January

Mini-bond firm London Capital & Finance collapsed into administration and a number of other companies offering high interest rates without the finances to back it up followed suit. The Serious Fraud Office got involved in the LC&F case, arresting five individuals involved with the business. The FCA used emergency powers in November to suspend the sale of mini-bonds to retail investors in November, but for thousands of savers who lost money after being lured by the prospect of 8% interest, the move came too late. The Financial Services Compensation Scheme (FSCS) is looking at ways LC&F investors can reclaim at least some of the money from the doomed firm.

February

Britain’s second-largest supermarket Sainsbury’s surprised the City lin 2018 when it announced plans to merge with Asda, which is owned by US retail giant Walmart.

But the Competition and Markets Authority (CMA) put the brakes on the deal in February, ruling that UK shoppers would be worse off under a merged Sainsbury’s-Asda entity. Sainsbury’s shares lurched lower in February and are 16% lower year to date.

It’s been a year of change for food retail in general with M&S teaming up with Ocado, and Morrisons expanding its food delivery partnership with Amazon.

March

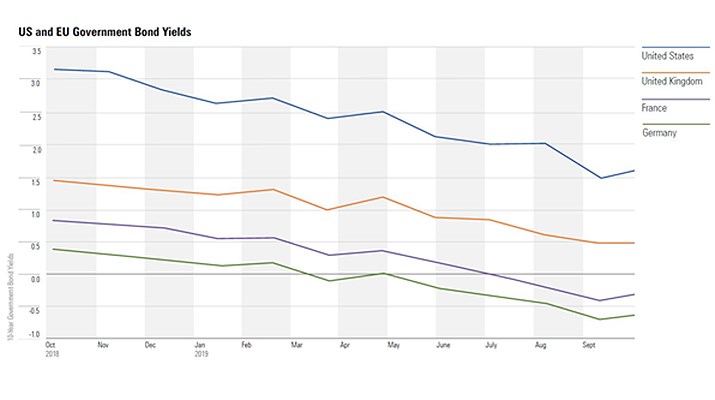

Bond markets don’t often grab headlines but this year investors started fretting about negative yields and “inverted yield curves”. For the first time since 2007, the yield on longer-term US government debt was lower than that of short-term debt. Usually it’s taken as a rock-solid recession indicator; after all, the move has predated every recession since 1950. The yield curve soon went back to its normal upward-sloping shape, only to invert again in August. Bond funds have seen big inflows this year, as we revealed in our fixed income week, and with more buyers, yields plunged. Investors in German and French government bonds are now paying to hold their debt, guaranteeing them a negative return.

April

The Spring Statement had nothing much to offer for savers and investors, with major changes expected to fall with the autumn Budget (which in the end was derailed by the Election).

The 2019/2020 tax year brought in some changes – the lifetime pension allowance was raised from £1.03 million to £1.055 million, but the annual allowance remained the same at £40,000. The Isa allowance stayed the same at £20,000, but the Junior Isa limit nudged up from £4,260 to £4,368.

The Isa itself celebrated its 20th birthday this year – and as well as a big increase in the allowance over that period (from £7,00 at launch), there has been an explosion in funds: in February 1999, there were nearly 1,200 actively managed UK domiciled funds; fast-forward 20 years and that number has increased more than six-fold, to more than 7,900.

May

UK politics was once again centre-stage and UK shares and the pound have gyrated wildly over the months. Theresa May resigned in May and Boris Johnson took over in July. This proved to be a pivot point for sterling and the more domestically focused FTSE 250.

Boris Johnson’s victory in the December election sent shares and sterling soaring. But Brexit still looms at the end of January so there’s still plenty of uncertainty ahead.

June

This year’s biggest UK investment story came in early June with the suspension of the Woodford Equity Income fund. At the time, this was seen a temporary measure to stem investor outflows and get the fund back on its feet. But in just a few months, Woodford’s reputation had been shattered, his firm closed and investors are still waiting to receive (some) of their money back. The flagship equity income fund is being wound up, Schroders has taken over what was Patient Capital.

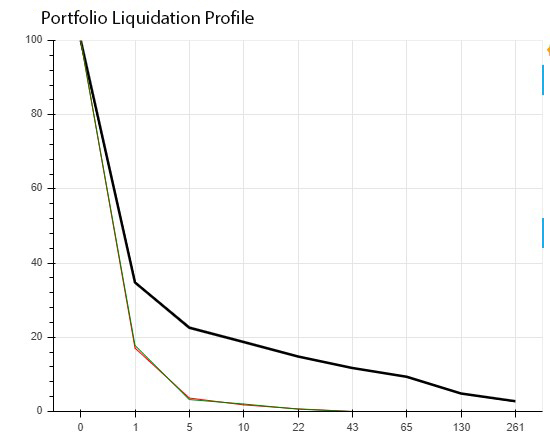

Some experts think the episode may have damaged the cause of active management for good in the UK. Certainly investors are now more focused on liquidity than ever before, an issue that resurfaced later in the year with the suspension of the M&G Property fund.

Morningstar's director of policy research, Andy Pettit, looked at the issue in the summer when the Woodford crisis was in full swing and analysed the liquidity profile of the Equity Income fund. In the above chart, the X axis represents the number of days, while the Y axis shows the percentage of the portfolio. The thick black line shows how long it would take to sell all of the holdings of the Woodford equity income fund at the end of April 2019, while the green line shows the time it would take to sell the holdings of Aberdeen Equity Income, a fund with a similar mandate.

BlackRock, the asset manager tasked with winding up the Woodford equity income fund, had sold off more than half of the portfolio by the middle of December. Investors will hear in January how much they will get back, said Link Asset Services, the authorised corporate director (ACD) for the fund.

July

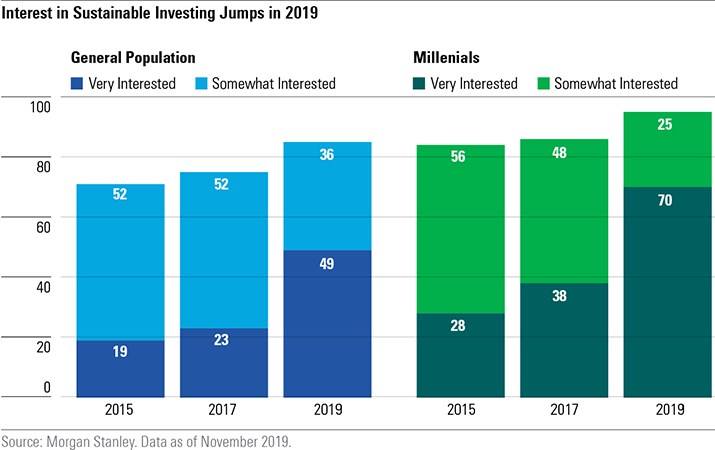

July saw the first London Climate Action Week after Mayor Sadiq Khan declared a “climate emergency”. Environmental issues have been at the fore this year and many investors are starting to prioritise environmental, social and governance (ESG) issues for the first time.

Indeed, 2019 felt like a breakthrough year for sustainable investing, a subject we covered in a special report week. Morningstar also enhanced its Sustainability Rating as well as its Morningstar Analyst Rating As Morningstar sustainability expert Jon Hale observes, 2019 has been a breakthrough year, both in terms of rise in assets under management but also in attitudes. He still thinks there's plenty of room for improvement as people start backing up their beliefs with hard cash. The chart above shows the sharp change in pawareness of ESG issues over the last four years.

August

Gold prices have struggled to hold above $1,300 for a few years now but 2019 was the year that the yellow metal broke through $1,500 as investors piled back in and gold-focused funds are some of the best performers this year. August was the key month for price moves but the precious metal has since struggled to maintain these levels.

Investors in Bronze-rated BlackRock Gold & General have had a volatile journey in recent years, with 2018 a difficult year after gold fell nearly 10%. The fund was downgraded by Morningstar analysts as a result, but’s 2019’s rebound in the yellow metal has pushed it back up the leaderboard. Morningstar Australia’s Emma Rapaport has looked at the pros and cons of investing in gold, which is traditionally valued as a safe haven but pays no dividend and is hard to value.

September

Office-sharing firm WeWork was one of the most hotly anticipated IPOs this year, with a value expected to come close to $50 billion. But the growth story unravelled with lightning pace – the IPO was pulled, its charismatic founder was forced out with a huge payout and its value was marked down to $5 billion by its owner, Japan’s SoftBank.

Even though US stock markets continued to hit record highs this year, investors are now wary of the “next big thing”, as the sagging valuations of Uber and Lyft can attest to. Unicorn founders and private equity backers used to see an IPO as a great time to cash in and get out while the going’s good. WeWork may have changed that mindset for good. The debacle has even cast doubt not just on hot US stocks but also caused people question the entire purpose of public markets - are IPOs just a way of enriching the founders and bankers, leaving very little for the small investors?

October

It was all change at the European Central Bank with Mario Draghi exiting after eight years and International Monetary Fund (IMF) boss Christine Lagarde taking over. The Bank of England’s Mark Carney is to depart as Governor next year. Famously Draghi said in 2012 the ECB would do “everything it takes” to save the eurozone at a very tricky period. He will also be known for never raising interest rates in his eight-year reign.

The Federal Reserve’s U-turn – four interest rate rises in 2019 have been followed by three cuts this year – set the tone for many asset classes in 2019. There are grumblings that central banks have run out of ammunition, having played a key role in steering the world’s economies away from the rocks after the financial crisis. “Fiscal stimulus” is the new mantra of governments, which are looking to use record low interest rates to borrow and spend to stimulate economies.

November

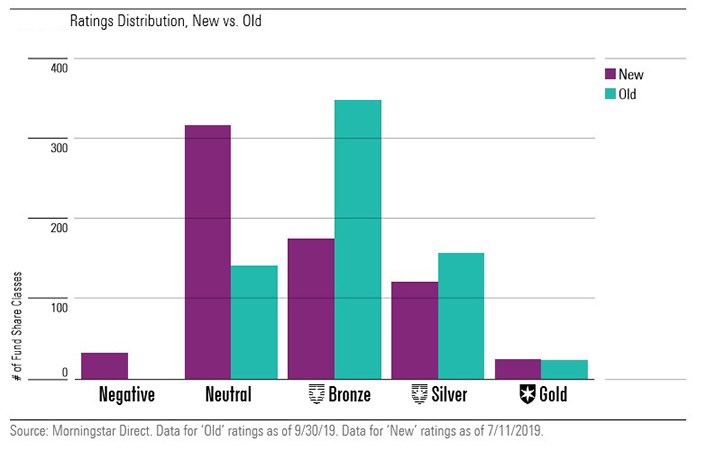

Morningstar’s enhanced ratings system came into effect on November 1. The changes have not yet been applied to all funds in our coverage but it’s clear that the changes, which focus on the impact of fees on performance, will lead to more downgrades.

December

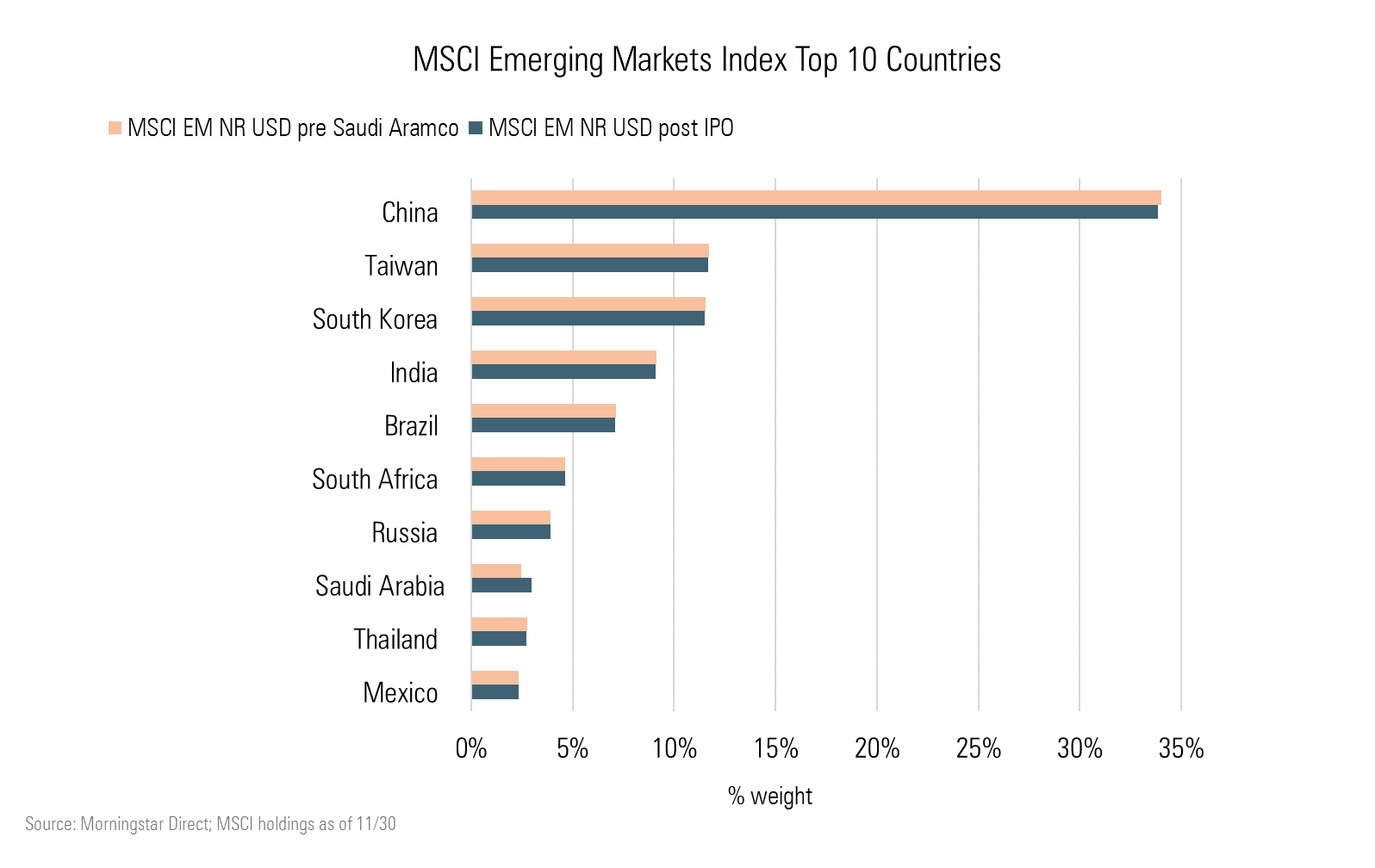

Saudi Aramco overtook Apple as the world’s most valuable company when it floated and briefly hit $2 trillion in value. The IPO has implications for emerging markets indices and ETFs as well as a number of investment trusts with exposure to Saudi Arabia. Morningstar analysts initially don’t expect the float, despite its size, to make a dramatic impact on the MSCI indices – not least because it’s only a fraction of the company that’s being floated ($25 billion).

The plan earlier in the year was for the oil company to float on a global exchange like New York or London – in the end, whether out of politics or because of weaker oil prices – the offer was only available to those living in Saudi Arabia.

And the Conservatives ended the year on a high after securing their strongest election majority since 1987. The pound and FTSE surged on the news, buoyed by the prospect of some clarity over Brexit, and suggesting investors may yet enjoy a Santa Rally as year draws to a close.