National equity-market indices are often cited as barometers of their countries’ economic health, but markets and economies are very different things. A stock market is a collection of individual companies, whose fortunes are shaped by forces macro and micro, fundamental and technical, domestic and foreign. But in today’s globalised economy, where a company is domiciled or listed may not necessarily reflect where it does its business.

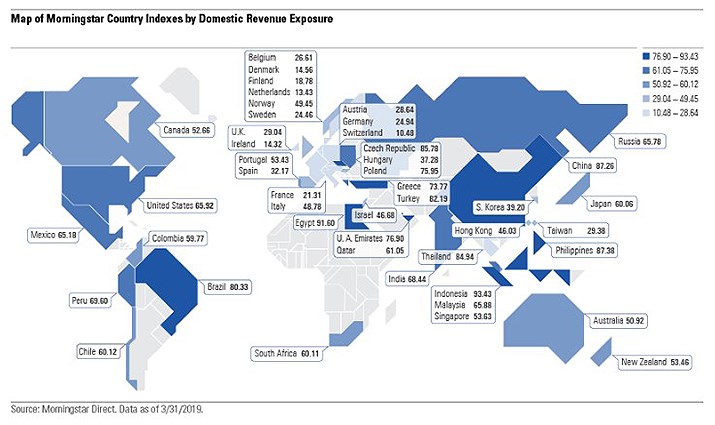

The Morningstar Revenue Atlas applies data from the Revenue Exposure by Region tool to Morningstar’s family of 46 country-specific equity indexes to illuminate the linkages spawned by an interconnected global economy.

The below map demonstrates that country indices vary considerably in terms of their geographic sources of revenue. Investors can use this data to better understand their risk exposures, manage portfolio diversification, and identify opportunities.

So what can we learn from this?

1. Developed European markets tend to source most revenue from outside their borders

Concerned about Brexit? Consider that just 29% of revenue from the Morningstar UK Index is sourced domestically and less than 15% is sourced from the eurozone. The UK equity market depends more on the US and China. Germany and France, meanwhile, earn even less revenue domestically (about 25% and 21%, respectively), though they are far more integrated with the rest of Europe. The world’s most global market is the Swiss equity market.

2. Other developed markets also source revenue internationally, though typically not as much as Europe

The Morningstar US Market Index sources roughly 34% of its revenue outside the US, and Japan is 60% domestic. The Canadian, Australian, and New Zealand equity markets each generate roughly half of their revenue domestically and half from outside national borders, roughly on par with developed Asian markets like Hong Kong and Singapore.

3. Emerging markets tend to be more domestically oriented than developed ones

An estimated 93% of revenue from the Morningstar Indonesia Index comes from Indonesia. The Brazilian, Turkish, and Chinese markets also primarily source revenue domestically. In the case of China, this exposure is surprising given its export-oriented economy. Equally surprising is that the Morningstar Mexico Index sources only 11% of revenue from the US.

4. Sector exposure matters, as emerging markets with significant technology exposure tend to be more globally oriented

For example, roughly one third of revenue from the Indian equity market is sourced outside of India, largely thanks to global technology players like Infosys and Tata Consultancy Services. The share is even higher for South Korea (about 60%), due to Samsung Electronics, and Taiwan (about 70%), due to Taiwan Semiconductor. This lines up with previous Morningstar research that found more value-oriented sectors such as utilities, financial services, and real estate are more domestic while technology and basic materials tend to be more global.

Country indices based on geographic source of revenue

For investors, the next step is to create revenue-weighted indices that select companies based on geographic source of revenue. For example, a UK index weighted toward companies with domestic revenue sources would behave far differently than the actual Morningstar UK Index, where 70% of revenue comes from outside national borders. Revenue-weighted indexes would function as a tool for both analysis and investment.