There are several reasons behind the relatively strong performance of the biotech companies. First, in early February Johnson & Johnson, a large American conglomerate, announced its $2.4 billion (£1.5 billion) acquisition of Scios, a biotech company. The share price of Scios, whose flagship product is Natrecor, a cardiovascular treatment, climbed 33% during February.

Also, a few days ago ImClone, another bio

tech company, received a $60m cash payment from Bristol-Myers to develop an experimental cancer drug called Erbitux.

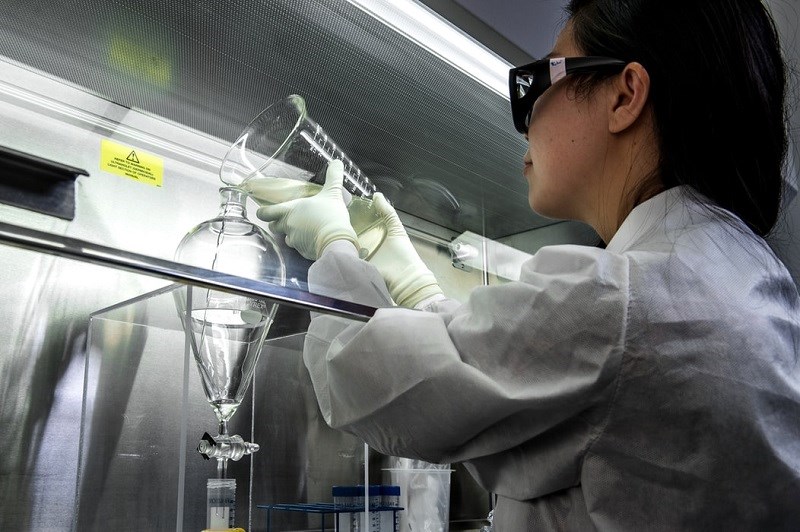

Biotech firms are again drawing the attention of investors. Prospects for the sector look appealing. The big pharmaceutical companies have an urgent need to launch new drugs on the market as they are gradually losing some patent protections and facing increasing competition from generic drug makers. One way of obtaining these new products is through the acquisition of biotech labs.

So it is likely that the healthcare sector will experience more mergers and acquisitions activity in the short term. While this trend will be favourable to biotech shares the impact on the big pharmaceutical firms is less certain.

New drugs

Another positive area for biotech firms is the new product approvals from America’s Food and Drug Administration (FDA). Last year, for example, no more than 20 new products were approved by this regulatory agency. Yet in the first two months of this year five or six new drugs have already received FDA approval.

According to Pictet, a Swiss fund group, all the big biotech labs intend to commercialise at least one new drug this year. But in a report in January Merrill Lynch said that: “although there should be more than ten new biotech products launched in 2003 we believe that few will represent major advances in medical care” and that “a lot of phase III clinical data could have high-risk implications” (

Phase III is the last stage of clinical trials before a drug receives the approval from the FDA). Merrill Lynch expects biotech shares to remain in a trading range during 2003.

The sector is undoubtedly a risky bet. The biotech funds have been volatile, are volatile and will be volatile. It is in the nature of this infant industry. ImClone is a good example. Its share price gained 44% during February but there is no guarantee that Erbitux will be approved by the regulatory authorities.