In a busy week for tech titans, we asked our Twitter followers to choose a stock of the week among them. They’ve gone for Apple (AAPL) ahead of Microsoft (MSFT) and Google parent company Alphabet (GOOGL), all of which have released strong first quarter results and been upgraded by Morningstar analysts.

Apple’s products and brand are so ubiquitous that it’s easy to forget that the company is by no means in the first wave of digital innovation, having floated in 1980. The iPod was introduced by Apple founder Steve Jobs in 2021, while the iPhone, now central to Apple’s fortunes, was launched in 2007. The company has just got bigger and bigger over time, and at a $2 trillion market cap, is the biggest listed company in the United States – and the second biggest company in the world after Saudi Aramco. And according to the annual Interbrand survey ranks Apple as the best brand in the world, ahead of Amazon (AMZN). The size of Apple creates problems for index compilers and active manager, as my colleague Dan Lefkovitz explains.

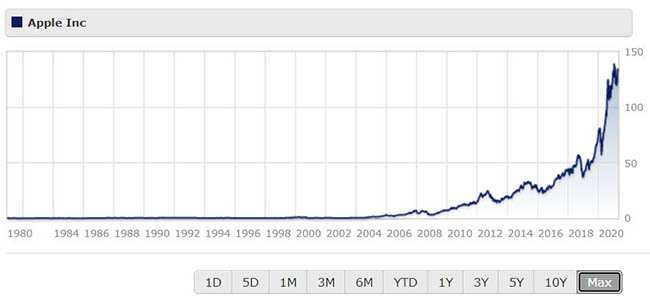

Far-sighted investors who bought into the 1980 float will have seen their investments grow by more than 100,000%. Its popularity over that period has caused headaches for potential new investors because the share price keeps getting too big. This has forced the company to undergo five stock splits since it floated – in the most recent split in August 2020, existing investors got four Apple shares for every one they own. This knocks down the share price, which makes it more appealing to smaller investors, but means there are more shares in issue. Before the last split, they were trading around $500, and are now around $133. Splitting shares makes return comparisons much harder over time – but without the splits the shares would be trading over $22,000 each now (the steep slope of the share price chart tells the story). Does this mean that the shares are a buy now they’re cheaper? Despite upgrading the shares after the recent results, Morningstar analyst Abhinav Davuluri says they are currently overvalued, and should be trading nearer $115.

Apple’s latest results saw the iPhone division’s revenue grow by 66% year on year to nearly $50 billion, helped by the rollout of the 5G iPhone, which has proved popular in China. Sales of iPads and Mac desktop computers also boomed amid the working from home trend (iPad sales were up nearly 80% on the same period in 2020). However, Davuluri points out that comparisons with the first quarter of 2020 will inevitably be flattering, and that growth rates will tail off in forthcoming quarters. “We think shares are currently overvalued, as we think recent growth trends could be unsustainable past 2021,” he says. The worlwide shortage of semiconductors, which is affecting industries from cars to smartphones, is also expected to have a negative impact on Apple sales in the forthcoming quarter. Despite strong Q1 numbers, Apple’s cautious outlook for the rest of 2021 meant the share price reaction was muted after the results were announced.

Competition and Customer Loyalty

Apple has a narrow economic moat rather than a wide one, like rival Samsung Electronics (005930), whose Galaxy smartphone has become a serious competitor to the iPhone over the last decade. Customer loyalty is key to Apple’s moat, especially among iPhone owners, says Davuluri. “As current iPhone users are familiar with the iOS environment (Apple-centric apps, services, and so on), it may take multiple subpar product releases to warrant an exodus to an Android, as these customers are likely loath to leave Apple’s seemingly superior walled garden,” he says. New products like the Apple Watch and Airpod headphones – around 80 million of these white, wireless earbuds were sold last year – are designed to work with Apple products like the iPhone, which deter switching to alternatives.

Still Davuluri says that consumer technology is an unforgiving space – Apple commands a premium on price because of the reputation for quality design and functionality, but this cannot be guaranteed forever. Apple’s “brand” is not enough on its own to keep customers loyal – “We don’t think Apple can charge twice the price of a similar set of hardware solely by sticking an Apple logo on it … we suspect that Apple's brand equity will wane if the firm's products were technologically inferior to competitors over an extended period of time.” Davuluri looks back to Nokia, Motorola and BlackBerry as examples of once innovative smartphone makers that were left behind by Apple and Samsung, and have never recovered. Davuluri thinks Amazon, with its suite of products including Prime Video, Echo smart speaker and Fire TV, could become the next serious competitor to Apple in the coming years. Still, would you bet against Warren Buffett, who owns $121 billion of Apple shares, making up nearly 40% of the Berkshire Hathaway portfolio?