Gold has been one of the hottest performers so far in 2020. The price of the yellow metal climbed 25% in the first six months of the year and has just hit a new record, while precious metals and commodities funds focusing on gold and other metals have been among the best performers in 2020’s turbulent market.

In response, money has flooded into gold funds. SPDR Gold Shares, an exchange-traded fund that ranks as by far the largest precious metals fund, has scooped up $20.4 billion in estimated net inflows over the past 12 months, increasing its asset base by roughly 30%.

So should you be investing in gold? Here, we take a look at the role gold can play in a portfolio and explain why it deserves a more sceptical look than the current hype might suggest.

Gold: A Brief Background

Gold has a long history as a safe haven. Its price is largely independent of other asset classes, and it has also traditionally been used as a refuge against weakness in the dollar. It can also serve as a hedge against inflation and market volatility.

There are two primary ways to invest in gold: buying the commodity directly (gold bullion) or buying shares in companies that mine and sell gold (gold equity). Because gold stocks have both financial and operating leverage, their results tend to magnify the impact of changes in the price of gold. They’re also significantly more volatile than bullion, which only depends on the underlying commodity price.

Both gold stocks and gold bullion have soared recently as the yellow metal (priced at about $1970 per ounce at the time of writing) has hit its highest level since 2011.

How Gold Performs in Downturns

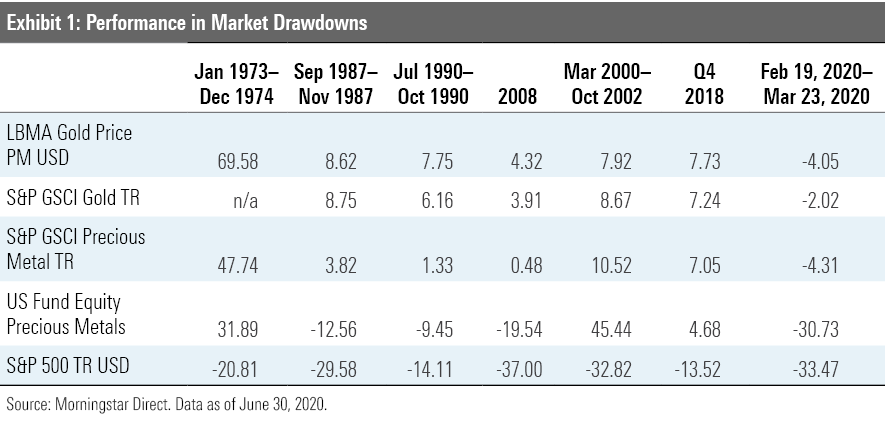

Over longer periods, gold has excelled during bear markets and periods of unusually high market volatility. The below table illustrates that gold has posted significantly better returns during previous market drawdowns and has generally even notched positive total returns during periods of deep losses in the equity market.

The coronavirus crisis in 2020 was a partial exception. While gold fared much better than large-cap stocks, it still posted a small loss. Market observers have attributed this somewhat out-of-character showing to a variety of factors, including liquidity-driven selling and the expectation that interest-rate cuts would help support the dollar. Mine closures and production shutdowns early in the pandemic wreaked havoc on equity precious metals producers. Toward the end of March, though, gold reversed course and gained about 9.9% in the second quarter alone.

Gold as an Inflation Hedge

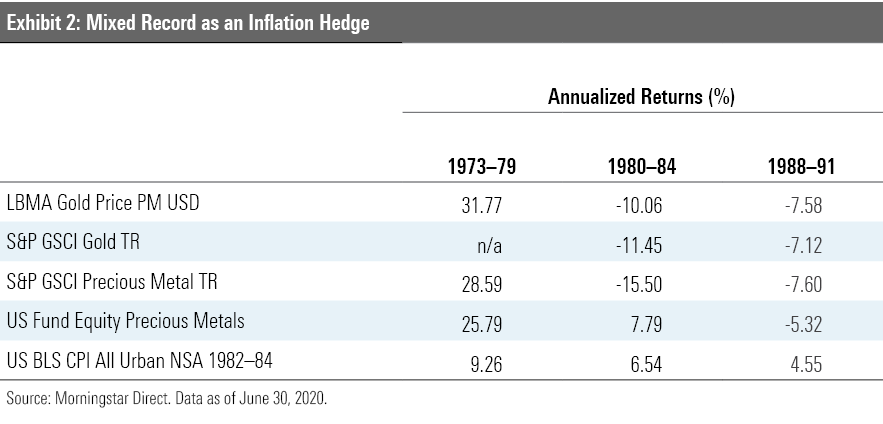

Gold is often touted as a hedge against inflation, but its record there is more mixed. Gold did excel during the high inflationary period of the 1970s, when surging oil prices and a rapidly expanding monetary supply pushed inflation to historically high levels in the US. But during the more muted inflationary environments of the early 1980s and 1988-91, it actually posted negative total returns, on average, and lagged large-cap stocks by a wide margin.

Overall, the evidence for gold as an inflation hedge is relatively weak. Over the past 15 years, gold has had a very low correlation with inflation, with a correlation co-efficient of just 0.07. The correlation has been even lower over the trailing three-year period, dropping to negative 0.26. Part of that may reflect the fact that inflation has been such a non-issue over the past 30 years or so that it’s difficult to pick up correlations with other asset classes. But even back in the high-inflation period of 1973-79, the correlation co-efficient was only 0.15. The upshot: Gold’s role as an inflation hedge is probably overhyped, or at least not guaranteed to deliver if inflation becomes more of an issue.

Can Gold Improve Returns?

Looking at risk and return trends over the past 15 years, the argument for adding gold to a portfolio looks pretty convincing. In fact, many asset management firms and gold advocates have trotted out studies showing the merits of adding gold to improve risk-adjusted returns, focusing heavily on performance over the past 15 years.

Morningstar tested a basic balanced portfolio (60% stocks and 40% bonds) and then added various gold allocations as part of the equity weighting. The portfolios with heavier gold weightings had lower volatility and higher Sharpe ratios (a measure of risk). That means, while adding more gold would have reduced returns over the trailing five- and 10-year periods, it also significantly reduced risk.

But the picture looks far different with a different choice of starting date. If we assume the portfolios started on January 1, 1980, adding gold would have reduced returns over the following 10-year period. It still would have reduced portfolio volatility, but not enough to improve risk-adjusted returns.

To see how consistently gold can perform, we compared the basic balanced portfolio with a portfolio that included 15% in gold as part of the equity weighting. We looked at five different 10-year periods starting in 1970, 1980, 1990, 2000, and 2010. Overall, adding gold improved returns in only two of the five periods. It reduced risk in every period but improved the Sharpe ratio only in the two periods where returns also improved.

Conclusion: Handle With Care

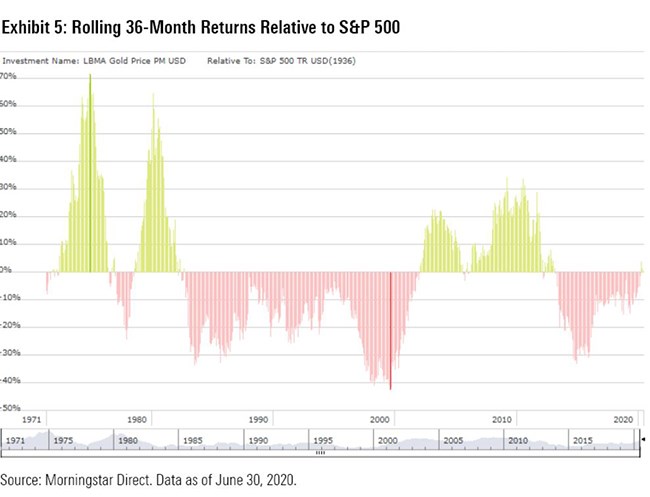

That means that gold is far from guaranteed to improve risk, return, or risk-adjusted returns in any given period. Instead, its track record is decidedly mixed. As Exhibit 5 shows, gold has gone through long periods of underperformance.

On balance, gold has a pretty reliable record as a safe haven in times of market turmoil. However, it’s better viewed as an insurance policy than as a core holding. Investors who decide to add gold to their portfolios should be wary of the current hype surrounding precious metals and be prepared for periodic dry spells.

View the latest pricing and investment return data on gold stocks available in the market.