The spread of the coronavirus has not just shaken up global stock markets, it has shaken up the performance of a raft of funds.

Funds which outstripped their peers in 2019 were among the worst performers in the first quarter of 2020 as the investing environment changed, while others have soared up the rankings from worst to first.

Morningstar Direct data shows there are five funds which were in the bottom decile of their Morningstar Category in 2019 but were among the top 10% of performers in the group year to date. Funds are ranked within their category based on their performance over a certain period; a fund that ranks fifth out of 50 funds, for example, would be in top decile, or top 10%.

| Fund | 2019 Rank (%) | YTD Rank (%) | 2019 Return (%) | YTD Return (%) | Morningstar Category |

| LF Ruffer Absolute Return | 93 | 1 | 8.1 | -0.2 | Moderate Allocation |

| McInroy&Wood Balance Pers | 93 | 5 | 11.5 | -4.9 | Moderately Adventurous Allocation |

| JOHCM UK Opportunities | 96 | 5 | 13.1 | -17.2 | UK Large-Cap Equity |

| Stewart Inv Global EM Sust | 94 | 6 | 6.5 | -9.2 | Global Emerging Markets Equity |

| ASI AAA Bond | 92 | 8 | 4.4 | 2.6 | GBP Corporate Bond |

Source: Morningstar Direct, data as of April 22, 2020

The four-star rated LF Ruffer Absolute Return paves the way, climbing from the 93rd decile in 2019 to the top 1% of performers in the Moderate Allocation category year to date. In 2019 the fund retruned 8.1%, some 4.3 percentage points behind the average fund in its group, while in 2020 so far it is down just 0.2%, some 10 percentage points ahead of its rivals.

The fund aims to achieve low volatility and positive returns in all market conditions. Investments in currencies, cash and money market instruments have cushioned its portfolio in recent weeks, and top holdings include UK and US government bonds.

The five-star rated JOHCM UK Opportunities has managed to beat its Morningstar Category Average, UK Large Cap, over the last months. While the fund has been down 17.2% year to date, the average fund in its category is down 24% over the same period.

Thee main contribution to the fund’s performance comes from gold mining stock Barrick Gold, whose share price up more than 50% year to date helped by a surge in the gold price and investors look for safe havens in which to invest. The price of the yellow metal reached a seven-year high as stock markets plunged in March.

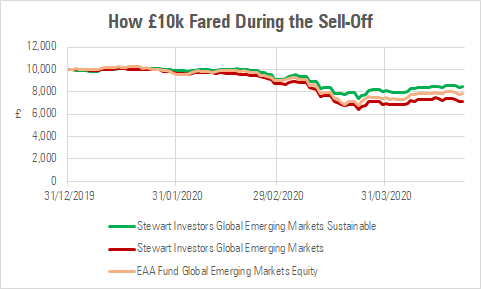

An investment in Japanese hygiene product maker Unichem has helped the five star-rated Stewart Investors Global Emerging Markets Sustainability fund up the rankings in recent weeks. It is now in the top 6% of its category, where last year it was languishing in the bottom decile.

Interestingly, Stewart Investors non-sustainable Global Emerging Markets is in the 95th percentile of the same category. The chart below shows how a £10,000 investment in each fund would have performed so far this year, and how this compares to the Global Emerging Markets Equity category average.

From First to Worst

At the other end of the spectrum are the funds that have seen a reversal in fortune for the worse. These funds ranked in the top decile of their Morningstar category in 2019 but have since fallen to the bottom.

The two-star rated LF Miton UK Value Opportunities fund, for example, was in the top 2% of its category last year, but has ranked in the 95th percentile year to date. The fund returned 39.2% in 2019 and is down 32.8% so far in 2020. Premier Miton says: "[Recovery opportunities] have themselves been out of favour in the coronavirus sell-off as a result of the record slump in business activity."

Among the fund’s main detractors is consulting business Capita, whose shares are down 81% after the firm reported a 98% fall in operating profit. Shares in Wagamama-owner Restaurant Group are down 61% year to date as the group's chains have been forced to close under lockdown measures, with sales expected to half in the first six months of the year.

| Fund | 2019 Rank (%) | YTD Rank (%) | 2019 Return (%) | YTD Return (%) | Morningstar Category |

| LF Miton UK Value Opps | 4 | 92 | 39.2 | -32.8 | UK Small-Cap Equity |

| Equitile Resilience | 2 | 95 | 34.0 | -11.8 | Global Large-Cap Growth Equity |

| Kames Diversified Mthly Inc | 4 | 94 | 18.3 | -16.7 | GBP Moderate Allocation |

| Kames High Yield Bond | 7 | 95 | 13.7 | -15.9 | Gbl High Yield Bond - GBP Hedged |

| Schroder Sterling Corp Bnd | 9 | 94 | 14.1 | -3.2 | GBP Corporate Bond |

Source: Morningstar Direct, data as of April 22, 2020

Kames High Yield Bond also fell from the 7th to 95th percentile of its category, something the managers put down to the fact that its portfolio diverges from significantly from the index. A spokesman says: "It means performance is likely to be more volatile than many peers. The fund endured a very tough quarter as a result of Covid-19 influenced fallout, and the primary reason for this was stock selection."

Indeed, among the fund's most impacted holdings are low cost gym operator PureGym, which has seen revenue fall dramatically - along with its bond prices - as its sites have been forced to close in the lockdown. Kames adds: "We do believe in the long-term structural tailwinds of this business and once gyms reopen, we fully expect the bonds to be marked up again. It is imperative to be patient when it comes to these situations."

The chart below shows how the rankings of these funds have changed from 2019 to the first quarter of 2020.