The EU’s taxonomy of sustainable activities is a foundational piece of the Sustainable Finance Action Plan, which we recently shared an update on. The taxonomy is a classification framework to identify environmentally sustainable economic activities and will serve to help finance the transition to a more sustainable economy.

Political agreement on this new regulation was reached at the close of 2019, though as of May 2020, the final text had not been adopted in the Official Journal of the European Union. However, the EU Technical Expert Group did publish its final report in March, which provides information about the final versions of many of these standards that are due to take effect at the end of 2021.

In our new paper “EU Taxonomy of Sustainable Activities,” our policy team explores what the taxonomy will likely mean for companies, financial products, and investors.

The EU Sustainable Finance Taxonomy in a Nutshell

In 2022, the first year that the taxonomy will be in effect, it will focus on activities related to climate-change adaptation and climate-change mitigation. In 2023, its scope will expand to cover water and marine resources; circular economy; pollution prevention and control; and biodiversity and ecosystems.

Each of those defined activities will come with a set of screening criteria, or thresholds for companies performing those activities against which to measure themselves. Companies that meet or exceed those criteria will potentially be able to claim a degree of alignment with the taxonomy. The activities span a range of industries and functions that include:

• manufacturing of low-carbon technologies, physical materials, or chemicals;

• electricity (its production, storage, and transmission);

• multiple transport-related activities;

• agriculture; and

• construction.

However, just meeting the criteria is not enough: Companies can only claim alignment if they do so without doing significant harm to any of the other taxonomy activities while also meeting minimum safeguards on worker and human rights.

In addition to company activities that substantially contribute to environmental performance of industry in their own right, there are two other routes to gaining alignment with the taxonomy:

1. Being an enabling activity, or performing a function that in turn enables other activities to make a substantial contribution.

2. Being a transition activity, or one where there is no technological and economically feasible low-carbon alternative, but which supports the transition to a climate-neutral economy.

How the EU Sustainable Finance Taxonomy Will Inform Investors

Thanks to the taxonomy regulation, investors dealing in shares and corporate bonds will be able to see how aligned a company is with sustainable activities. Similarly, investors using investment funds that promote ESG or sustainable investment will be told the degree to which the fund portfolio is aligned with taxonomy activities.

How this information will take shape for investors will become clearer over the next 18 months, in part due to further guidance from the regulators that is expected to be released in mid-2021.

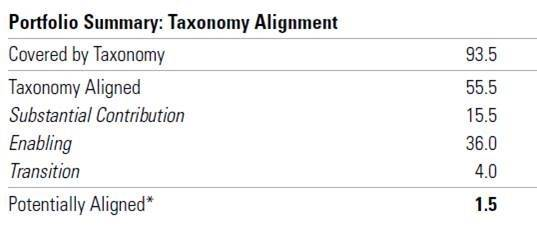

In our new research, we lay out our own high-level interpretation of the key features of both a company and a fund disclosure. At a minimum, fund investors can expect to see a summary of a fund portfolios’ overall alignment with the EU taxonomy somewhat like what’s shown on the table below.

This table shows that, across all the securities owned by the fund:

- 93.5% of business activity is covered by activities listed in the taxonomy;

- 55.5% meets the screening criteria corresponding to that activity; and

- A further 1.5% of assets potentially conform with the taxonomy, according to the fund’s evaluation of its owned companies’ business activities, but they are not obligated to make their own taxonomy disclosures.

In addition to analysis of the activities a company conducts and the taxonomy objectives those activities align to, arriving at this summary entails extensive analysis of both associated turnover and capital expenditures. Associated turnover illustrates the extent to which a company’s undertakings are already aligned, and capital expenditures show how much a business is spending to become more aligned.

Timetable and Challenges for the Taxonomy

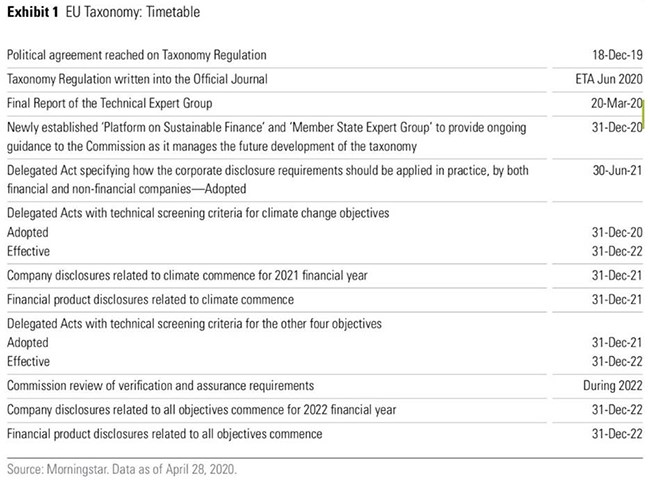

The key date when companies, funds, advisors, and investors need to be ready for this taxonomy to take effect is Dec. 31, 2021. There is still much to be done before then, both by the regulators to finalise the details and by the companies and product manufacturers that will have to implement them.

The tentative timeline of the taxonomy’s rollout is shown on the table below:

A project of this scale and ambition will always have challenges. One of the early ones with the taxonomy is that financial products must have precontractual and website disclosures ready at the end of 2021, which is when the reporting requirements will start to take effect for the companies in which they are invested. After this date, only large public-interest companies with more than 500 employees, banks, and insurers will be reporting their taxonomy alignment.

The taxonomy-based disclosures are only a fraction of the new reporting requirements facing investment products. Principal among them are those imposed by the Sustainability-Related Disclosures Regulation, which we will break down in our next report.