Annuities used to be the norm when it came to funding your retirement. Before the introduction of Pension Freedoms in 2015, around 90% of people without a company final salary scheme had no choice but to use their pension pot to buy an annuity when they reached retirement.

But under the new regime, pension savers can opt for other routes and annuities have become increasingly unpopular. This is in part because ultra-low interest rates means you need a sizeable pension pot to buy an annuity that’s going to deliver a decent income.

So, are annuities ever the right choice?

What is an Annuity?

An annuity is effectively an insurance contract. You buy this with your pension pot, swapping your savings for a guaranteed income for life (an annuity).

The benefits of this are obvious: you know exactly how much you have to live on in retirement, you don’t have to manage the pot yourself, and you know you won’t run out of money before you die.

But there are downsides too: the amount of income an annuity pays is linked to the size of your pension pot and interest rates, and with interest rates at a record-low, annuity rates have plunged.

Since the introduction of Pension Freedoms, drawdown has become an increasingly popular option. This is where you leave your money invested after you retire so it can continue to grow, while withdrawing regular or ad-hoc amounts as income. But unlike an annuity, drawdown does not provide a risk-free or secure income, and because your pension pot is left invested it can be badly affected by market falls.

Nonetheless, drawdown has increasingly become the default option. It is appealing not only because your money has the chance to keep growing, but because it offers much more flexibility and control over your money. Importantly, with drawdown you can also leave any unused pension savings to younger generations, whereas an annuity dies with you (or your spouse, in the case of joint annuities).

As well as being inflexible, annuities have provided poor value over the past decade. Indeed, consumer dissatisfaction with persistently low annuity rates was a main driver behind the government’s decision to introduce pension freedoms.

Data compiled by williamburrows.com shows that when annuity rates were at their highest in 1990, a £100,000 pension pot would buy a healthy 65-year-old a lifetime income of £15,000 a year. Today, it gets you less than £4,800.

While that’s partly down to interest rates, it’s also because life expectancy has increased, meaning your money has to stretch over more years. But the real problem is that yields from gilts (government bonds), in which annuity providers invest to provide the income needed, have been at rock-bottom levels since the government introduced quantitative easing in the wake of the 2008/09 financial crisis.

Against this backdrop, it’s perhaps no surprise that these days just 12% of pension pots are being used to buy an annuity.

Should You Ever Buy an Annuity?

So does the combination of low rates and inflexibility, plus alluring alternative routes to a retirement income, mean annuities have had their day?

The Association of British Insurers (ABI) says not, arguing in a recent report that “speculation about the ‘death of the annuity’ was proved wrong”. It says sales have held steady since 2017, the market is working more effectively than it used to, and average annuity purchases are now markedly bigger than they were.

The average pot size used to buy a guaranteed income has risen from £36,800 in 2014 to £67,200 in 2019, according to the ABI.

Billy Burrows, retirement director at Better Retirement, suggests there are two groups for whom annuities remain the best solution. Firstly, those with a small pension pot of between £10,000 and £50,000 – too big to take as a cash lump sum because of the tax consequences, but not large enough to be cost-effective in drawdown. “For them, an annuity alongside state pension provides secure regular income,” he says.

The second group includes older retirees over age 70 or 75, who used drawdown earlier in retirement but now have less tolerance for market shocks (such as in March 2020) and want the peace of mind offered by a guaranteed income. One benefit of buying an annuity later in life is that your pot buys a bigger income: a healthy 75-year-old could buy an annual income of over £6,700 - some 40% more than they’d have got at age 65. Those with health conditions, meanwhile, could qualify for an enhanced annuity, which could see your income boosted as much as 30%.

Burrows adds: “Someone with several different pensions could use one to buy an annuity for core security alongside the state pension, and put the others into a drawdown account for non-essentials. More and more advisers are looking at this kind of approach now.”

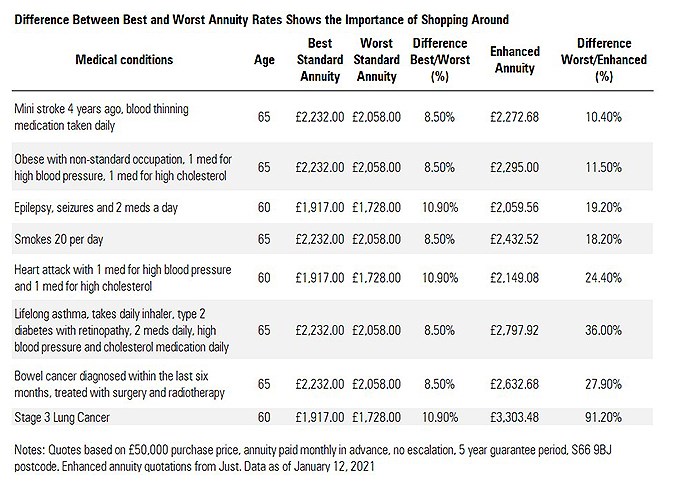

Whatever your circumstances, shopping around is crucial – don’t just take the offer given to you by your pension provider, as it’s often not the best deal. It’s important to reveal any medical conditions too, as these might qualify you for an enhanced annuity. The following table drives that point home. It shows a sample range of medical conditions, with the best and worst standard annuity income you can expect to achieve if you had a £50,000 pension pot, with an enhanced annuity quote from Just Group for comparison.