As the first country to report the cases of Covid-19 and the first to implement lockdown measures, many western countries have taken their cue from China in how to handle the virus's spread. It could be that the Asian powerhouse also provides the clues for how a recovery could look.

The Chinese stock market plunged at the end of January as the government locked down the Hubei province in an attempt stop the coronavirus spreading. The rest of the world looked on in horror.

Just weeks later, however, and already there is evidence that the economy is bouncing back and green shoots of recovery are appearing across many sectors. Indeed, Chinese-focused funds have already started to claw their way back towards positive territory, after a tough start to the year.

Ned Salter, head of global research at Fidelity International, is optimistic about the rebound in consumer spending in the country as life slowly returns to normal after months of lockdown.

But there are reasons to be cautious too, he warns. While 80% of retail stores have no re-opened, sales remain down as some households are clearly still practising social distancing and limiting their outings. Estimates suggest retails sales in March were down around 40% compared to the same month last year.

Consumer Goods Lead the Recovery

For now, consumer staples such as food and personal care products are driving much of consumer spending rather than luxury goods. Salter says uncertain economic conditions makes people delay spending on big-ticket items such as travel and jewellery.

Salter is more confident about the outlook for supermarket chains, which have seen business boom as households have stocked up on goods in recent months. He points to Yonghui Superstores (601933) and Sun Art Retail (06808) and two stocks which are expected to report sales growth in the first three months of the year.

Meanwhile, Jason Pidcock, manager of the Jupiter Asian Income fund, has taken the opportunity to increase his stake in telecoms giant China Mobile (00941), which he believes is a resilient business event in a downturn. He has also added to his investment Hengan (01044), a Chinese producer of personal hygiene products including tissues, nappies and sanitary towels. “And, as of earlier this year, face masks,” adds Pidcock, who thinks the business will do well because it is an established brand with a strong distribution network.

Hengan is benefiting from a decline in raw material prices while demand for personal hygiene products is strong right now. “I expect this to remain the case even after the coronavirus has passed, too,” says Pidcock. “Events like this often trigger permanent adjustments to personal lifestyle.”

Zehrid Osmani, fund manager at Martin Currie, thinks there will be opportunities in areas where the government will be ramping up spending to combat any slump in economic activity such as healthcare infrastructure. “We expect some increased spending in rail infrastructure, notably high-speed railways, and the 5G telecoms infrastructure upgrade could be accelerated,” he says.

Yet it’s not all set to be plain-sailing; the fund manager is wary there could be widespread cuts to dividends among Asian companies this year as earnings are hit by the lockdown measures taken across the region.

Opportunities in Technology

It’s a problem also on the mind of Mike Kerley, manager of the Henderson Far East Income trust (HFEL), who has been reducing his investments in banks across Asia including those in Singapore, Taiwan, Indonesia and Australia. He has kept two Chinese banks in the portfolio because the dividends they pay only account for around 30% of company earnings, which should make them sustainable even through a downturn.

However, he warns that other sectors may be less resilient, such as retail mall operators, where the government has ruled that tenants may have a rent holiday. Kerley adds: “With pressure on dividends in some key sectors in Europe, Asia will stand out as a relative beacon of stability for income investors struggling to find alternatives in this environment of record low interest rates.”

Pruksa Iamthongthong, manager of the Bronze-Rated Asia Dragon Trust (DGN), is looking to the tech sector for opportunities. As home-working and self-isolation become widespread, she expects online giant Tecent (00700) to benefit, with individuals turning online for entertainment such as gaming and film streaming. Digitalisation was already a structural trend, but she expects that to accelerate because of the coronavirus crisis: “Tencent is well-positioned because of its WeChat (similar to Whatsapp) ecosystem. It lies at the heart of communication and in facilitating businesses in moving their activities online.”

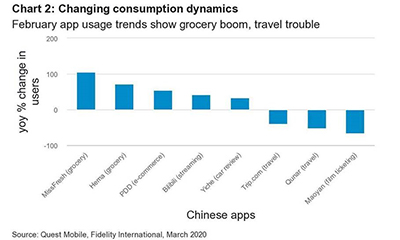

Indeed, one hypothesis of the Covid-19 lockdown is that it will change people's behaviour permanently. Data from Fidelity shows that grocery apps in China saw usage doubled over February, for example, while e-commerce app PDD saw usage increase around 50%. At the other end of the spectrum, travel apps Trip.com and Qunar saw usage drop off significantly, as did film ticketing app Maoyan.

While the coronavirus outbreak may change the short-term opportunities, Osmani says the trends that make China attractive over the long-term have not changed: a growing middle class driving consumption and growth in financial services, as well as a thriving and innovative technology sector.

Salter adds: “China’s experience, from initial outbreaks to ensuing lockdowns, has served as a leading indicator in this global pandemic. Now the signs of a consumer-led recovery in domestic demand should offer a dose of cautious optimism to the world in panic.”