This is Mother Nature’s year. For both policymakers and investors, preserving biodiversity and halting nature loss are starting to go hand in hand with tackling climate change. Already, an increasing number of asset managers, including two of the largest five globally, have adopted policies around biodiversity. Expect to see more, as the forthcoming COP15 biodiversity conference, due to start on December 7 in Montreal, focuses attention on preserving nature.

Last month, world governments at the COP27 climate conference highlighted the “urgent need” to address “the interlinked global crises of climate change and biodiversity loss… as well as the vital importance of protecting, conserving, restoring and sustainably using nature and ecosystems for effective and sustainable climate action.”

What Is Biodiversity?

Humankind depends on the natural world for everything – including food, water, energy, and healthcare. Biodiversity describes the variety of life on earth. Its value is enormous, as several studies have shown. The World Economic Forum estimates that $44 trillion of economic value generation, over half of the world’s total gross domestic product, is “moderately or highly dependent” on nature and its services. Meanwhile, the Organisation for Economic Co-operation and Development (OECD) estimates the total global value of the benefits we derive from nature is $125 trillion to $140 trillion per year.

The purpose of the COP15 conference is to set new goals for nature preservation over the next decade, under the Convention on Biological Diversity, a binding treaty ratified by 200 countries. The new “post-2020″ framework will replace the previous 10-year Aichi Biodiversity Targets, which expired in 2020. Unfortunately, none of the 20 Aichi targets were fully achieved. The new framework would “ensure that, by 2050, the shared vision of living in harmony with nature is fulfilled”.

In light of all this, asset managers are increasingly realising the importance of taking a robust approach to preserving biodiversity alongside their steps to combat climate change. “Companies have recognised biodiversity is a relevant issue for investors, but they’re struggling to communicate a top-down strategy. We’re expecting a more clear, ambitious framework from COP15 similar to what we’ve seen from COP26 on greenhouse gas emissions and climate change,” says Cassandra Traeger, vice president and governance lead, EMEA & APAC, responsible investment at Columbia Threadneedle. Our latest research paper examines the ways in which managers are addressing the issue.

Biodiversity as an Investment

It remains rare to find funds that specifically target biodiversity and natural capital as an investment theme. At the time of writing, there are 14 such funds in Morningstar Direct, representing $1.6 billion of fund assets. For example, they may invest in companies in “the circular bio-economy,” such as food, feed, and biomaterials. While these 14 funds represent a promising start for biodiversity-specific investments, they are dwarfed by the assets in over 1,100 climate funds, representing over $350 billion in assets globally. Clearly, there is a long way to go before biodiversity gains the same prominence as climate as a fund investing theme.

That said, asset managers are beginning to take a more advanced approach to biodiversity in their active ownership activities: how they engage with their investee companies to improve practices and transparency. For example, the Finance for Biodiversity Pledge has 111 signatories representing over $16 trillion of assets who “commit to collaborate, engage, assess, set targets and report, by 2024 at the latest, [and] call on global leaders to agree on effective measures at the Convention on Biological Diversity COP15 to reverse nature loss in this decade.”

The planned launch of Nature Action 100, a collaborative global investor engagement initiative for biodiversity and natural capital similar to existing initiatives for climate, will be a key development. Such engagements, when many institutional investors work together to improve corporate practices and increase transparency, are particularly effective in convincing companies that a systemic shift is occurring.

How Asset Managers Are Addressing Biodiversity Now

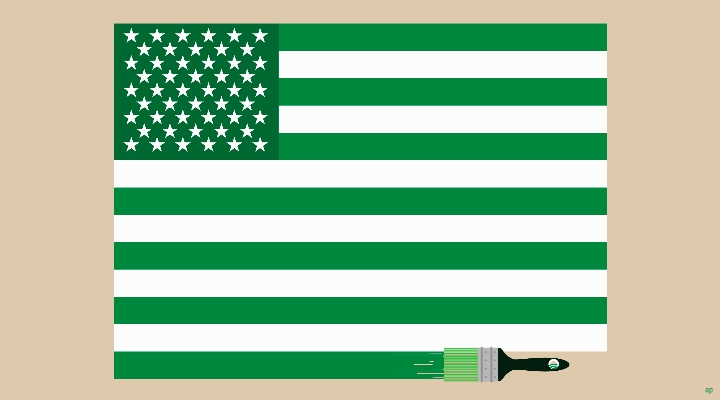

Many asset managers are already taking steps to include biodiversity as a key theme supplementing their policies and practices on achieving net-zero greenhouse gas emissions in the fight against climate change. In our research, we examined the policies of a selection of 25 US and European asset managers, including the global top five by fund assets: Vanguard, BlackRock, Fidelity Investments, Capital Group, and State Street.

We found that 13 of the 25 asset managers provided detail on their active ownership approach to biodiversity. Out of the top five global asset managers, we found that only BlackRock and Capital Group made significant specific comments about their approach to investment stewardship on biodiversity. Policies by Vanguard, State Street, and Fidelity Investments address environmental issues at a high level, focusing on climate without addressing biodiversity specifically. Of the other 20 asset managers we reviewed, 11 provided detail on their biodiversity-related active ownership policies. AllianceBernstein, AXA, BNP Paribas, LGIM, and Schroders are the largest of these managers.

Managers addressing the issue most want to know about material biodiversity impacts and dependencies and how these link to climate action. Improving reporting and transparency is also seen as a key factor. Asset managers are keenly looking to the ongoing work of the Taskforce on Nature-related Financial Disclosures to provide a framework under which investee companies can give them the information they need. It appears that many companies agree; in October, over 300 business and finance institutions called for nature impact disclosures to be made mandatory by 2030.

As Pratima Divgi, head of Capital Markets at CDP North America, an environmental reporting organisation, says, “We cannot solve the climate crisis without addressing nature, and the stability of our global capital markets depends on the availability of high-quality disclosure data to drive vital, sustainable financial decision-making.”