Google parent company Alphabet (GOOGL) is the latest to announce a stock split, following on from Apple (AAPL) and Tesla (TSLA) in recent years. Alphabet is planning to perform a 20-for-1 stock split in July 2022, handing more shares to investors in the process.

What is a Share Split?

Exactly what it sounds like. One share gets divided, or split, into multiple shares. Don’t worry, though. The value of your holdings is the same, it's now just in smaller chunks.

Think about it like a chocolate bar. Your one big chocolate bar is broken down into multiple bite-size pieces. You still have the same amount of chocolate, just in smaller pieces.

Similarly, in a stock split, it is very important to remember that the price of the share also is reduced. For example, if a company board announces a two-for-one split, then you get one extra share for each share you own. But price of each of those shares is halved. In this example of a two-for-one split, if you had one share of Company X at £10 per share, you now have two shares of Company X at £5 per share. Crucially, your investment is still worth the same overall amount.

This does not mean that the stock has become cheaper. The fundamentals of the company and the stock price have not changed. Sticking with the chocolate bar analogy, after breaking the bark into smaller bits, you have smaller bits of chocolate, not more chocolate overall.

Is This New?

Not really. When Apple announced its latest split in 2020, this was the fifth time the stock was split. The first time the company announced a stock split was in 1987; that was a two-for-one split. It also announced two-for-one splits in 2000 and 2005. The last stock split was a whopping seven-for-one split in June of 2014.

For Tesla, it was the first time the company had split its stock.

But Why?

Why do companies announce stock splits?

Stock splits are a way for companies to increase the overall liquidity.

Liquidity means the ease with which investors can buy or sell shares on a stock exchange. The smaller the pounds and pence price of each share, the smaller number of shares are needed by even the smallest investor to buy or sell that stock.

In most cases, stock splits are undertaken by companies when the share price has gone up significantly, particularly in relation to a company’s stock market peers. If the share price becomes more affordable for smaller investors, it can reasonably be assumed that more investors will participate, and so the overall liquidity of the stock would increase as well.

But remember this with stock splits: though the number of outstanding shares changes, and though the price of each share changes, the overall market capitalisation of the company stays the same. The value of the company doesn’t increase when a split occurs, therefore the value of your stocks, your shares, doesn’t change, either.

Take Tesla, for example. Before the stock split, Tesla shares traded at around $1,500 per share. Many people might not have been able to invest in Tesla because they did not have enough money to buy one share in the company. After the five-for-one split, the stock price dropped to around $300 per share, which is a lot more attainable for many more investors. It's now around $930 per share.

Fractional Shares

This is especially true now as more investors have access to low-cost trading platforms. Buying and selling stocks is now easier than ever, and for many investors, these recent splits might be an entry point for companies they have long admired.

All of this being said, these recent high-profile splits seem superfluous given that most brokerage platforms now enable trading in fractional shares. Perhaps the psychology of owning at least one whole share is at play in companies’ decisions.

But additional participation by smaller investors could also lead to the price increasing, as happened with the prices of both Apple and Tesla immediately after their stock split announcements.

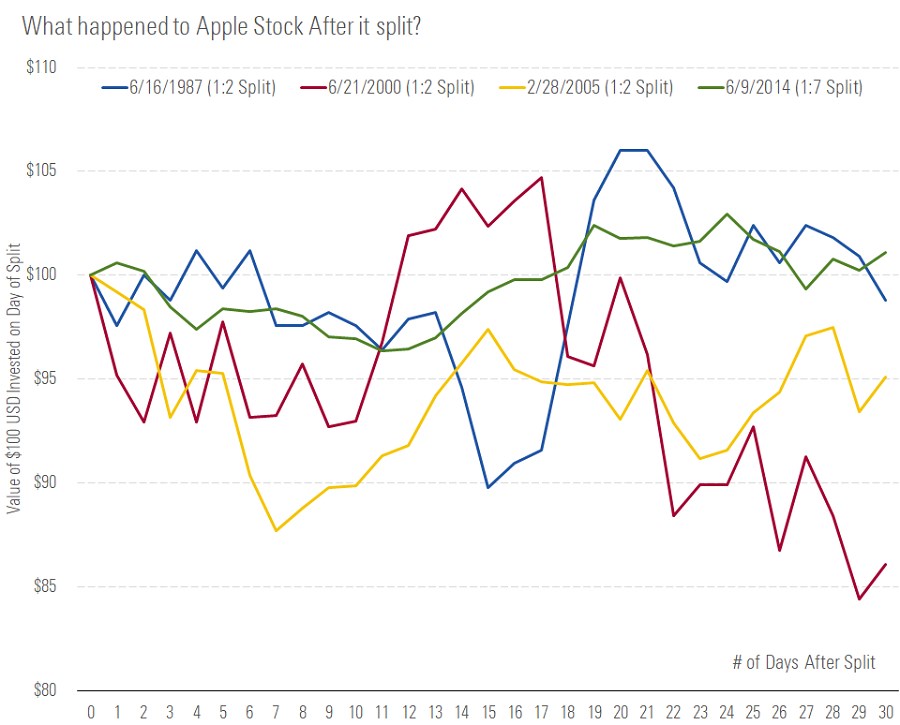

“When we look at a company like Apple and observe the value of an investment immediately after a stock split, there really isn’t a discernable pattern in the change. What is noticeable is the trading volume of the stock, which might be attributed to news flow." says Ian Tam, director of investment research at Morningstar Canada. "That said, for long term investors in a stock, a stock split (or reverse split) really doesn’t affect the fundamental value of the company or the wealth in your pocket."

Here’s what happened to Apple after each of its splits:

Does the Company Change?

Not at all. Stock splits do not alter the fundamentals of the company in any way, apart from the short-term price increases described earlier. There’s no harm done in this regard if the stock doesn’t split either.

Tesla and Apple were not even the highest-priced stocks in the market. That distinction goes to Warren Buffett's Berkshire Hathaway Inc Class A (BRK.A), which is trading around a whopping $417,184 per share (£308,312). Another stock with a high price, while we're on the subject of chocolate, is the Swiss maker of Lindt chocolate, Chocoladefabriken Lindt & Spruengli (LISN), that trades at over 108,400 Swiss francs per share (£89,953).

Currently Alphabet A shares trade at $2,752 per share. Apple shares trade at $174 per share.

The Upside Down

The opposite of a stock split is a reverse stock split.

This is when the company divides the number of shares that investors own, rather than multiplying them. As a result, the price of the shares increases.

For instance, if you own 10 shares of Company X at £10 per share, and the company announces a one-for-two reverse stock split, you end up owning five shares of Company X at £20 per share. Usually, reverse stock splits are announced by companies that have low share prices and want to increase them – often to avoid being delisted.

You may think that reverse stock splits are bad news for the company, but this is not always the case. One of the most famous examples of reverse stock splits is Citigroup. Its share price fell below $10 during the 2008 financial crisis and stayed there, so the board decided in 2011 to do a reverse split of one-for-ten. The split took the price from $4.50 per share to $45 per share. The company — and the stock — survived and is now trading at around $66 per share.

More recently, with the collapse of oil prices, we saw the large United States Oil Fund ETF do an 8:1 reverse split when it fell to around $2 per share. If you held 8 shares before the split, you would had have just one worth $16 afterwards. They’re now around $62 each. See, just maths!

This article first appeared on Morningstar Canada

Are you getting the right returns?

Get our free equity indexes to benchmark your portfolio here

.jpg)