The recent wave of dividend cuts and sharp sell-off in income stocks and funds means that now is a good time for investors to stop and think about whether dividend investing actually make sense as a strategy. Here are three key things to consider:

Jam Today or Jam Tomorrow?

Let's take the example of two stocks, Company A and Company B. Company A does not pay a dividend and instead re-invests its earnings for future growth, whether through increasing efficiencies or innovating to bring new products to market. The eventual investment return provided by Company A comes when you sell the stock, if the company is successful at deploying that capital and turning a profit, thus commanding a higher company valuation.

Company B opts to pay out a percentage of its earnings in the form of dividends on a regular basis. You receive this amount in cash, and you are now responsible for doing something with it. You may choose to purchase more of the same stock, which will increase your stake in the company and entitle you to more wealth when you eventually sell. In turn, company B will likely take that additional investment and deploy it much like Company A did. In other words, if you re-invest your dividend back, the wealth in your pocket will be similar to Company A. If you do not re-invest, Company B’s growth rate will be lower than Company A’s because it now has less capital to deploy as it's paid you an income.

Over the long term, both companies will provide the same amount of pre-tax wealth to you as the investor. The difference is in the timing of when you receive the cash. Company A pays you when you sell the company while Company B pays you along the way and will sell for less than Company A, all things being equal.

Selling for Income

Some investors require a steady income stream, namely those who are in retirement and require the steady income to fund regular expenses. Traditionally, this income used to come from bonds. However, with interest rates at near-zero levels, low yielding bonds are driving many investors to look for dividend-paying companies to supplement the income requirement, which may be a reason why dividend investing has continued to rise in popularity.

What many yield-hungry investors may forget is that a dividend is not the only way an investor can derive income from a stock investment. You could simply sell off some portion of your equity in a disciplined manner. Doing so has the same effect as a dividend paid by the company and allows you to de-couple the income requirement from the type of stocks that you pick - ie. you can buy high-growth stocks that don't pay an income and trim your holdings when you need the cash.

Are Income Shares Defensive?

Traditionally investors have sought out income stocks because of their defensive properties, with companies that pay a regular income such as water companies and utilities seen as safer than growth stocks. Looking at various times of market stress in the last 20 years, the results are more mixed. During the technology bubble, dividend stocks and funds did offer significant protection - the obvious reason being that technology companies didn’t pay dividends so when they crashed, this hardly affected income investors.

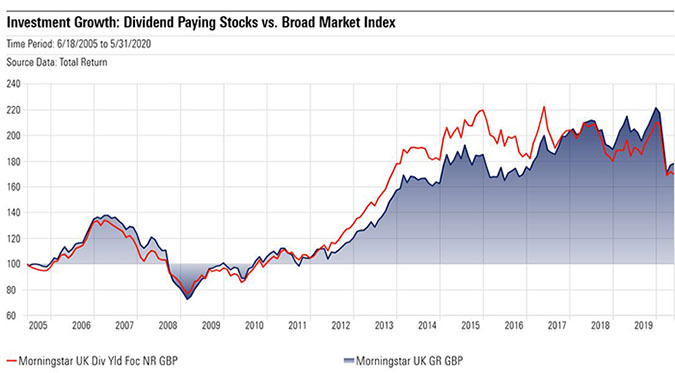

In the global financial crisis, the Morningstar UK Dividend Yield Focus index just about outperformed the broader Morningstar UK index but has underperformed during the coronavirus crisis. Looking at the chart, the period from 2011 to 2016 was a golden era for UK dividends with significant outperformance of the dividend index over the wider market. This was a time when companies started getting back on their feet after the credit crunch, rebuilt their balance sheets and increased dividend payments as life returned to normal.

Remember that dividend paying investments are still stocks, and will exhibit volatile characteristics similar to the rest of the asset class. During times of economic hardship, the decision to maintain or cut dividends rests solely on the shoulders of company management. When dividends do get cut, not only does the fundamental valuation of the company get reduced, but so too does market sentiment which will cause short term fluctuation in the stock’s price.

This article originally appeared on Morningstar Canada

.jpg)