one of Morningstar’s favourites for Chinese equities, holding a third of its assets in consumer defensive stocks like Kweichow Moutai and Wuliangye Yibin. It returned 32.88% in 2020, but sits in the bottom 10 for the second month in a row, losing 14.2% in July and averaging 0.32% growth so far this year. However, the fund has historically outperformed both the index and its peers.

Ben Yearsley, investment director at Shore Financial Planning, says it remains to be seen whether the unexpected crackdown will have a long-term impact on the outlook for investing in China, but that fund managers seem to be relaxed about the situation.“It’s dull, but again last month showed that having diversity within portfolios is important. Not many would have guessed that property, inflation-linked and long dated bonds would be the sectors to own. Many may well have written those asset classes off and certainly property has had many detractors over the last 18 months, but it does show again don’t bet the ranch on one idea, theme or type of investment,” Yearsley says.