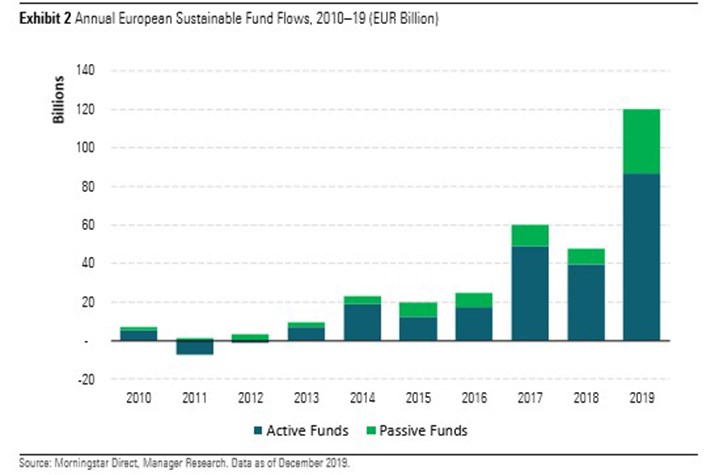

Investors poured a record-shattering €120 billion into sustainable investment options in 2019, Morningstar data reveals. More than a third of the year’s inflows - €47.3 billion – came in the final three months of 2019 as the drive towards sustainable investing picked up the pace.

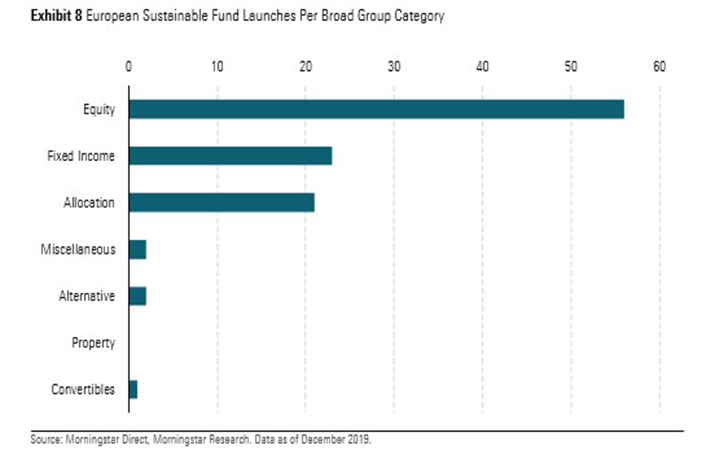

European sustainable funds now hold a hefty €668 billion of assets, up 58% from 2018. Helping to propel the growth is an increase in new products, with 360 sustainable funds launched in the year, bringing the total number across Europe to 2,405. Some 50 of the sustainable funds launched in 2019 had a specific climate-oriented mandate.

Hortense Bioy, director of sustainability research at Morningstar, says: “Strong inflows were driven mainly by growing investor interest in ESG issues. Investors increasingly want to align their investments with their values and sustainability preferences.”

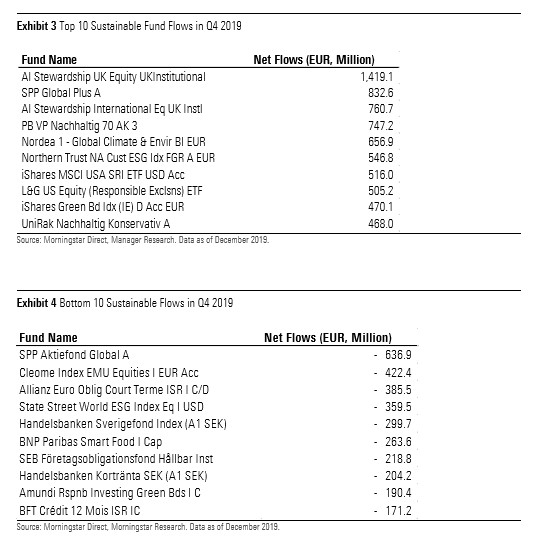

Passive funds have enjoyed significant inflows from sustainable investors, and many of the most popular options in the final three months of the year were index funds and ETFs. The L&G US Equity (Responsible Exclusions) ETF, for example, saw net inflows of €505.2 million over the period, and the Northern Trust North American Custom ESG Equity Index €546.8 million. Passive funds now account for 21% of sustainable assets across Europe, up from 14% five years ago.

Two Aviva funds made it to the list of best-selling sustainable funds, and the Aviva Investors Stewardship UK Equity fund pulled in almost double the amount as the next best-selling fund with net inflows of £1.4 billion. Bioy explains: “This follows the announcement in July that Aviva Investors would offer a workplace pension default investment strategy with funds dedicated to providing portfolios that are socially, ethically and environmentally sound.”

Of course, inflows were not enjoyed across the board and a number of sustainable products saw outflows during the year. Swedish fund SPP Atkiefond Global suffered outflows of £636.9 million in the final three months of 2019 and State Street World ESG Index Equity £359.5 million.

As the sustainable movement gains traction, BlackRock has pledged to put environmental, social and governance (ESG) factors at the heart of its investment process. But even before this announcement from the fund giant’s chief executive Larry Fink, the firm saw the greatest inflows in sustainable products of any fund house. In total, BlackRock enjoyed inflows of €4.45 billion into sustainable funds in the fourth quarter of 2019, significantly ahead of second-place UBS, which achieved €3 billion of inflows in that period.

Equities continue to be the most common way for investors to incorporate sustainability into their portfolio, and that is reflected in the number of product launches through the year. Fixed income is, however, starting to catch up and 21 new sustainable fixed income funds were launched in the fourth quarter of the year.

Another way that fund groups are commonly shifting their attention to sustainability is by repurposing existing funds. Asset management firms are converting existing funds by rebranding them and switching their mandates to incorporate ESG factors. Bioy points to the BMO Sustainable Opportunities European Equity fund as one example; previously the BMO European Equity fund, it was renamed in October 2019. In Europe, ODDO BHF AccuZins was rebadged as ODDO BHF Green Bond in the same month. Just shy of 40 funds were repurposed in the year.

Meanwhile, the Greta Thunberg-effect has seen many fund houses increase their focus on carbon emissions and climate change. Bioy says: “2019 saw a number of asset managers reduce their exposure to or completely divest from fossil fuels.” BlackRock, for example, lowered the exposure to fossil fuel companies in five of its iShares social responsible ETFs, while BNP Paribas launched three fixed income passive funds with a reduced fossil fuel mandate.

Elsewhere, Swedish pension investment provider SPP announced plans to make its entire fund range fossil fuel-free for both environment and financial reasons, and rival Handelsbanken has almost completed its divestment from companies with activities related to fossil fuel production, extraction and distribution. Morningstar figures show there are at least 160 funds across Europe. that explicitly aim to screen out or offer reduced exposure to fossil fuels.

However, Bioy warns that investors need to do their homework before choosing one of these funds to ensure it meets their own definition of responsible investing. “As always, the devil is in the detail. Thresholds and business scopes vary greatly, and funds can state they exclude companies that derive more than 5% or 10% of their revenues from oil and gas production and distribution, but excluded companies can also be limited to those that own fossil-fuel reserves.”