When it comes to choosing a provider with which to keep your Stocks and Shares Isa, there are plenty of options out there. Which is the best one for you will depend some key things such as how much money you have saved and how often you plan to buy and sell funds or shares.

Investment consultancy the Lang Cat has done some number-crunching to work out which fund supermarket could be the cheapest for your needs.

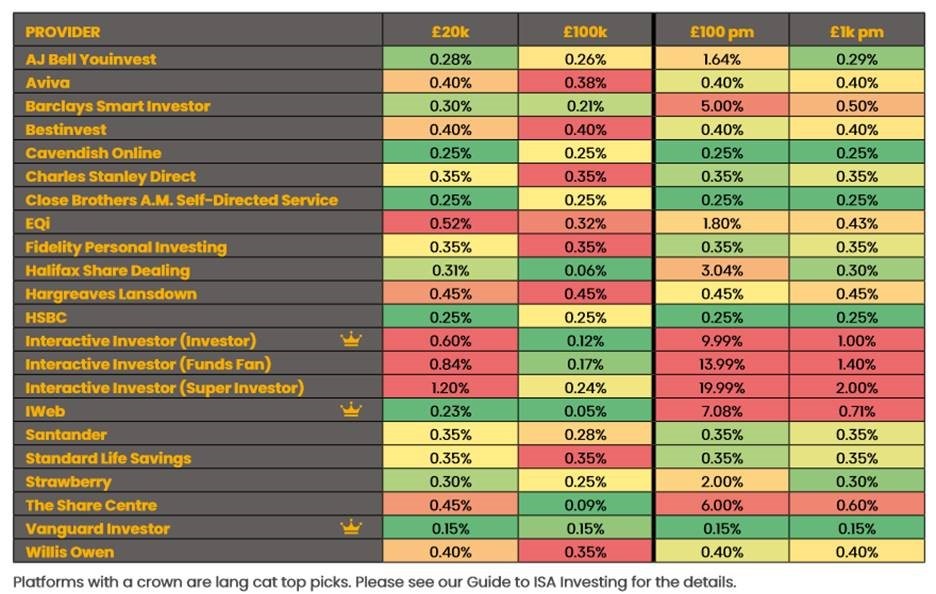

Comparing Isa Charges

The below table shows the annual percentage charge you would pay to a fund supermarket depending on how much money you have and how much money you save. Providers often have a tiered charging structure, meaning the fee reduces the more you invest, but this heatmap takes that into account.

The first two columns show the fees for someone paying a £20,000 lump sum into their Isa (the full annual allowance), who does not add more money to their Isa but does four trades through the year.

Here we can see that Vanguard Investor is the cheapest option, charging just 0.15% regardless of how much you invest. Of course, it’s worth pointing out that this account only allows you to invest in Vanguard funds so if you want to hold others you’ll have to look elsewhere.

iWeb charges are equivalent to 0.23% for someone with a pot of £20,000 saved, and its fee falls to just 0.05% for those with £100,000. In fact, iWeb’s annual fee doesn’t change but it is capped at £45 a year so the effective rate you pay falls the more money you have.

Interactive Investor is the most expensive option for savers with a £20,000 pot but becomes one of the cheapest providers for those with £100,000 owing to its flat fee charging model. Other popular options include AJ Bell, charging 0.28% for someone with £20,000 invested, Charles Stanley Direct at 0.35% and HSBC 0.25%.

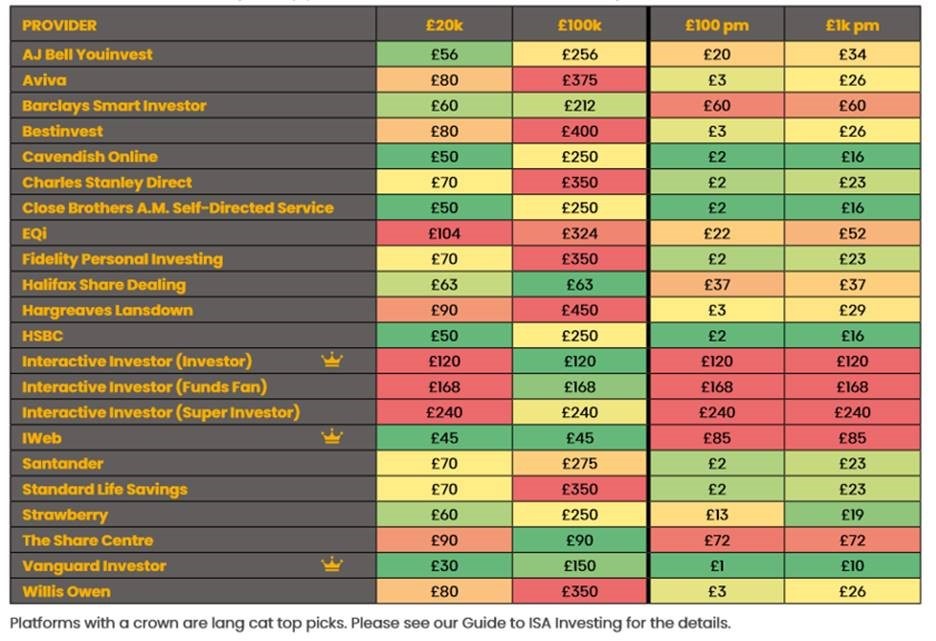

Charges in Pounds and Pence

The second table expresses the charges in pounds and pence, which is often a much easier way to understand how much you’re paying to a provider. Here again, there are wide variations.

The third column shows how much an investor would pay if they set up a regular savings plan of £100 a month, and the final column if you invested £1,000 a month – with both, 12 trades each year are assumed.

The cheapest options would see an investor pay just £2 a year to invest £100 a month. The fees with Cavendish Online, Charles Stanley Direct, Close Brothers, HSBC, Santander and Standard Life all clock in at just £2 a year. Vanguard, again, comes out cheaper but does not allow access to the whole of market.

The most expensive options here are Interactive Investor and iWeb. The latter racks up costs because, as well as a flat annual fee, it charges investors £5 each time they trade, which racks up when you buy and sell regularly. Interactive Investor includes a certain number of trades in its flat fee depending on which of its packages you choose, but conducting more trades than the package allows for can result in further charges.

Mark Polson, principal at the lang cat, says: “The first thing to note is that whether you’re investing a lump sum or regular amount does, in most cases, make a big different to what you pay. Fixed fees can take a chunk out of smaller investment pots and regular investments.”

Of course, price is not the only consideration that investors should bear in mind when choosing a fund supermarket. Customer service, range of investments available, and ease of use of the website or app are all important features to bear in mind.

It is also worth checking out other charges you could come up against, such as the cost of moving your money elsewhere if you ever wish to change to a different provider; some fund supermarkets charge up to £25 for every fund or stock you hold whereas others will let you switch free of charge.