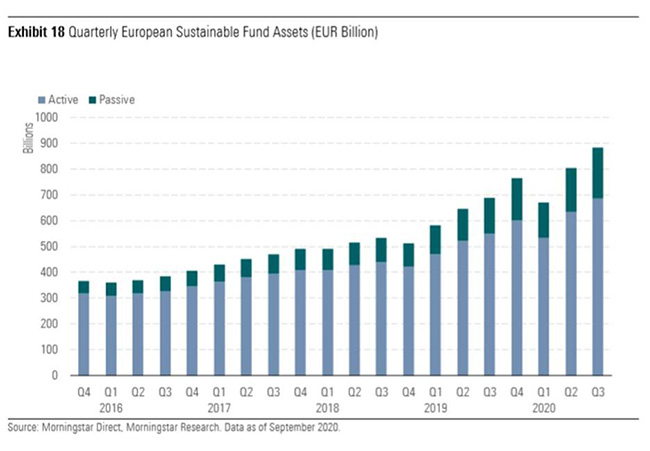

The European sustainable fund market reached a milestone in the third quarter of 2020 with almost £800 billion (€882 billion) of assets under management, an impressive feat when viewed against the backdrop of the Covid-19 crisis.

Assets were up from £720 billion at the close of the second quarter, a 10% increase. This compares with just a 1.6% increase in assets for the overall European fund universe. And sustainable fund assets now account for 9.3% of total European assets.

Higher levels of assets in the ESG space were driven by the continued stock market recovery and growing investor interest in environmental, social, and governance issues.

European sustainable fund flows remained steady in the third quarter at €52.6 billion. While this is slightly down from €55.5 billion in the second quarter, it represents a bigger share (40%) of overall European fund flows for the period.

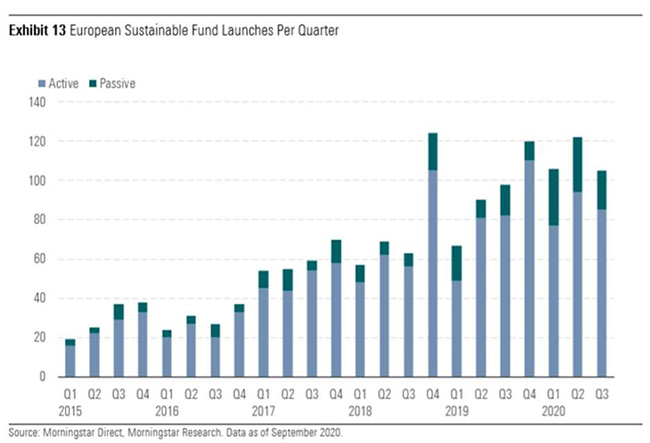

Another contributing factor to the strong sustainable fund flows was the continued growth in the number of ESG products available to investors. We have so far identified 105 new ESG funds that hit the shelves in the third quarter of 2020, which brings to total number of new sustainable offerings so far this year to a new record 333. This compares with 265 over the same period last year.

It is fair to say that this high level of product development is unprecedented, spurred by European regulation, which aims to divert even more money into sustainable products to meet Europe's Paris Accord targets. With its Sustainable Finance Action Plan, the European Commission aims to reorient capital towards sustainable activities and align to the EU goal of being net zero carbon emission by 2050.

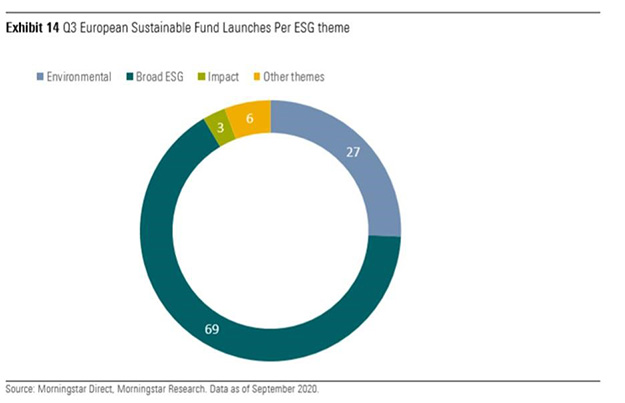

While broad ESG funds continued to represent the bulk of new offerings, some 27 new funds with an environmental flavour came to market in the third quarter of the eyar, accounting for 26% of total sustainable fund launches over the period.

These include a handful of new Paris-aligned funds, such as Lyxor S&P 500 Paris-Aligned Climate UCITS ETF, Franklin S&P 500 Paris Aligned Climate ETF, and Swedbank Robur Access Edge Europe. In order to achieve Paris-alignment classification, a fund must invest in companies that reduce their emissions by an average of 7% annually — the pace of phasing-out of fossil fuels set out in the Paris Agreement — and the fund overall must have a carbon emissions footprint 50% below that of the broader market.

In addition, the third quarter saw the launch of three new green bond funds, namely Amundi Funds - Emerging Markets Green Bond, R-co 4Change Green Bonds, and Evli Green Corporate Bond. We expect more climate- and environment-focused funds to come to market in the coming months.

Also worth highlighting as well are two products offering exposure to ocean health, namely Credit Suisse Rockefeller Ocean Engagement Fund and BNP Paribas Easy - ECPI Global ESG Blue Economy. The former invests globally in companies that are leaders, improvers, and solutions-oriented in understanding the environmental and social impacts of ocean health. It focuses on companies that aim to transition away from plastic pollution, mitigate sea-level rise, mitigate ocean acidification, and help improve sustainable fishing practices.

In terms of broad asset class, the allocation and fixed-income universes continued to expand, with 26 and 18 new sustainable funds launched in the third quarter, respectively.

Examples of new allocation funds include the three BlackRock ESG Multi-Asset Portfolio UCITS ETFs, which are the first and only ESG allocation ETFs ever launched, and the five BNP Paribas Perspectives Modere. But equity was still the source of the most proliferation, with 53 new launches. Investors can enjoy increasing choice when constructing sustainable portfolios.