Did you know that currencies can play a significant role in your investment returns? Yet most investors don’t consciously factor currencies into their decision about what to buy and sell. When you invest in shares, ETFs, investment trusts and funds you may be making a bet on currency without even realising.

Why Currency Matters

Holidaymakers will already know that sterling has been weak since the Brexit vote and that their pounds are worth less abroad than they were a few years ago. But the strength of sterling affects more than your holiday spending money; for investors, a soft pound can actually be positive for your returns.

Weak sterling actually helps UK investors, explains Morningstar analyst Samuel Meakin. If the companies you invest in, report their earnings in stronger currencies like the dollar, euro or yen.

If these companies’ shares are rising too (as has been the case for US tech firms, for example), the currency and the appreciation provide a double benefit. “Essentially you’re owning US dollars, and if the dollar is going up, you’re making money on that,” says Meakin.

So for example, if you buy Amazon (AMZN) shares at the start of the year, you are exchanging pounds for dollars. At the end of the year, assuming the share price has risen and the pound has weakened over the period, your investment is worth more because of the currency you've bought the shares in has appreciated.

Minor Differences

Life isn't so straightforward with UK funds that invest overseas, as you are often faced with a range of currency options, including dollar, euro and sometimes yen share classes for popular funds. For the sake of simplicity, most UK investors would choose the GBP version. But does the version of a fund you choose affect your returns?

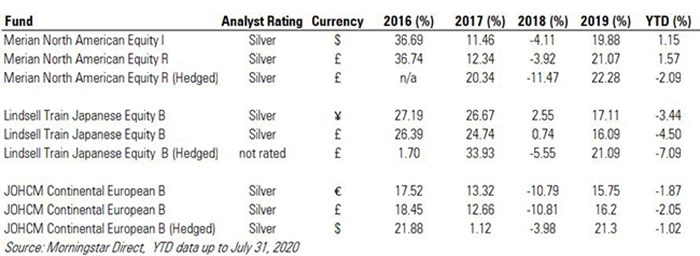

We have picked three funds that invest in the US, Japan and Europe, each with a Morningstar Analyst Rating of Silver, to compare annual performance since 2016: Merian North American Equity, Lindsell Train Japanese Equity and JOHCM Continental European.

Overall, there weren't significant differences in performance each year between the sterling share class and the overseas equivalent - the annual divergence ranges from 0.05% to 1.19% for the Merian US fund, between 0.8% and 1.93% for the Lindsell Train Japan fund and between 0.02% and 0.93% for the JOHCM European fund (see table).

In some years, an investor holding the sterling share class have fared slightly better than those holding the domestic currency version (whether dollar, euro and yen) and other years the opposite has been true.

In 2017, the sterling-denominated "R" share class of the Merian North American Equity fund returned 12.34% while the US dollar "I" share class returned 11.46%, so investors owning the sterling share class gained the edge because the pound strengthened against the dollar that year.

But in the same year, the pound weakened against the euro, so the JOHCM Continental European fund’s euro-denominated B share class slightly outpaced its sterling equivalent, posting a gain of 13.32% versus 12.66%.

This year, the yen has been in favour this year because of its safe-haven status. As a result investors in the yen share class of the Lindsell Train Japan fund have this year fared marginally better (-3.44%) than those holding the sterling version (-4.50%).

While this isn't a comprehensive survey, it's notable that in years when the pound was stronger, the GBP share class outperformed - and vice versa when the pound was weaker.

Hedged or Unhedged?

What if you want to remove the currency risk altogether? Funds usually offer a “hedged” version of each share class which aims to neutralise as much as possible the effects of currency movements on returns.

But hedging is never perfect, and hedged share classes can often be more expensive. Hedges are based on currency futures (a type of derivative) and, like any other trading strategy, the manager may get the trade right one year and wrong the next. Currencies, like stock markets, have a habit of doing unexpected things.

Our analysis found significant differences between the annual performance of the hedged and unhedged share classes. The hedged Lindsell Train Japan fund would have returned 1.7% in 2016, for example, while an investment in the unhedged version would have grown 26% that year as sterling slumped. The following year, however, the hedged version returned almost 34%, while the unhedged share class returned 24.74%.

Can You Beat the Market?

Morningstar's Meakin says hedged share classes often appeal to professional investors who have a particular view on where a currency is going, or need to balance out their portfolio.

They are also often used by bond investors who want exposure to a particular country's debt but also want to reduce the currency risk as much as possible. This is particularly the case when investing in emerging market debt, where countries like Argentina and Turkey have suffered currency crises, but you might want to tap into their higher-yielding bonds.

And Ben Yearsley, director of Shore Financial Planning, says there are times when exposing yourself to currency risk can work in an investor’s favour too: “After the Brexit vote,when sterling collapsed, one of the things that saved many investors was the collapse in the pound, which effectively increased the value of overseas investments. If you had been hedged you wouldn’t have benefited.”

So where does that leave the average investor who doesn't have an opinion on whether which way the pound is going to go? Yearsley concludes: "For most investors an unhedged GBP share class is the simplest and best solution especially with global funds where there are many different underlying currencies potentially moving in different directions."