One of the main appeals of investing in bonds is the steady stream of income. However, in these days of ultra-low interest rates that stream has rather dried up.

It's no wonder then that many investors are looking elsewhere for yield - and Chinese bonds are proving a firm favourite. Yuan-denominated Chinese government bond ETFs attracted £4.2 billion of inflows in 2020 and the iShares CNY Bond ETF was the highest-grossing fixed income ETF of the year.

Why Invest in Chinese Bonds

It's not hard to understand the appeal of Chinese bonds. The yield on a 10-year Chinese Treasury bond currently stands at 3.2%, whereas the 10 year UK Gilt offers a mere 0.3%. Besides, the credit rating of Chinese government bonds is higher than many developed countries at A+.

While most economies, developed and emerging, continue to grapple with recessionary forces, China has staged a remarkable rebound from the depths of the Covid-19 crisis. China’s GDP grew by 6.5% year-on-year in the fourth quarter of 2020, locking in three consecutive quarters of growth to fully reverse the damage of Q1, when its economy went into hibernation.

Overall in 2020, China’s GDP grew by 2.3%. This may have been the weakest annual growth rate in the past four decades, but it nonetheless shows the resilience of the Chinese economy and its special status within the cohort of emerging market economies.

China’s strong economy supports its local currency, the Yuan. This helps address one of the key risks when investing in bonds denominated in a foreign currency: that higher bond yields are eroded when we exchange the income into our domestic currency. In fact, this was a key reason why investors shed money from multi-country local-currency emerging market bond ETFs in 2020.

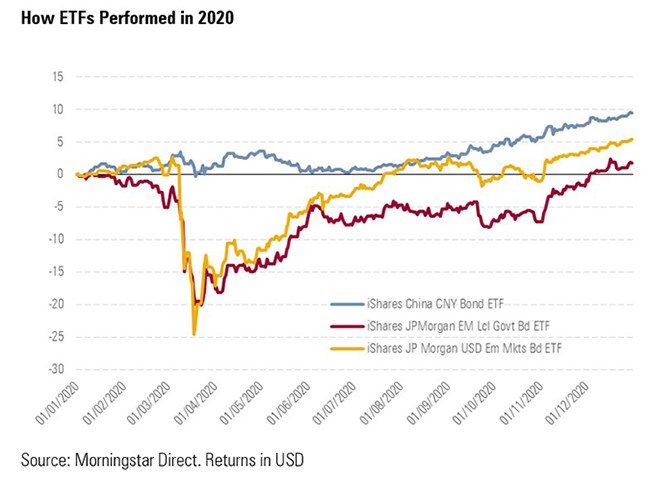

The iShares China CNY Bond ETF delivered returns of 9.5% in 2020 in USD terms (6.2% in GBP terms). By contrast, the iShares JPMorgan Emerging Market Local Government Bond ETF, which provides exposure to a basket of local currency government bonds from multiple countries, returned 1.8% in USD terms (a fall of 1.3% in GBP terms).

The exposure to China in the multi-country ETF is 8%, but the positive returns of that portion of the basket were largely offset by losses from many other countries that make up the index. As the below chart shows, in 2020 the Chinese bond ETF also delivered higher returns than the hard currency multi-country emerging market bond ETF.

The opening of the onshore Chinese bond market to international investors has seen more funds launched offering exposure to these assets, whether through broader emerging market bond funds or those focused solely on Chinese onshore bond market.

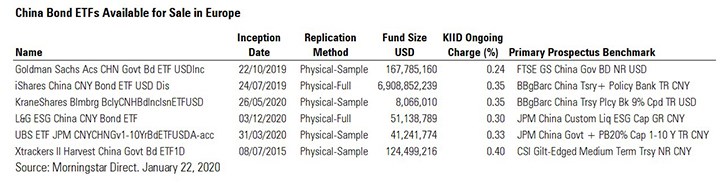

The iShares China CNY Bond ETF was only launched in July 2019 but has already amassed more than $6 billion in assets and ranks as one of the largest bond ETFs in Europe. It tracks the Bloomberg Barclays China Treasury and Policy Bank Bond Index, providing 100% exposure to investment-grade bonds issued by the Chinese treasury and the three policy banks: China Development Bank, Agricultural Development Bank of China and the Export-Import Bank of China.

Currently the ETF’s portfolio is broadly split 50/50 between Treasury and Policy Bank bonds and around 10% of the bonds have maturity over 10 years. It comes with an ongoing charge of 0.35%.

The range of China onshore bond ETFs increased in 2020 with the addition of three new products from UBS, Chinese ETF specialist KraneShares and L&G.

The UBS JPMorgan CNY China Government 1-10 Year Bond ETF caps exposure to policy bank bonds at 20% and only includes bonds with maturity up to 10 years. It comes with an ongoing charge of 0.33%.

Meanwhile, L&G's ETF adds an ESG twist, tracking an index that applies an ESG scoring and screening to tilt toward issuers ranked higher on ESG criteria and underweight those that rank lower. Exposure to each of the policy bank issuers is capped at 19%. The ongoing charge is 0.30%.