Spot prices for gold and copper have bounced in the New Year, as officials from Washington and Beijing prepare for further trade talks and the gold price countered the equity market downturn.

However longer term, the trade dispute between US and China has weighed on metals prices on expectations it could hurt demand, especially from China as the top global consumer. Copper on the London Metals Exchange has fallen to $5,926 a tonne, down 28% since the June 2018 peak of $7,250 and 4% down since 1 October.

Aluminium's $1,810 LME spot price is down 22% since the start of October 2018, and 25% below April 2018 peak of $2,597 a tonne.

Zinc prices of $2,460 a tonne are also down more than 25% from highs of more than $2,730 set in October and December 2018.

Morningstar's Global Materials Index fell 18% last year, with nearly all the decline realised in the final three months due to global growth concerns stoked by trade tensions

"The materials sector has soundly underperformed the broader global equity market year to date," said Morningstar's sector director Andrew Lane at the end of 2018.

He sees comparably fewer opportunities in the metals and mining industries, because of structural change in demand growth from China – driven by its maturing economy transition toward less commodity-intensive growth.

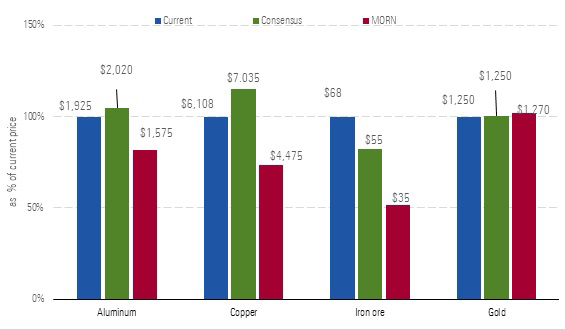

"Our long-term price forecasts for most industrial metals are well below consensus," he says.

Looking to precious metals, Morningstar analysts are more constructive on the outlook for gold, as one of the few mined commodities not directly tied to Chinese fixed asset investment.

Although Lane doesn’t anticipate gold’s investment attractiveness to improve, he believes growth in other demand categories should lead a price recovery to $1,270 per ounce in 2019 and $1,300 per ounce in 2020.

"We expect Chinese and Indian jewellery demand to fill the gap left by waning investor demand," he said.

Traditionally seen as a safe haven asset during times of geopolitical uncertainty, the gold price tends to fall when tensions ease.

Gold prices have also historically fallen as the US dollar rises, as the precious metal becomes more expensive for those who hold other currencies. The dollar rebounded from a nearly three-month low last week, amid expectations of a pause in the US rate hike cycle.

Bullion prices in recent weeks hit their highest since June 2018, at $1,298, largely in response to stock sell-offs and concerns over the global economy. Gold prices on the London Metal Exchange dipped to $1,188 on 1 October.

ETF Demand Fuels Metal Prices

While State Street's NYSE-listed SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, had some outflows in early January, holdings of $33.1 billion are still at their highest since August 2018.

"ETF demand has been one of the primary drivers of the move higher for gold over the past month or so and is still continuing to increase," MKS PAMP Group traders said in a recent note.

"This has been mainly apparent in US and UK based funds amid uncertainty on growth and Brexit risks," they said.

Among other precious metals, palladium was up nearly 1% at $1,311.60 per ounce, after hitting a record high of $1,328.62 earlier in the session.

"The expectation of the supply-demand issue is going to continue and accelerate. ... The supply is not going to be able to reach demand," said Walter Pehowich, executive vice president of investment services at Dillon Gage Metals.

The 90-day trade truce agreed between US President Donald Trump and his China counterpart, President Xi Jinping will expire at the end of March.